Melanie

De Jong

Melanie

De Jong

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

retirement

How to Retire Well

When it comes to retirement sometimes we don’t know where to start. Here are a few ways you can start thinking about retirement.

retirement tools

Freebies Made For You

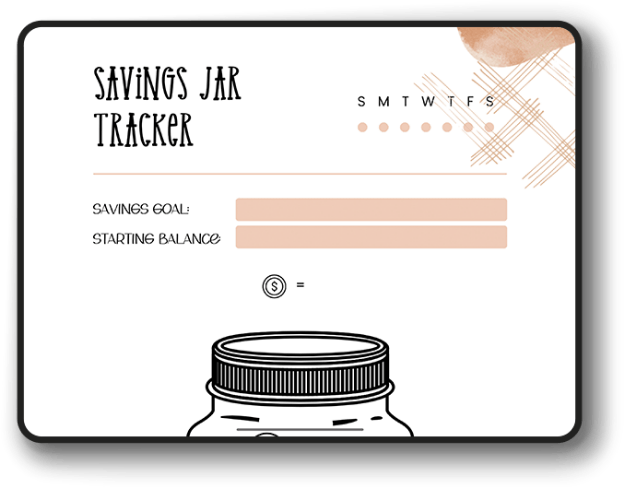

Savings Tracker

A key part of hitting goals is writing them down, and being reminded of them every day. A visual reminder is a great way to motivate yourself to hit your goals every time! Use this free printable savings tracker to track your progress towards your money goals!

FOLLOW

ON IG