7 Things You Should Never Do in Times of Financial Hardship

It's no secret that financial hardship either has come right now or will come for many people at some point in their life.

Many people just happen to be experiencing that time right now, and I want to encourage you!

Breathe. You'll make it through this. It won't last forever.

During times of uncertainty, it is SO SO tempting to panic and live life based on the spirit of fear.

When the rest of the world is in complete hysteria it's hard NOT to lose your cool.

But you know what I'm challenging you to do right now? Not lose your cool.

God is still in control. You're alive. Take it one day at a time and focus on what you CAN control, not what you can't.

Regarding your finances, I want to help you out and be a voice of reason in your life in the midst of chaos.

So here are some common mistakes many people make during times of financial hardship that you might be tempted to do right now.

7 MISTAKES PEOPLE MAKE DURING FINANCIAL HARDSHIP

1. Make Decisions Based on Panic & Fear

We almost never make smart decisions when our decisions are based on panic and fear.

You have the power to decide how you will react. Focus on what you can control.

It's natural see your heart rate jump as you scroll through social media or constantly check the latest headlines. There is unrest and fear everywhere.

Stay calm. Do NOT freak out. Don't let your emotions take control of your money.

When we operate based on our emotions, we don't operate well.

Have you made a lot of good decisions in the heat of the moment?

Now is not the time to go into doomsday mode and put all your cash under your mattress, drain your checking account buying toilet paper and water, or sit in the bank line for three hours because everyone else is.

If you're in a particularly difficult time of financial hardship, it might be extremely tempting to follow the crowd that is operating completely out of fear and panic.

Letting fear consume your thoughts will NOT help your situation.

Instead, I'll give you some tips (keep reading) to help you navigate this time of hardship.

2. Cash Out Your 401k

Repeat after me: I will not touch my 401k. I will not touch my 401k.

I know what you're thinking, easier said the done.

Take these wise words to heart-

A climate of fear is their [investors] best friend. Those who invest only when commentators are upbeat end up paying a heavy price for meaningless reassurance."

Warren Buffet

Just don't do it. You WILL regret it. Specifically, you'll regret it when the market bounces back.

3. Go Into Debt

No matter how tempting it may seem, now is NOT the time to go load up your credit card and dig yourself further into a hole.

It sounds promising, but remember, at some point the bill will have to be paid and digging yourself further into a hole isn't the way to go at a time like this.

Debt is slavery.

Paying off debt & other debt resources:

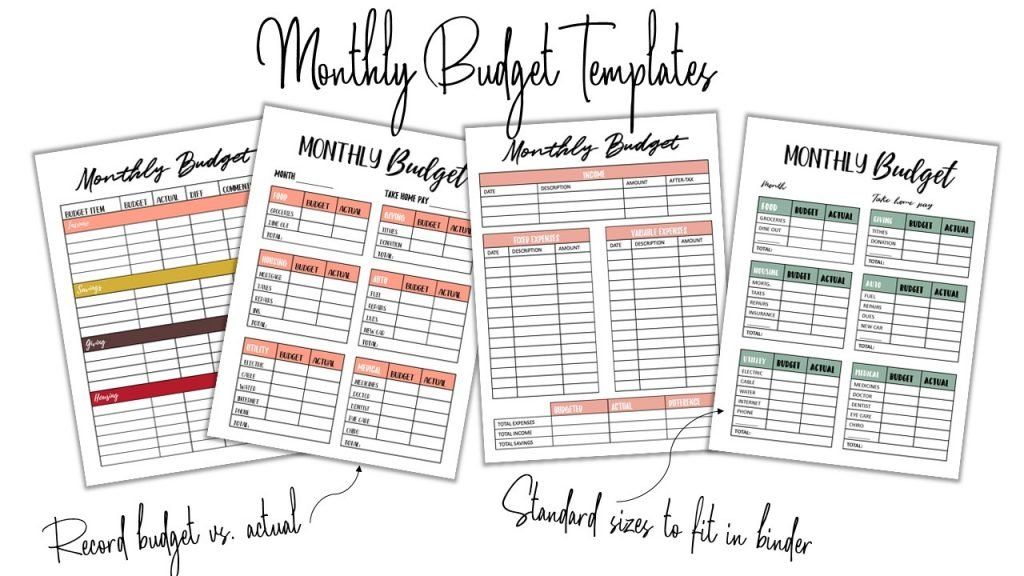

4. Neglect Your Budget or Live Without One

I think many people are learning something right now- that a financial plan is crucial!

If you aren't on a budget yet, it's about high time you get on one.

This is a wake up call for many people who have never cared to track where there money is going. Now they're left wondering why they don't have any spare change.

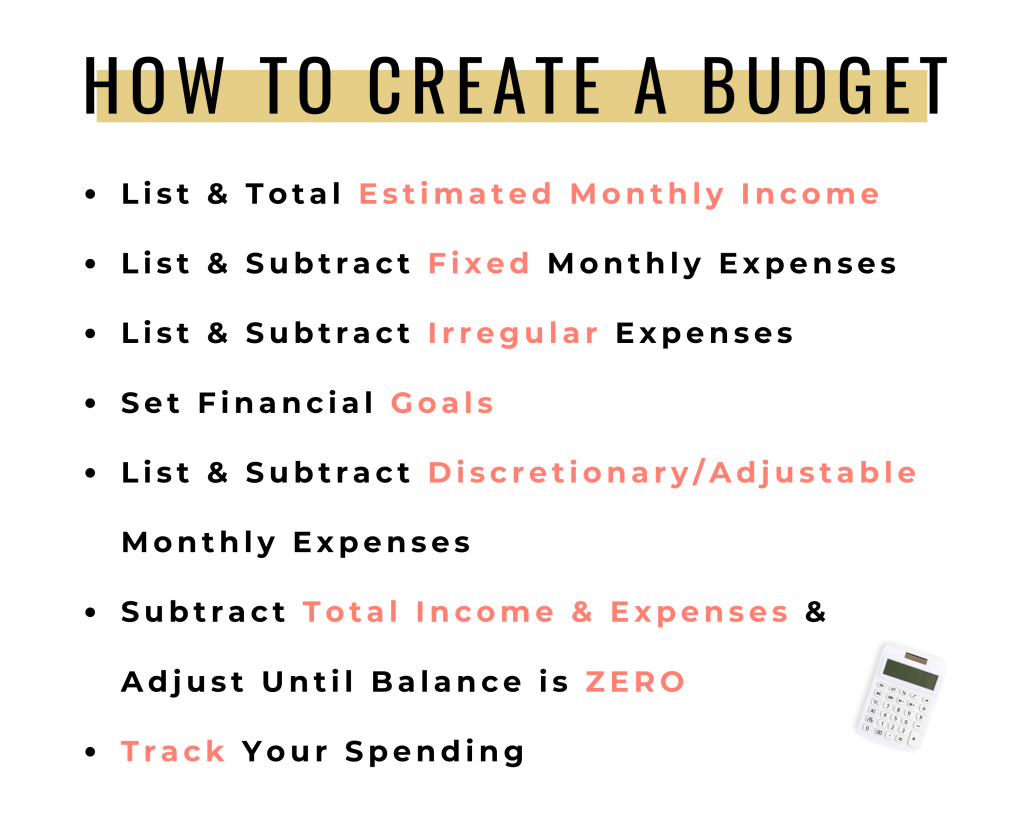

So if you aren't living on a budget, here's how to create your first budget.

If you don't live on a monthly budget, you really can't ensure that you are stretching every dollar as far as it can go because you don't know where your money is going in the first place.

Getting on a budget will allow you to make your dollars go FARTHER because you can find what you can cut out and get your budget in tip top shape.

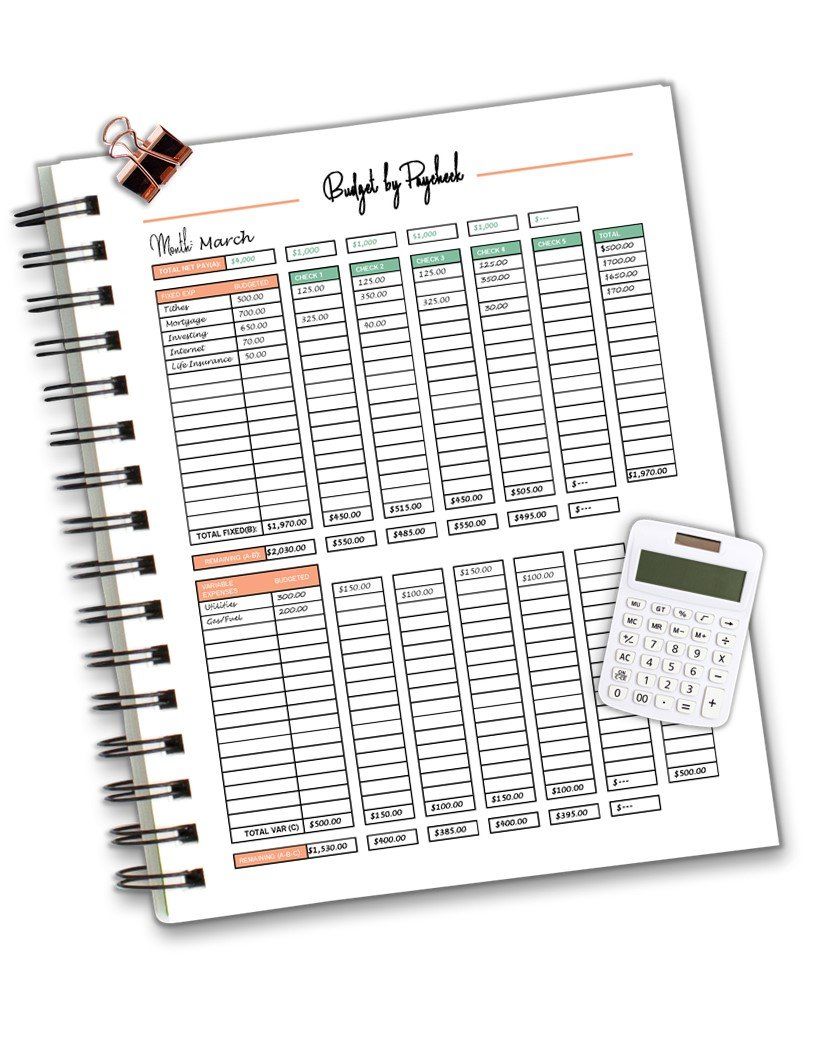

PAYCHECK TO PAYCHECK BUDGET

Once you have a broad monthly budget set up where you direct every single dollar to a purpose, you need to break your budget down by paycheck and allocate your income to different categories.

If you don't do this, all your doing is creating a forecast instead of a budget.

Budgeting requires you to be proactive.

On the left is an example of a budget that is being broken down by paycheck.

This is the exact budget by paycheck template I use every month to allocate our income to our budget categories.

When you budget this way, you can break down your big picture monthly budget into smaller chunks that make it easier to follow & easier to track!

Every time you get paid, you can fill out this template and adjust for any differences in expected pay vs actual pay.

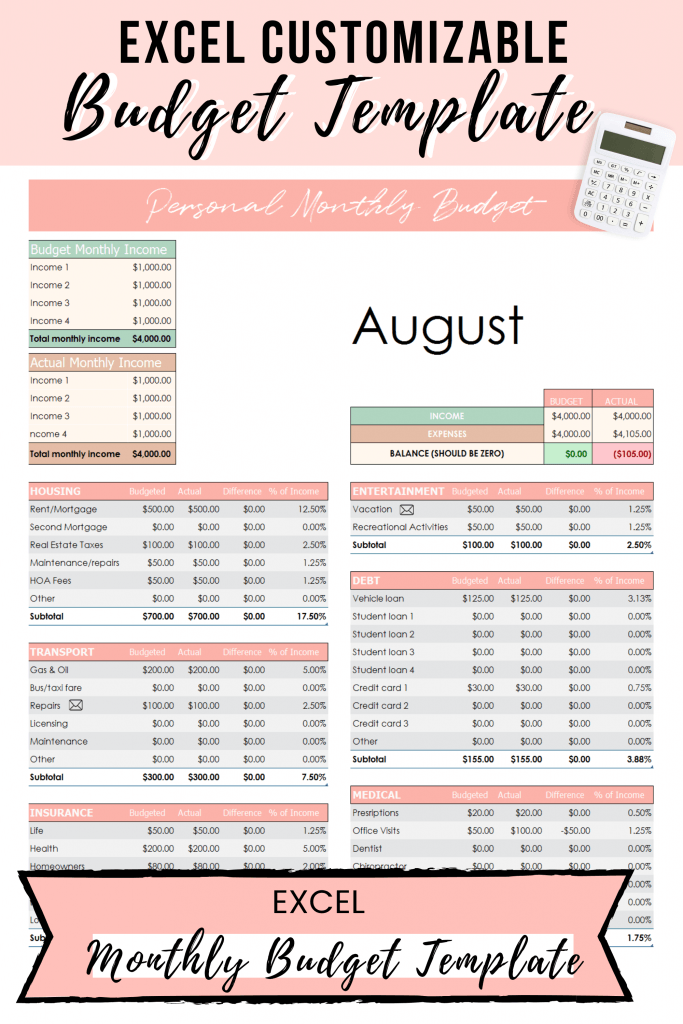

EXCEL BUDGET

If you like to track your finances digitally, keeping an excel budget template makes the process seamless.

The template I created to the right is simple, easy to use, and will help you keep your finances on track.

All it takes is filling in the budgeted column until the budgeted income and expenses total balances to zero, and update the actual column as the month goes on.

The two columns on the far right show the difference between your budgeted and actual spent as well as what percent of your income that category took up for the month!

An excel budget template works great for people who are using their computers regularly and like to keep everything digital!

5. Not Make Any Changes if Your in a Tough Situation

Many people are going to have to make some major budget changes in the near future. It's inevitable.

Think about what you can cut out/go without for now.

- Stop/pause unnecessary subscriptions. I'm talking about Netflix, Hulu, makeup boxes, etc. If you can live without it right now, it might be a good time to press pause.

- Sell stuff. If there are things you can part with right now to get some cash in your hands, do it. Did you just purchase a new vehicle on payments? If so, try and sell it.

- Focus on necessities. The necessities are food, utilities, shelter, and transportation. If you can't pay all your bills right now, focus on paying for those four things first.

- Make extra money. Pick up a second job, or if you've lost your job, find something fast. Think delivery jobs, Instacart (grocery delivery), a seasonal job with your local grocery store, FedEx, UPS, etc.

I'm not saying everyone needs to drastically change their budget, but if you need to, take heart knowing there's always ways you can reduce spending.

If you find yourself out of work and in financial hardship, don't panic. Go out and get some part-time work!

There are many jobs opening across the country as people flock to grocery stores, delivery services, etc.

Resources to Make More Money:

6. Keep Your Debt Snowball Going if Money is Tight

If you're being hit very hard right now (or likely will be in the near future), it's okay to pause your debt snowball.

Instead, focus on building up your baby emergency fund.

Once this particularly difficult time passes, then it's time to get gazelle intense again.

Don't feel like you're failing if you have to put paying off debt on pause! We had to put our aggressive debt payoff on pause when we had to replace the motor in my husbands truck.

While at the time it felt like failure, I was glad that we had to cash set aside to pay for the expense, and that's exactly what we did- paid for it and then resumed the debt snowball.

Remember, this too shall pass.

7. Focus on What You Can't Control

You can't control the returns on your retirement account right now. Nor can you control other peoples reactions to the social, political, and economic environment.

You can control your attitude, your decisions, and whether you will operate out of faith or fear.

Take heart, my friend. It won't last forever.

Financial hardship is temporary, don't fall into a negative long-term mindset.

The thoughts of the diligent tend only to plenty; but the thoughts of everyone who is hasty only to poverty.

Proverbs 21:5

Share this post!