meet melanie

When it comes to Budgeting, It should be Simple

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When I began budgeting, I found myself overwhelmed with all of the details of tracking my budget monthly. It seemed like a big task, and I needed it broken down into smaller steps. My husband and I turned to the Budget by Paycheck forms and paid off $20k of student loan debt in 12 months. All while living on ONE income. Our dream is to help other families get out from under the burden of debt, save, and invest for their future! That dream begins with you.

Its time you took the stress and confusion out of your finances.

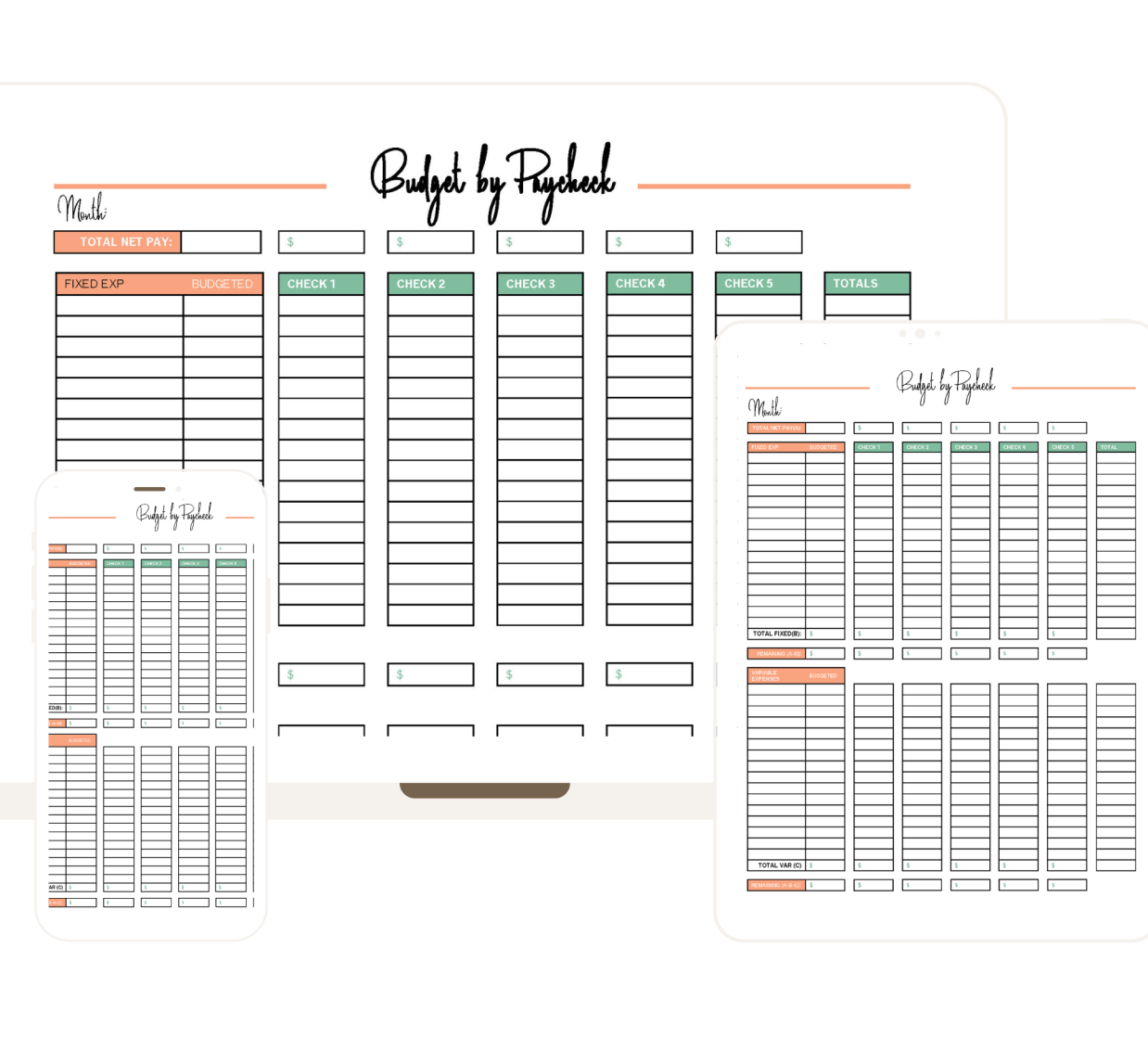

budget by paycheck

WHEN IT COMES TO BUDGETING, IT SHOULD BE SIMPLE

When I began budgeting, I found myself overwhelmed with all of the details that came with tracking my budget monthly. It seemed like a big task and I needed it broken down into smaller steps. My husband and I turn to the Budget by Paycheck forms and paid off $20k of student loan debt in 12 months. All while living on ONE income.

The budget by paycheck method allows you to look at your budget in terms of the big-picture and break it down into paychecks. This will help you know exactly what expenses are being budgeted with each paycheck. When it comes to budgeting, the budget by paycheck method keeps it simple and easy.

the beginning

WHERE IT ALL BEGAN FOR MEL

After graduating college, I remember looking at the debt sentence that showed up on my cheap, outdated apartment, and thinking…this is going to take forever to pay off. I decided to dust off my copy of Dave Ramsey’s Total Money Makeover and see if he had any ideas and that’s when everything changed.

Over the next 12 months, my husband and I paid off over $20k of student loan debt; all while living on one income. At that time, we were making $50k/year. So we saved nearly half our income to pay off debt! Not long after I began writing about our journey and quickly realized I have a passion for personal finance. That’s why I do what I do- to help other families get out from under the burden of debt, save, and invest for their future.

budgeting tools

FREEBIES MADE FOR YOU

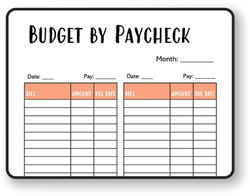

PAYCHECK BUDGET FREEBIE

Get instant access to my free paycheck budget template that will help you layout a detailed plan for your finances!

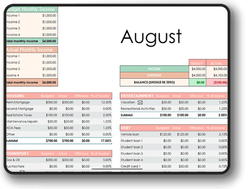

GOOGLE SHEETS TEMPLATE SIGN-UP

This is the exact budget template we use to create our monthly budget every month in just 15 minutes. This template gives you the freedom to spend your money guilt-free, with purpose!

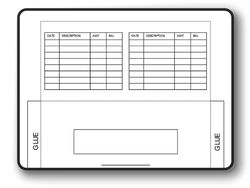

CASH ENVELOPES FREEBIE

Get instant access to my free printable cash envelope blueprint that will help you curb your spending habits and save more money every month!