How to Create a Simple Budget for Irregular Income

One of the biggest mistakes entrepreneurs, visionaries, and others with unpredictable and irregular income make is believing that either a budget won't work for them, or that they don't need one.

This couldn't be further from the truth! In reality, these are the people who need a budget the most!

The uncertainty of not knowing when you are going to get paid, how much it will be, and how long it will be until you have money in the bank can cause a lot of stress.

Creating a budget for your irregular income will help life the load of unnecessary stress off your shoulders!

⭐️ Read:

HOW TO BUDGET IRREGULAR INCOME

1. WHAT'S COMING IN?

When you have irregular or unpredictable income, it's important that you make a budget based on your lowest expected income.

This way, when you adjust your budget as money actually comes in, you hopefully only have to make upward adjustments, not downward adjustments!

Look at your income over the last year, of your lowest months of income, what is the average? Use that are your estimated income.

2. WHAT'S GOING OUT?

Next, you need to get a grip on what your true expenses are. I'm not just talking about the number in your head that you *think* is accurate.

If you want to win with money and be financially responsible, you need to know what it truly you to live every single month.

This seems straightforward, but calculating monthly spending is where most people make the biggest errors.

TWO BIG MISTAKES WHEN CALCULATING MONTHLY SPENDING

Calculating your monthly spending is not difficult, but it does require thinking beyond your obvious monthly spending.

Because of this, many people are frustrated financially and don't realize with a little digging, they can fix the issue!

The problem is, when I ask someone what their monthly expenses are, they are able to easily rattle off the obvious - r ent/mortgage, utilities, daycare, at least a general idea of groceries, Hulu, Netflix, cable, dining out, fuel, etc.

Honestly, this is why they come to me in the first place- because after they take their monthly income and subtract the items mentioned above, there SHOULD be a ton of money leftover! But they are frustrated, because at the end of the month there never seems to be much left over.

They wonder, how can this be? According to my calculations, we should have plenty left over!

The reason typically is either one or both of the following-

- Failure to account for TRUE monthly expenses. Sure, you are likely able to list off your monthly expenses pretty easily. But in order to get an accurate picture of your monthly expenses, you need to take into account expenses that aren't monthly. What about school registration and sports fees? Annual insurance premiums?

- Mistakenly believing that the little expenses are so minute they don't need to be accounted for. This includes things like coffee a few times a week, a new outfit, a few trips through the drive thru, etc. These expenses seem so small that they aren't even worth accounting for in a monthly budget. However, these expenses though small, add up over time! Additionally, if you have 5-10 little expenses you aren't accounting for, in total, these expenses are relevant!

If you fail to do these two things, your monthly budget won't work.

You'll find yourself frustrated because it seems like you can never get it right. While perfection isn't the goal (we want to leave room for flexibility), you can get pretty close if you take these two things into account.

THE RIGHT WAY TO CALCULATE EXPENSES

If you want your budget to work, you need to create the best plan possible.

This will make it more likely you will succeed at budgeting and stick with it!

The trick to creating the best possible plan is to account for every single dollar , and put in the work up front to figure out where things REALLY are.

In order to do this, you need to account for your yearly spending, and break your yearly spending down into a monthly budget, and then if desired, a paycheck budget.

CALCULATE TOTAL YEARLY SPENDING

Depending on how much of a grip you have on your spending, this might require you to go through 6 months to a years worth of bank statements.

While doing this, look for not just your monthly expenses, but expenses throughout the year that always seem to catch you off guard. When we account for our TRUE expenses, we actually have an idea of what it takes us to live every single month instead of a wild guess.

List ALL your expenses month by month. After you do this, take an average for things like groceries, household supplies, baby supplies, etc.

Again, be sure to include non-monthly expenses that tend to catch you off guard, such as annual insurance premiums.

SEPARATE EXPENSES INTO CATEGORIES

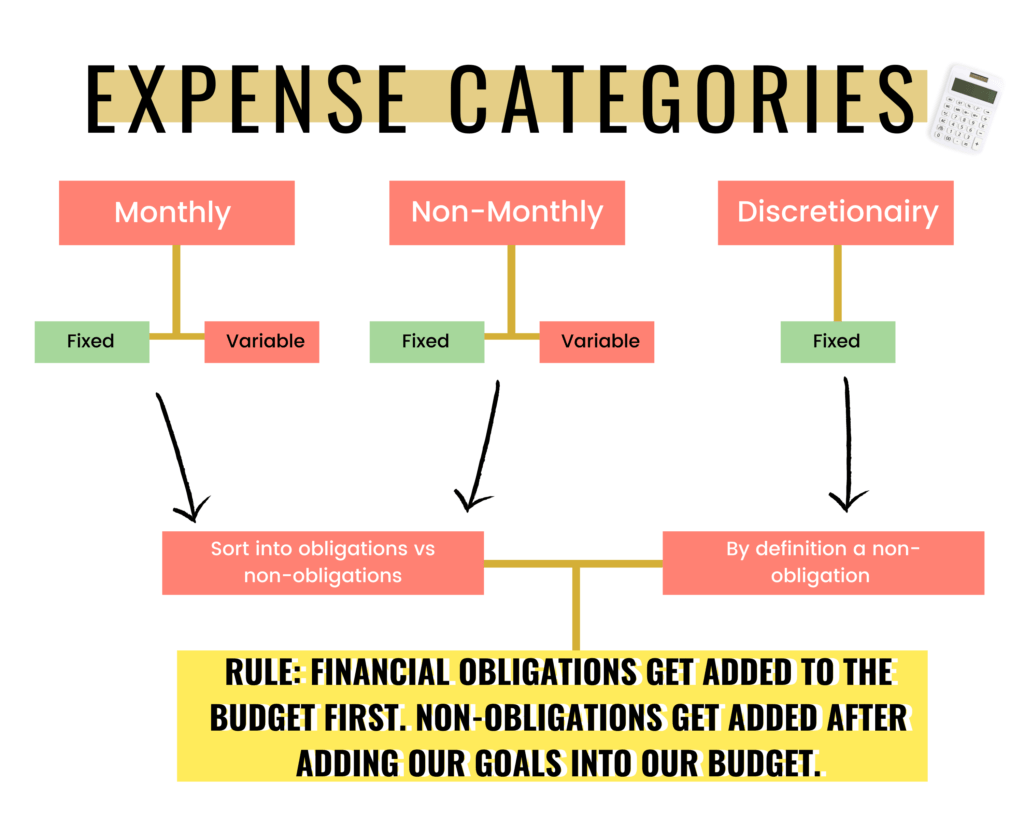

After you've listed all your expenses, separate them into categories based on the nature of the expense , as follows:

- Monthly : All the expenses that are recurring every single month.

- Non-Monthly: Expenses that are not monthly but come up, like annual insurance premiums or car repairs.

- Discretionary: Expenses that can be monthly or non-monthly but are easily adjustable and not necessities. For example, money you spend on yourself for things like beauty, possibly clothing, etc.

🔑 Key Tip: For variable expenses, calculate the average (and err on the high side).

CONVERT NON-MONTHLY EXPENSES INTO MONTHLY AMOUNTS

For expenses that come up irregularly or seasonally, convert these into monthly amounts. Do this for both expenses that are obligations and non-obligations.

Obligation Example: Your annual car insurance premium is $500. To have this money on hand when it's due, you can set aside $42 every month in a sinking fund.

Non-Obligation Example: You are spending about $200 on car servicing and repairs every couple months. This translates to $1,800 a year. Set up a sinking fund for car repairs and budget $150 per month.

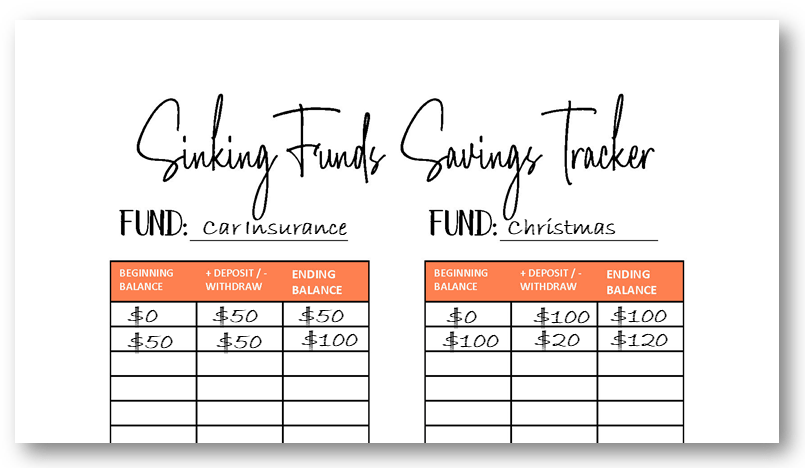

A sinking fund is just a fancy term for a budget category that carries it's balance over from month to month. Hopefully you can see that by doing this, you will be better prepared for ALL your expenses, including ones that "pop up" out of nowhere.

Track your sinking fund balances from month to month using a sinking funds savings tracker. This ensures that your sinking fund money doesn't get lost in your other money. If you don't separate out your sinking funds, you might find that you accidentally spend the money you've set aside!

3. ADD ALL FINANCIAL OBLIGATIONS TO THE BUDGET FIRST.

If you have irregular income, you want to have a budget that ensures you are covering, at minimum, your financial obligations. These are expenses that are unavoidable, not easily adjustable, and due no matter what (hence the word obligation).

Obligations can be both fixed and variable expenses, and monthly or irregular. Be sure to include them all! For example, you would want to include the annual car insurance premium we broke down into a monthly amount in step 2.

This includes things like debt payments, utilities, rent/mortgage, daycare, HOA fees, insurance, etc.

These are the expenses that you add to your monthly budget FIRST.

If your lowest monthly income can't cover your obligations, you need find a way to cut expenses.

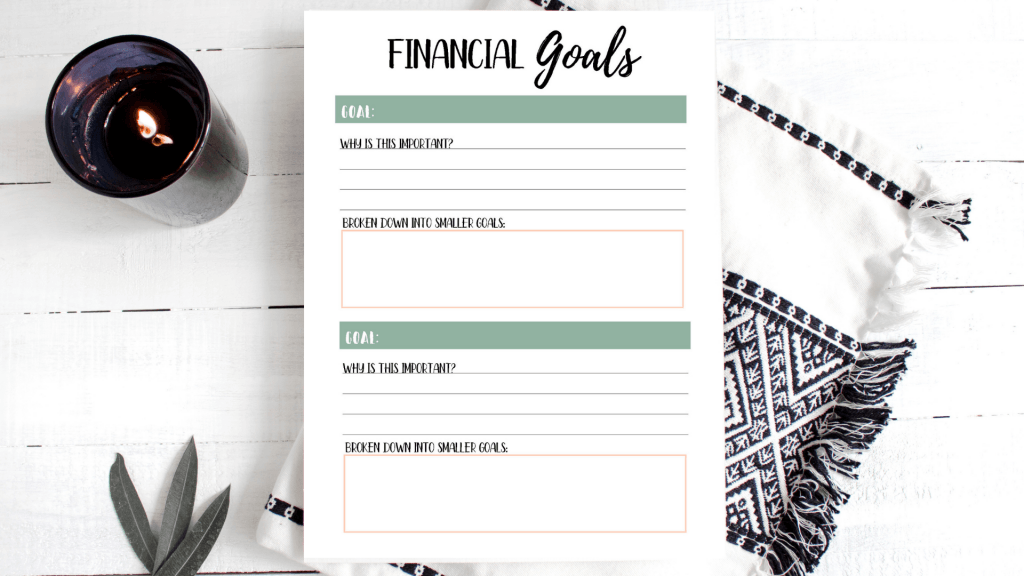

4. DEFINE & ADD YOUR GOALS/PRIORITIES.

This step might seem out of order (like it should be after step 5), but I want you to consider your financial goals into your monthly budget BEFORE you set your budget for discretionary expenses (things like eating out, clothes, entertainment, recreation, etc.)

This way, your budget is lining up with your priorities.

Here are some examples of goals that would be added to your budget in this step:

- Invest 15% of take-home pay into retirement accounts

- Have 3-6 months of expenses in savings

- Pay off all debt as quickly as possible

- Save for a down-payment on a house

- Save for a new (used) car

- Take a family vacation every single year together

Many of these priorities can have a sinking fund set up to save!

For example, if you want to save $30,000 for a downpayment on a home over the course of 2 years, you would need to save $1,250 per month. Put this $1,250 in your budget as a line item and treat it like a financial obligation!

This is how we were able to save for a down payment on our home as well as pay for a car in cash!

5. ADD DISCRETIONARY SPENDING.

Discretionary expenses are expenses that you will have every month, but they are not necessities.

This includes things like eating out, recreation, entertainment, blow money, clothing, etc.

After you have listed out all your income and all your expenses (both fixed and variable) and your financial goals, subtract them and see where you end up. If you have a positive balance, it's time to add in your discretionary spending.

At this point, I'd like to note that this step you might have to go back and adjust the budget items you added in step 4.

You need to decide what your priorities are.

If your personal spending money is more important to you than traveling every year, then adjust your budget to reflect that!

6. ADJUST AS MONEY COMES IN.

When you have irregular income, it's important that you adjust your budget for actual dollars received during the month.

The hope is that you'll only have to adjust upwards, meaning, you took in more money than initially planned and budgeted. This won't always be the case, but if you properly plan, 99% of the time this will be the case.

Let's say you planned $3,000 of income for the month. However, mid-way through the month you've already received $3,000. The temptation will be to take whatever you make in excess of $3,000 and treat or reward yourself. Don't do this! Rather, have a plan for the money that you make in excess of what you budgeted.

Where do you want the excess to go based on your priorities?

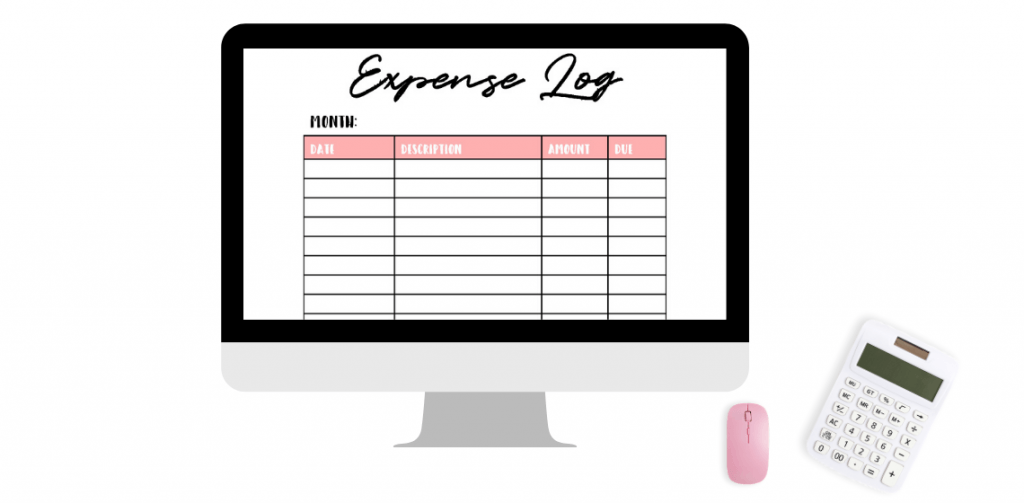

7. TRACK YOUR SPENDING.

It's extremely important that you actually track what you're spending throughout the month.

This is true for both consistent and irregular income budgeting. If you have a plan but fail to see how your plan is performing, your plan is useless.

You can use an expense log or a digital accounting software system.

The most popular accounting systems for small business owners are QuickBooks and FreshBooks. As an accountant, I've had experience with both.

QuickBooks is for more traditional brick and mortar businesses, while FreshBooks is geared towards service based businesses and online professionals.

Whatever you choose, just be sure you are keeping track!

8. BREAK YOUR BUDGET DOWN BY PAYCHECKS

Since your income coming in every month will always be different than the previous month, you can't simply use a traditional monthly budget template to track your income and budget throughout the month.

This is why I created the budget by paycheck spreadsheet, a simple, robust worksheet specifically designed to help budget irregular income.

In the left column, you enter your planned monthly budget. In other words, the budget you'd like to stick to if your income allows it that month.

The green columns are where you actually budget as you receive your paychecks, and keep track of how much you have left to budget.

This spreadsheet allows you to take your monthly budget and break it down into smaller, more manageable chunks. This way, you are more likely to stick to your budget, because you are actively taking your planned budget and allocating your income based on those budget amounts.

If a paycheck isn't close to your planned amount, no problem! You simply adjust your budget for that paycheck!

This spreadsheet works because it helps you take your actual dollars and make them coincide with your plan.

It creates a simple way to help you keep flexibility with your budget.

Share this post!