How This Professional Paid Off $18k in 15 Months By Moving Home!

Becoming debt free is no easy task, and one of the best ways to stay motivated is to hear about others' success!

This is why I think it's important and encouraging to hear other people's stories to learn from them, and stay motivated yourself by knowing what is possible!

Today I am interviewing Elisabeth, a young professional who is currently in the midst of her debt free journey! She is a content marketer who also blogs at thefinanceeffect.com , which you should be sure to check out for more financial advice and motivation.

Let's get into her story!

MEET ELISABETH!

I am a Georgia girl who loves my family, Chihuahua pup and traveling. I was a business major in college and eventually went for my MBA (specializing in International Finance & Investments). This was a dual degree where I studied both in North Carolina and Germany.

While I wouldn't trade the experience for the world, that degree put me over $70K in student loan debt!

Give us a little background leading up to your decision to pay off debt. How much debt did you have? What kind of debt was it and how long did it take you to pay it all off? Did you have a rock bottom moment?

To get serious about paying this student loan debt off, I moved back home as a 28-year-old professional (I have a remote job in content marketing that allows me to do this).

I am one of six kids and two of my little brothers are still at home. I moved back into my old bedroom and readjusted to having my parents and siblings as roommates, and I struggled HARD with the decision.

After living in Frankfurt, Germany for six months for an internship, it felt like a step backwards. I also was ready to get a cute place of my own. But the move back made sense for my situation. I didn’t have a lot in savings and desperately needed to build that up and make a dent in my loans. Thankfully, my parents were open to me moving back in (and my brothers like having me around most of the time ;)).

I've paid off $18K in debt in one year and three months with an aggressive payoff plan and budget. I'm also on track to pay off almost $22K by the time I move out in August.

A LOT OF PEOPLE TALK ABOUT THE IMPORTANCE OF HAVING A “WHY” ON A DEBT FREE JOURNEY. WHAT WAS YOUR WHY?

I was so sick of worrying about payments and having that huge debt amount hanging over my head (I was even scared to open my Great Lakes student loan account every month to check the balance!). I was also tired of not being able to save for other things in life or invest money in a business!

HOW DID YOU TAKE ACTION? WHAT MADE YOUR DEBT PAYOFF JOURNEY POSSIBLE?

As I mentioned above, I moved back home to begin my debt payoff journey. This move happened officially in August 2018 - at first, it was just a temporary solution until I could save up some money. I built up my emergency fund over several months.

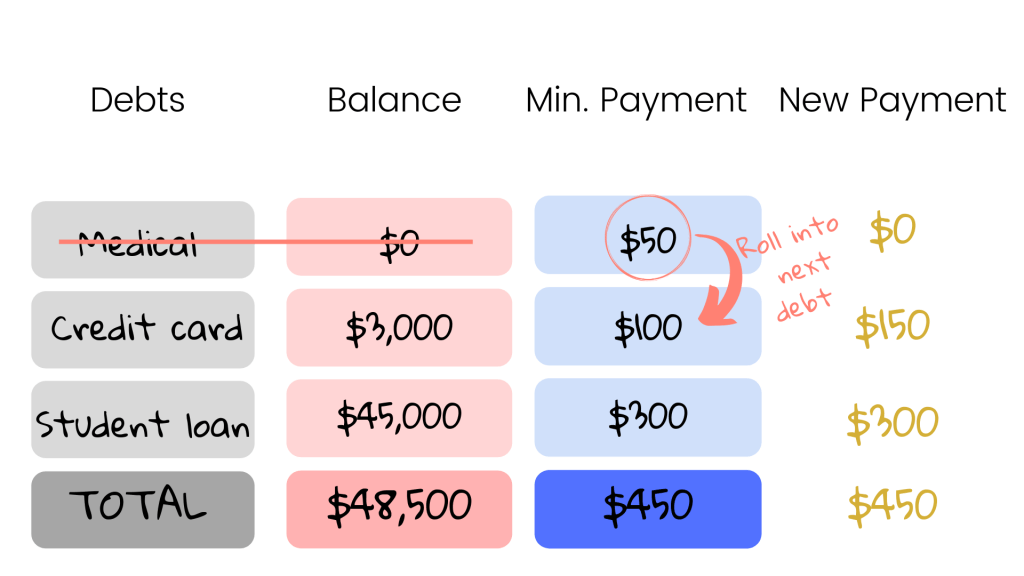

In January 2019, I followed the debt snowball method and paid off credit card debt first while making minimum payments on my student loans.

Debt snowball visual illustration:

In short, the debt snowball method is a form of aggressively paying off your debt. To. do this, you pay off debt in order of smallest to largest, regardless of the interest rate.

After my credit card debt was paid off, I jumped into paying off the $74K in February 2019. I sat down and calculated exactly how much I owed (I had GRADUATE PLUS loans and Stafford loans) and the interest rates.

Then, I looked at my budget and determined how much extra I could pay each month on my loans. After realizing that I could pay $1200 of my paycheck per month if I continued to stay at home (and pay a small rent to my parents every month), I had honest conversations with my parents who were supportive of me moving back for a while longer.

HOW DID YOU STAY MOTIVATED ON YOUR DEBT FREE JOURNEY?

I have two motivation strategies:

- I check the unbury.me platform on a regular basis to visualize how long it will take me to pay off my debt (it’s a free webpage that I highly recommend).

- Also, I have a great financial coach through the Qoins app. He has helped me budget-wise, talking through payoff strategies and breaking down how much I need to budget to continue to stick with my $1200 student loan payments.

⭐️For visual motivation on your debt free journey, check out my editable pdf debt snowball tracker!

WERE THERE ANY SACRIFICES YOU HAD TO MAKE TO BECOME DEBT FREE?

From sticking to the $1200 student loan payment every month, I can’t exactly save as much as I would like for other things like retirement or investing in a business.

Also, moving back home hasn’t always been easy. My parents have been supportive, but it’s been different being back with my little brothers (16 and 14) and sometimes feeling like I’m still in high school. There’s also those awkward conversations at family events, answering the question, “So where are you living now?” Telling them that I’m living at home at almost 30 years old isn’t information that I’m excited to share. :P

However, in addition to paying off a good chunk of debt, I’ve made good memories being back at home. I’ve gotten to attend most of little brother’s football games and other events. I’m also close with my parents (my mom is technically the other member in my ‘at-home co-working space’).

So though the journey hasn't been without its small sacrifices, I’m thankful that I’ve had the opportunity to both pay off debt and spend quality time with my family.

WHAT WERE THE BIGGEST OBSTACLES YOU HAD TO OVERCOME ON YOUR DEBT PAYOFF JOURNEY?

I wouldn’t call living back at home an obstacle (since it’s the reason I’ve been able to make progress with my debt), but it has been challenging sometimes just struggling to feel like a successful adult. There's a certain stigma still attached to living back at home and I've gotten strange looks from people when I share my living situation.

It’s also not always easy knowing that $1200 of my paycheck is off limits every month (I would LOVE to be using that amount to put more into my blogging business or investments).

WHAT IS THE BIGGEST LESSON YOU’VE LEARNED BECOMING DEBT FREE?

I'm not completely debt free yet, but the closer I get, the more that I realize that getting out of debt is all about planning and being consistent with that plan.

Once I decided that I was going to be living at home, I mapped out a debt-payoff plan and gave myself a move out month (August 2020). I made my payment amounts automatic (and bi-weekly) so I wouldn’t feel tempted to spend my $1200 payments.

I’m also saving for a new(er) vehicle so I’ve had to be consistent with how much I’m stocking away for that purchase every month. Once I’ve finished saving for my car ($500 savings every month), I’m going to roll that $500 over into my student loan payments.

Having a solid plan with debt payments, savings, and also knowing that my move home is temporary has helped me pay off as much as I have.

WHAT IS YOUR BEST PIECE OF ADVICE YOU’D LIKE OTHERS WHO WANT TO PAY OFF DEBT TO HEAR?

Make a debt payoff plan and be consistent with your payments!

Maybe you’re not able to move back home like I did. Still try to block off a realistic amount of your paycheck that can serve as a student loan payment every month (more than the minimum amount). Write it down in your budget and live off the other portion of your paycheck. Make your debt payments automatic so you can kiss the monthly amount goodbye and not feel tempted to spend it.

You can always add more on top of this payment, but it’s important to have a baseline amount to ensure that your debt is going down as much as possible.

Consistency is key!

IS THERE ANYTHING ELSE YOU’D LIKE TO SHARE WITH THOSE WHO WANT TO BECOME DEBT FREE?

Get a hold on your spending! Paying off my student loan debt has made me more aware of how much I spend each month on things that aren’t really necessary. Look at your bank statement. It’s a little tedious, but go line by line of your transactions. Determine which purchases count as a “want” and which purchases count as a “need.” Budget how much you actually should be spending on certain purchases and eliminate the fluff (e.g. do you need to be paying for both Netflix and Hulu every month?). This extra money can then go toward your debt payments.

⭐️Read more from Elisabeth at thefinanceeffect.com!

Click here to read our debt free story, how we paid off over $20k in 12 months living on one income!

START YOUR DEBT SNOWBALL

- The exact printable worksheet we used to pay off over $20k of student loan debt in 12 months

- Editable & fillable PDF printable worksheet - type directly into PDF

- Visualize your progress and stay motivated on your debt free journey

Share this post!