The 7 Baby Steps to Stop Living Paycheck to Paycheck

Would it surprise you to know that the majority of Americans are living paycheck to paycheck?

If there is one thing I've learned from our financial journey, it is that building wealth and pursuing financial freedom does not come from following the crowd.

In fact, if you follow the crowd, you'll end up swimming in debt. Americans are now twice as likely to rack up debt than accumulate savings.

Millenials are notorious for this. According to Northwestern Mutual's 2018 Planning & Progress Study, millennials between the ages of 25 and 34 have an average of $42,000 in debt each.

If you find yourself wondering how your friends are affording their world travel, new car, etc., there is your answer. They are financing it. In other words, they really can't afford it.

They are going to spend the rest of their life paying off a lifestyle that they can't afford.

We began our financial journey $30k in debt. By practicing self-discipline and being intentional with how we spent our money, we were able to pay off $20k of student loan debt in ONE year, and we only had one source of income for half of that year! We paid off the remaining $10k soon after.

It was not easy. It hurt. It REALLY hurt. We had to make sacrifice after sacrifice, but boy is it WORTH it.

Just remember, your financial future is up to YOU.

If you are sick of living paycheck to paycheck, drowning in debt, and constantly being worried about money, only YOU can change that.

We were able to dig ourselves out of our hole and work our way to financial freedom by following Dave Ramsey's 7 baby steps that I outline below.

7 STEPS TO STOP LIVING PAYCHECK TO PAYCHECK

1. SAVE $1,000 IN AN EMERGENCY FUND.

When we started, we already had this step completed, and my guess is if you don't already have $1,000 in savings (not your checking account), it won't take you long to do.

While going through the baby steps, DO NOT TOUCH this fund unless there is a legitimate emergency.

Your yearly vacation in the Bahamas is not an emergency. A new TV is not an emergency.

2. PAY OFF ALL DEBT EXCEPT YOUR MORTGAGE USING THE DEBT SNOWBALL.

Imagine a life with no payments.

How much extra money would you have if you had NO monthly payments? $200? $500? over $1,000? How would a debt-free life feel?

To make freedom from debt a reality, work the debt-snowball plan. IT WORKS. Our story is proof that it works.

Here is how the debt snowball works!

STEP 1: List all your debts from smallest to largest (excluding your house).

First, sit down (with your spouse if you're married), and list all your debts from smallest to largest. This includes credit card debt, car debt, student loan debt, etc. Everything except for your house.

You might be surprised at just how much debt you have!

In this step I made a visual of our debt and would fill in part of the visual whenever we made an extra payment so that I could stay motivated and see our progress.

In my budget bundle , I have a specific section that includes debt payoff templates.

If you are serious about taking control of your finances, start today.

If you can't find a good enough reason today, you won't find a good enough reason on Monday.

STEP 2: COMIT TO NO MORE DEBT!

This is where I see people have the most trouble. I tell them that they need to literally cut up their credit cards, and some are very reluctant to do so.

They will say things like "well I'm just going to keep one in case of an emergency." Considering how much credit card debt most people have, it sounds like a lot of things fall under the category of "emergency."

Here is a better idea- be a responsible adult and SAVE cash for emergencies rather than relying on a piece of plastic.

You have to be all in when you're getting out of debt. You can't half-ass it.

Your habits will never change if you only kind of or partially commit to getting out of debt and never accumulating any sort of debt again.

Remember, every time you borrow money, you're robbing your future self.

STEP 3. START PAYING OFF DEBT FROM SMALLEST TO LARGEST, THROWING ANY EXTRA MONEY YOU HAVE AT YOUR DEBT.

You will start by paying off the smallest debt, and then working your way down your list, paying off your debt from smallest to largest.

It is important that you pay them off in this order because this way you gain momentum.

People often wonder why it isn't recommended to pay off the highest interest rate debt first. The reason for this is that this step of the baby steps is the one where most people quit. If you start with your highest interest rate debt (which could be one of your largest), then you can easily become discouraged by how long it is taking to pay off your debt.

If you pay off your debt from smallest to largest, it is easier to stay motivated as you have a few easy/quick wins from the get-go.

It is also important that you literally ONLY buy necessities during this time.

No tropical vacations, shopping sprees, etc.

YOU WILL EAT BEANS AND RICE.

Just kidding. You can eat whatever you want, but you get the point.

You have to be INTENSE.

A NOTE ON INTENSITY

During this step, we were throwing anywhere from $2,000-$3,000 per month at my student loan debt. Literally any extra money you can squeeze out, throw it at your debt.

Sell you car. Sell your junk. Start a side job . You want to do this as fast as possible.

We rented for cheap, didn't go on a lavish honeymoon (in fact it cost under $1,000), and we were very, very frugal.

If you live like no one else for a while, later you can be financially free and live like no one else.

People will make fun of you, but that is how you know you are on the right track!

Very few people will actually complete this step, but those who are determined will surprise themselves with how fast they are able to do it.

From someone who has been there and made the sacrifices, IT IS SO WORTH IT.

If you want to throw the most money you can at your debt, it is important that you are on a budget to keep your spending in check.

More debt payoff resources:

3. SAVE 3-6 MONTHS WORTH OF EXPENSES (BUILD YOUR EMERGENCY FUND).

This is where you beef up the $1,000 emergency fund that you have in place.

The key word here is EXPENSES.

You want to save 3-6 months worth of household expenses. Household expenses includes things like rent/mortgage, utilities, groceries, insurance, etc.

These are the necessities.

The reason that we want to save 3-6 months worth is we want to make sure that in the case of a tragic event (probably the most common would be a job loss), is so that we have liquid savings to cover the emergency.

This provides financial security.

4. INVEST 15% OF YOUR TAKE HOME PAY INTO ROTH IRA'S & PRE-TAX RETIREMENT.

During the debt payoff stage and emergency fund stage, Dave's plan recommends that you stop all investing, and that is what we did during the previous steps.

Once you have completed step 3 and have a fully-funded emergency fund, now it is time to invest at least 15% of your gross pay.

The investing can be done a few different ways, but first and foremost take advantage of any retirement plan that your work offers that includes an employer-match.

The employer-match is FREE money, so we want to take advantage of that. It is recommended that you defer into your retirement plan at least what your employer-match is.

After that, to get to 15%, invest in mutual funds. I would recommend consulting a financial adviser to help you with that.

5. SAVE FOR KIDS COLLEGE.

Once you are investing 15%, you can begin to put any extra cash towards saving for your kids (or future kids) college.

This is only if you plan to pay for your kids college!

Joe and I feel strongly about having our kids pay for their own schooling, so we skipped this step.

However, I know many parents do pay for their kids college, so there is no time like now to start saving for the hefty price tag that college brings!

6. PAY OFF YOUR HOUSE.

After you have saved for your kids college (if you plan to do so), any extra cash (after investing) should go towards paying off your house early.

This step is pretty self-explanatory.

Just make sure that you are investing 15% and have your fully-funded emergency fund in place and of course all debt paid off before you tackle this step!

7. BUILD WEALTH & GIVE!

Finally, probably the most rewarding part, build wealth and GIVE!

Throughout the whole baby step process (even while paying off debt), we also recommend tithing 10% to your local church.

DO NOT quit just because you are paying off debt. The Bible never mentions stopping a tithe.

The more you give, the more blessed you will be!

We believe that ultimately our money is not ours, but it belongs to God and he will provide.

We respond to His faithfulness to us by giving generously and with a cheerful heart!

Related: Giving Until it Hurts

YOU'LL NEED A BUDGET.

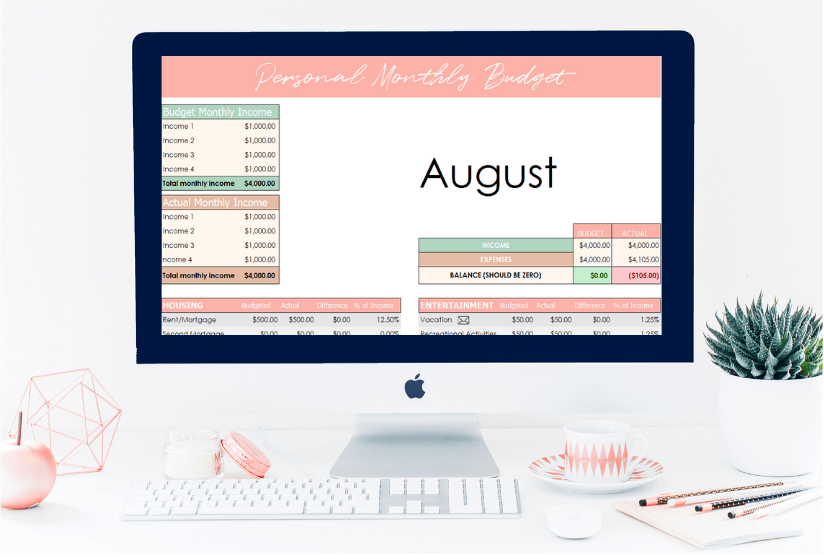

I'm going to be honest, it's going to be really hard (impossible) to complete these steps if you do not live on a monthly budget. Here's a step by step tutorial to get your first budget made.

The excel budget template pictured above is a zero dollar budget , meaning every single dollar is given a purpose before the month begins.

Giving your dollars a place to go before the month begins allows you to make room in your finances for your priorities.

Other budgeting tips & hacks:

These are the 7 baby steps that we have been working through since early in our marriage, I hope that you find them useful!

Remember, all you have to do is decide to START.

Choose to have freedom from living paycheck to paycheck, you won't regret it!

Don't waste another day!

Share this post!