How to Quickly Start a Budget When You're Completely Lost

It can seem like an impossible and daunting task to start a budget when you have absolutely no idea where to begin.

Maybe at this point you have no idea where your money is going. Or, maybe you have somewhat of an idea, but you want to be more disciplined and dedicated to a budget plan.

I've always been a girl who loves numbers. I make spreadsheets for fun. My ideal date would be planning our next months budget over a couple calculators and a glass of wine. I'm not kidding.

However, if you're not this type of person it can feel hopeless to get control of your finances!

That is why I started this blog. To help people who feel like they're not equipped or not knowledgeable enough to manage their finances and kill money stress.

Let me tell you right now, you CAN do it, and you WILL.

Yes, it's frustrating at times, but it's SO worth it, and to be quite honest it's a lot simpler than you probably think!

Here's where to start with budgeting when you have absolutely no idea what you're doing.

HOW TO START A BUDGET WHEN YOU'RE LOST

THE MYTH: BUDGETING ONLY WORKS FOR SOME PEOPLE

FRUSTRATION #1: UNEXPECTED EXPENSES

Many people avoid budgeting offering the excuse that budgeting is frustrating because the budget never works out perfectly, and they claim there's only so much you can plan for- unexpected expenses always come up!

Let's be real here. How many expenses are REALLY, TRULY, unexpected?

Yes, your car might suddenly break down and cost $500 to fix. You can't predict when that will happen, but did you really expect your car to run forever with no issues whatsoever?

If you're being HONEST with yourself, the expenses that you claim are unpredictable are actually expenses that are probable, but

FRUSTRATION #2: TIME

If you have ten minutes to scroll through Instagram, you have time to keep up a monthly budget.

While it's true that the initial set up takes a little more time, the time lost is paid back exponentially as you learn to save more, spend less, and meet your financial goals.

I'd submit to you that you can't afford NOT to budget. It must be a priority in your schedule. Once you get a few months of budgeting under your belt, it starts to become second nature and you'll be on your way to a budget that only takes minutes to complete every month.

FRUSTRATION #3: I'M NOT A NUMBERS PERSON

You don't have to be good with numbers to be great at budgeting. In fact, you don't even have to know how to add because we have a calculator to do that for us.

My husband is a free spirit, meaning he's a go with the flow type person who

WHAT IT COMES DOWN TO

Ultimately, you can throw out every excuse in the book not to budget.

The truth is, most people are simply afraid to face their money fears and are scared of seeing where things are really at.

It's not the time, or unexpected expenses frustration, because you make time for a lot of things in your life that are frustrating at first.

It's the fear of knowing where you truly stand and realizing that your money habits and behaviors need change.

1. START WITH WHAT YOU HAVE RIGHT NOW

How much money do you have? What bills need to be paid before your next paycheck? This is your starting point.

I'm a realist, so although it's important to make a monthly budget BEFORE the month begins and have a plan in place, it's also important to ultimately adjust and deal with your ACTUAL monetary dollars.

Before you set up your monthly budget, start with what you have in your bank account right now.

Take that amount, and assign every single dollar a job until you're paid again.

Here are some pointers for doing this:

- Bills - What bills are due before you get paid again? Assign the balance to bills due first.

- Priorities - what are other priorities that need to be met before you get paid again? Do your kids have dues/fees for school that you forgot about?

- Goals - If you have money left over after assigning your dollars in your account RIGHT NOW, prioritize them to saving or investing or another goal you might have (college fund, pay off house early, save for a new car, etc).

Once we have the dollars in our account RIGHT NOW (actual money) assigned, we can move onto making an actual budget for the rest of the month and a blueprint for every month.

2. THE MECHANICS- SET UP THE BUDGET

STEP 1: WHAT'S COMING IN?

STEP 1: WHAT'S COMING IN?

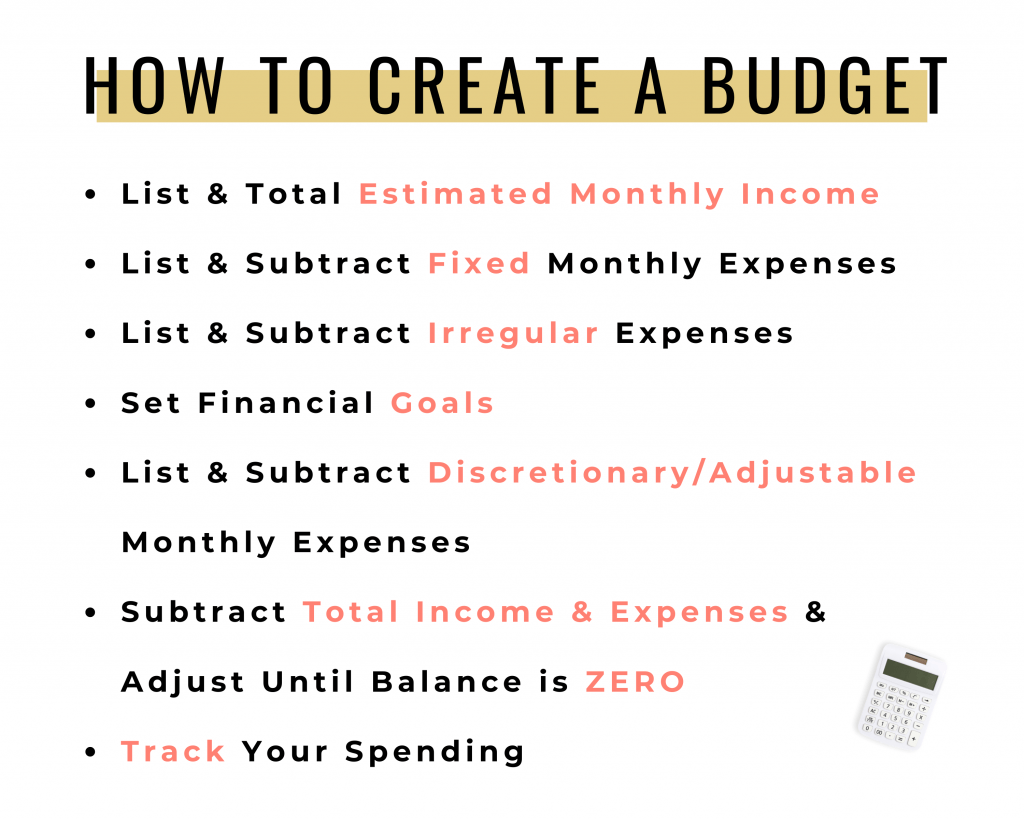

Before every month begins, you need to review what income you expect to come in. Don't leave anything out- include bonuses, cash gifts, alimony, child support, annuities, unemployment, social security, etc.

Write this amount down at the top of your budget template.

IRREGULAR INCOME?

If you have irregular income, estimate your months pay either based on prior year or current year trends.

Be conservative in your estimate.

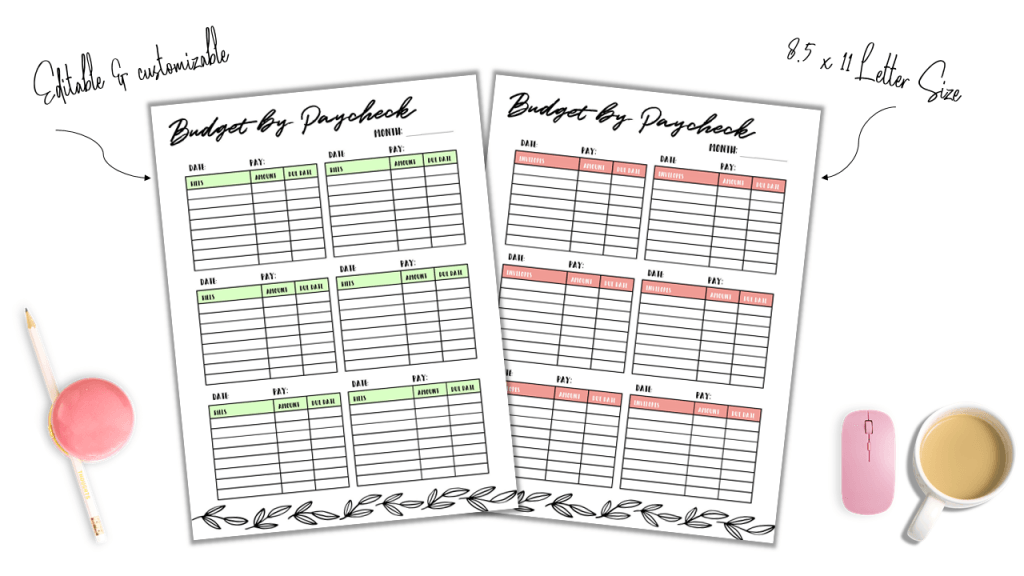

I highly recommend using a budget by paycheck worksheet if you have irregular income, because this helps you stick to your overall monthly budget by breaking your budget own by each specific paycheck.

Irregular income tips:

STEP 2: WHERE IS YOUR MONEY GOING?

STEP 2: WHERE IS YOUR MONEY GOING?

What are your fixed, variable, seasonal & discretionary expenses?

To get an accurate picture of what it takes you to live every month, go over your past couple months of bank statements.

This will give you a good idea of what your true expenses are, rather than your best guess that you have in your head.

The reality is that what we THINK it takes us to live is often a lot less than what it actually takes us to live every month.

The little costs add up, the big costs sneak up on us, and unless you have a written monthly budget and you're consistently tracking your spending, the truth is you really have no idea where you're at financially.

At this point, many people realize that what is going out of their checking account is actually more than what's coming in, the timing is just off.

You could constantly be operating your household at a deficit and not realize it because your bank account shows a positive number.

But then you forgot about the real estate taxes that are due next month, your semi-annual car insurance premium, and you're forced to pull money from your savings to avoid an overdraft.

In reality, you're just living on a "float", and if you were to have any major unexpected expense you'd have a negative account balance.

LIST YOUR EXPENSES

Once you've figured out what's coming in, list all your fixed and irregular expenses. These are the necessities.

List discretionary expenses after you've listed your goals.

I like to keep track of all my irregular/seasonal expenses using an expense log worksheet.

Be sure to take your time with this step to make sure you are capturing all your expenses (I promise you'll forget a few).

FIXED EXPENSES

These are expenses that don't change from month to month, they are a set amount.

- Rent/Mortgage

- Internet

- Cable

- Insurances

IRREGULAR/SEASONAL EXPENSES

Irregular and seasonal expenses are great sinking fund categories. For more on sinking funds, read 9 sinking funds everyone needs in their budget.

- Real estate taxes

- Semi-annual insurance premiums

- Gym dues/fees

- Gifts (weddings, baby showers, birthdays, etc)

- School dues/registration fees

- Car registration dues

ADD THESE IRREGULAR/SEASONAL EXPENSES TO YOUR BUDGET

These are the "gotcha" expenses that show up *seemingly* out of nowhere.

In this step, break these expenses down into smaller, manageable monthly amounts.

Basically, you put these in your monthly budget and treat them like a bill (just an imaginary one).

This way, when the expense comes due or event takes place that requires a cash outlay, you already have the money saved!

Wouldn't that feel amazing??

DISCRETIONARY EXPENSES (*** CALCULATE IN YOUR BUDGET AFTER YOUR GOALS***)

Discretionary expenses are ones that can be easily adjusted. They aren't DUE (like bills), and therefore they hold room for manipulation in the budget.

Write these expense categories down for now, but don't assign amounts quite yet, we will first add our financial goals to our budget.

- Restaurants/Date Night

- Personal spending

- Miscellaneous

Once you've listed all your different types expenses, add your goals into your budget.

STEP 3: WHAT ARE YOUR GOALS?

STEP 3: WHAT ARE YOUR GOALS?

Financial goals include things like saving, investing , and leaving a legacy.

The first goals that you should add into your budget include:

- Build an emergency fund.

- Pay off all debt.

- Invest at least 15% of your gross income (ongoing goal that never stops).

- Whatever other financial goals your heart desires (pay for kid's college, pay off your mortgage, save for a home down payment, take a trip to Italy, etc).

If you don't have a lot of money in savings, focus on building your emergency fund first.

To add goals into your budget do the following:

- Write down your goal. Example: Save $20,000 for a down payment on a home.

- Set a realistic timeline. Example: Have money saved for down payment in two years.

- Convert to monthly amount. Example: $20,000/24 months = $833 per month.

- Add into your budget.

By performing this exercise/step in the budget process, you are forced to realize that there are trade offs with your money, and you are able to make decisions based on your priorities.

This gives you POWER over your money. You are now controlling it and telling it what to do instead of the other way around.

STEP 4: ALLOCATE REMAINING DOLLARS TO GOALS & DISCRETIONARY SPENDING.

STEP 4: ALLOCATE REMAINING DOLLARS TO GOALS & DISCRETIONARY SPENDING.

So, in light of the whole budgeting process, after you've taken your income less your fixed & seasonal/irregular expenses, what are you left with?

Take that amount and allocate it to your financial goals and your discretionary spending.

The reason I want you to first consider your financial goals is because you will now decide what your priorities are. If you REALLY want to save money fast, adjust your discretionary spending to the lowest possible level and allocate the remainder to your goals.

If you don't want to be super aggressive and having personal spending cash is more important to you than paying off debt, you can allocate the money based on those priorities.

Look at your discretionary (most flexible/adjustable expenses) in conjunction with your financial goals and set your budget for each.

STEP 5: BALANCE THE BUDGET TO ZERO

.

STEP 5: BALANCE THE BUDGET TO ZERO

.

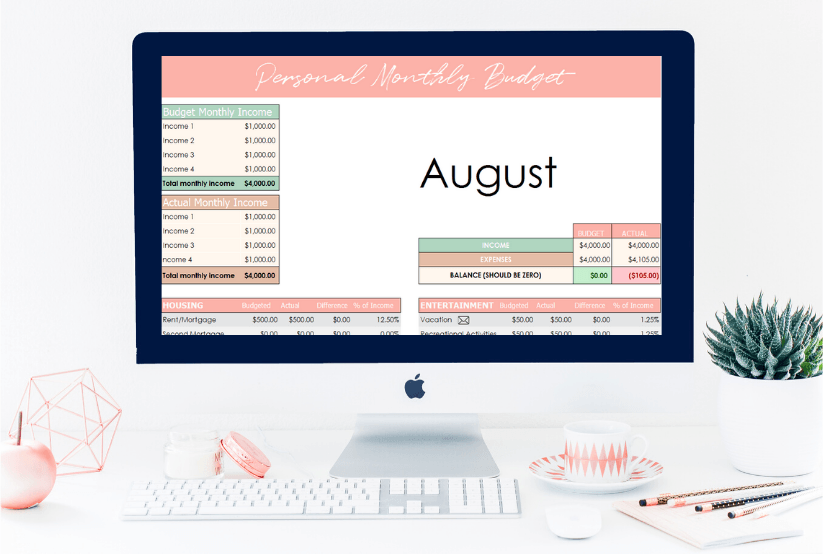

After all is said and done, your total expected income minus your total budgeted expenses should equal zero.

If you budget all your income for the month and you have $100 left over, you're not done yet.

Allocate those dollars to saving, paying off debt, retirement or another goal.

Don't leave any dollars unaccounted for!

STEP 6: TRACK YOUR SPENDING.

STEP 6: TRACK YOUR SPENDING.

After you've made your budget, it's time to track your spending .

If you've never done this before, you're about to learn a lot about where your money is going.

This isn't meant to be a restriction but rather a strategic plan to free you from the stress of constantly having to worry about money.

STEP 7: ADJUST BUDGET FOR ACTUAL DOLLARS.

STEP 7: ADJUST BUDGET FOR ACTUAL DOLLARS.

If you create your budget but then don't update it throughout the month, all you've done is created a forecast.

Budgeting requires you to be proactive. No, I'm not talking hours a day spent on your budget.

Maintaining your budget shouldn't take more than five minutes per day.

I highly recommend entering your transactions daily, so that you get in the habit and you don't have to login to your online banking and try to figure out where you left off.

Tracking digitally can save you a lot of time budgeting every month, and that's why I create an excel budget template that is easy to use and lays out your budget in a simple format.

You can use this template to fit your budget schedule- enter amounts daily, weekly, or use it at the end of the month to put your budget in "final format" and use it as a starting point for the next month!

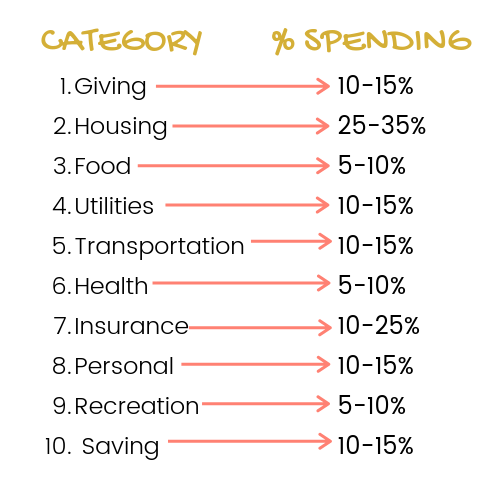

HOW DO YOU COMPARE TO RECOMMENDED BUDGET PERCENTAGES?

Once you have a well drafted budget, it's important to evaluate.

Are there certain areas that you deviate from the chart (pictured left) by a lot?

If so, evaluate if this is reasonable. Obviously, if you have an hour long commute to your job, your transportation budget might not fall within the 10-15%, but use the chart as a guide to evaluate if you're overspending.

Remember, every budget will be different.

However, use your discernment to evaluate if a budget category is drastically different from the recommended percentages because of circumstances, or because of behavior problems.

For instance, if you're single and spending $500 a month eating out (I know that's a bit dramatic), don't make excuses for why that's necessary because of your circumstances.

NOW WHAT?

START WITH SMALL CHANGES

While there's a time and a place for drastic budget changes (if you're paying off debt), being realistic with your budget is key to helping you stick to it.

If you're spending $800/month on groceries for your family, don't try to cut the budget to $400 in one month.

Rather, focus on trimming different areas over the course of a few months.

As you get your feet wet budgeting for a few months, you'll be able to get an idea of what is realistic for your budget.

WORK OUT THE WEEDS

I'm going to be honest, your first few months budgeting will probably not go great.

That's because just like anything else, budgeting takes practice. It's a learned skill.

It takes approximately three months to get a budget that works down, be committed to working through the weeds of budgeting!

IF YOUR BUDGET IS IN THE RED

If after you create your budget you realize you're actually spending more than you're taking in every month, you need to find a way to either increase income or cut costs.

You can't operate at a budget deficit, it is impossible to build wealth that way.

Here are some tips for cutting costs:

Share this post!