Melanie

De Jong

Melanie

De Jong

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

Budget by Paycheck Method

Do you have a monthly budget but have trouble sticking to it? Maybe it's too overwhelming, or maybe you simply have trouble staying organized. Budgeting by paycheck is the perfect way to help you stay on top of your budget.

When you budget by paycheck, you break your budget down into min-budgets.

By doing this, you can better organize what bills are budgeted at what point during the month and with what paycheck.

Let's get right to it!

BUDGETING BY PAYCHECK

When you are first getting started budgeting, it's a good idea to create a monthly budget before the month begins, and then break that budget into two or more budgets every time you are paid during the month.

If you like this method, you can continue to do this even if you are an intermediate or advanced budgeter!

WHY TO BUDGET BY PAYCHECK

Budgeting by paycheck is perfect for people who get paid more than once a month.

Budgeting by paycheck allows you to look at your finances from a monthly perspective and break up your expenses by paycheck so that you can have an established monthly bill paying routine.

This method will help you break down your budget into pay periods so you can decide what bills will get paid with what paycheck.

It can be difficult when you first start budgeting to plan expenses for an entire month, remember to pay all your bills, and track your budget!

Trust me, I've been there.

Personally, I budget by month and by paycheck.

This doesn't mean that I live paycheck to paycheck, but rather that I have broken up my monthly budget into "sections" , with each section being payday.

Confused? Let's go through it!

HOW TO BUDGET BY PAYCHECK

1. Get a Monthly Budget Template

First things first, you will need a monthly budget template.

To get started, you can get my free google sheets paycheck budget template or my PDF paycheck budget template. Either will work!

Having a WRITTEN monthly budget is an essential step to taking control of your finances.

I also have four different monthly budget templates included in my budget bundle , which has 40+ pages of personal finance resources.

I print a new budget template for every single month, write our budget on paper, and keep it in a place where I'll see it often!

Having a written monthly budget allows you to remind yourself of the budget, commit it to memory, and organize your finances.

Even if it's just on a piece of plain notebook paper, create a template that you can re-use every month.

2. Create Your Monthly Budget

In order to budget by paycheck, you need to have a monthly budget that you can breakdown into sections by paycheck.

For the purposes of this post, I'm not going to get into the detailed steps of creating a budget, but rather just do an overview. You can see the posts below for help with creating a budget.

Budgeting Resources:

3. Split Your Budget Into Sections by Paycheck

The budget by paycheck method of budgeting allows you to break up your budget into sections by paycheck.

This step is really simple, list out all your income received throughout the month by day.

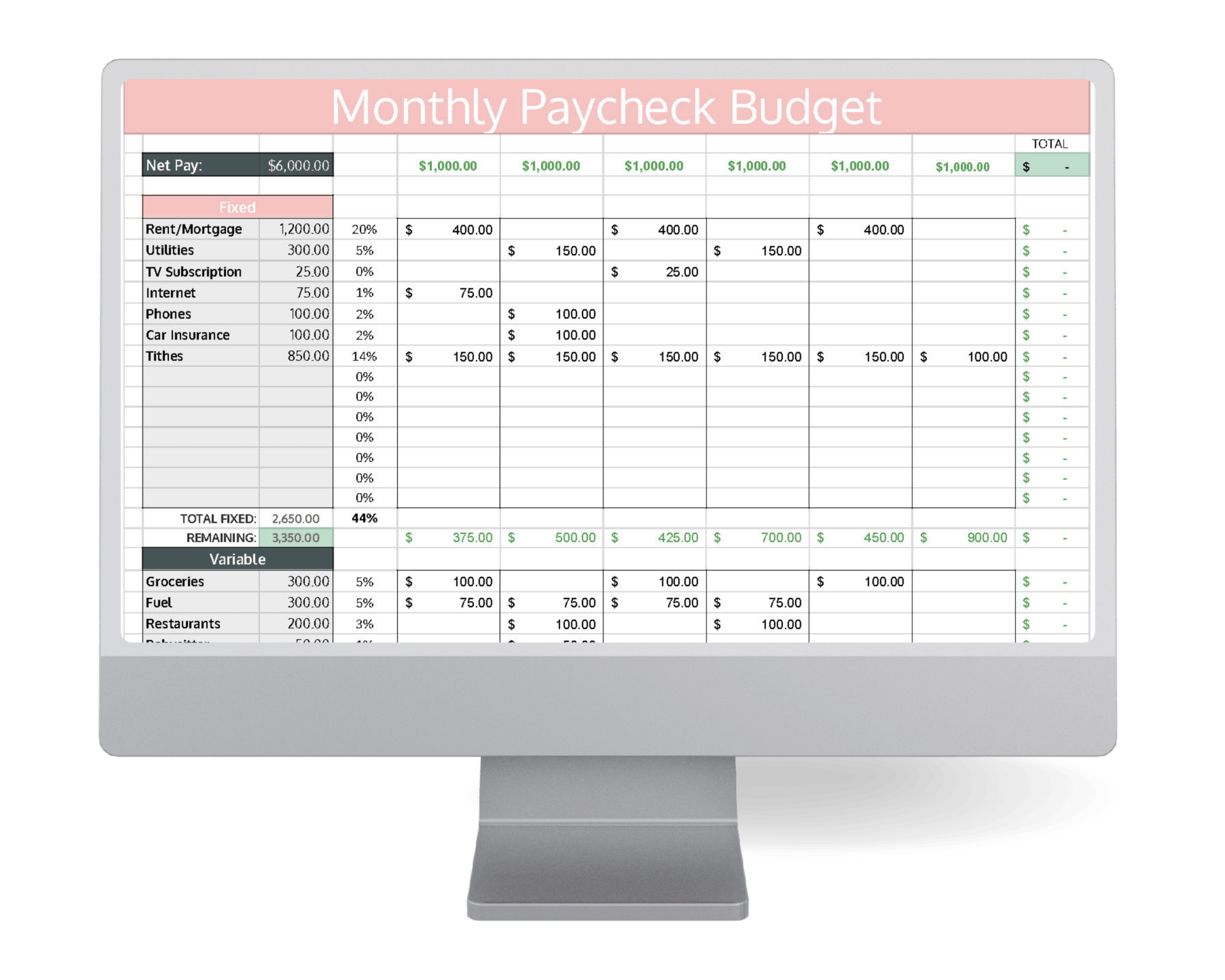

The above example is shown using my free google sheets template!

Next, we will create a list under each paycheck of what bills will be paid (or envelopes filled) with that paycheck.

4. Establish a Bill Pay Schedule

In this step, you will build a bill paying routine/schedule based off of your budget and dates that you are paid.

It is important that you find a schedule that works for YOU and your family.

If you are paid bi-weekly, your budget schedule will look different than someone who is paid weekly or once a month.

Here are the steps you need to take to establish an bill pay/expense schedule by paycheck:

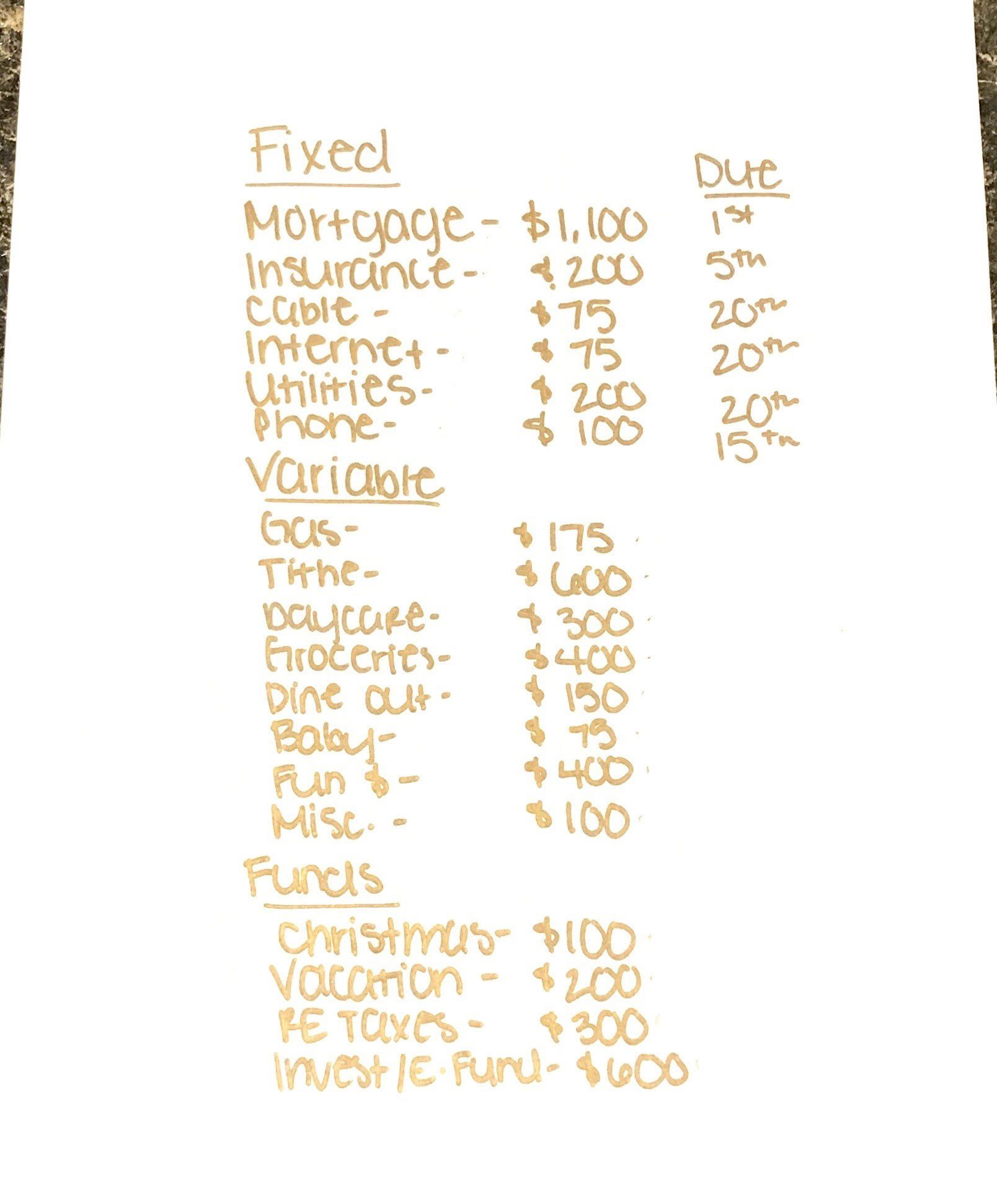

List all your fixed and variable monthly expenses as well as any amounts being sent to savings, investing, or other sinking funds (vacation, new car, medical, etc). Write the due date next to any bills due.

Continuing with the example, here is a sample budget that I've created. Notice this is a zero dollar budget, meaning EVERY single dollar is assigned.

In other words, net pay less budgeted expenses equals zero.

Be sure you are capturing every single expense form your monthly budget.

Divide any bills that can't come out of one paycheck by two or three, and start arranging your budget.

Divide cash envelope money and other budget amounts amongst pay dates until you have created a schedule that you like and that fits your financial needs.

If you look in the example above, the first spreadsheet is all bills/other expenses that automatically come out of a bank account.

The spreadsheet on the right is any cash envelope amounts.

I spent some time playing around having different amounts budgeted on different dates!

5. A Few Pointers

Personally, I like to try and be consistent and have certain budget categories always come out of the same paycheck.

For instance, looking at the example above notice that the same budget items come out of the $1,000 paycheck on 4/8 and the $1,000 paycheck on 4/22. If you look at the fun money budget, it always comes out of the weekly $800 paychecks.

Find a schedule that works for you and the situation you are in.

For example, if you have a spending problem, I would recommend splitting your fun money budget into weekly amounts like the example above.

On the other hand, if you're pretty controlled with your spending, maybe you take your whole $400 fun money budget out on the first paycheck of the month instead!

To make sure that all your bills are paid on time and you don't forget to log them in your budget, create reminders.

I use my bill pay checklist ( included in my budget bundle )to remind myself what bills need to be paid during the current month and I check them off as I go.

I've tried using various apps on my phone, but I find when the reminder comes up, I snooze it no matter what.

Once again, find a system that works for you!

6. Organize/Create a Budget Binder

Create an organized, physical personal finance binder for your family to keep your monthly budgets, financial goal planning sheets, and/or budget by paycheck worksheets.

I have a cute little binder I got at Walmart and it is filled with the pages from my budget bundle !

My budget binder is looked at daily. I use it to remind myself of how we're doing, where we are, and where we would like to go!

7. Track Your Spending

Your budget is pointless if you fail to track your spending throughout the month.

Most people opt to log their expenses once a week.

Or, if you are keeping track of your expenses in the EveryDollar app (like I do), then I log my expenses on paper once a week, and I just group all transactions for the week by category.

I update my spending weekly (or daily if I have time), I compare it to our budget once a week, and I update our Net Worth and financial goal planning monthly!

Do not let yourself get into a bad habit of not keeping track of where your money is going.

Otherwise I can tell you from experience, you won't know where it went but there wont' be any left!

ON A FINAL NOTE

Budgeting by paycheck is the perfect budgeting method for anyone who is not paid once a month.

This method works especially well for those who are self-employed or have irregular income.

This method allows you to look big picture at your finances with a monthly budget, while also staying organized and consistent day to day!

PAYCHECK BUDGET RESOURCES

BUDGET BY PAYCHECK

FOLLOW

ON IG