Melanie

De Jong

Melanie

De Jong

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

How to Budget Your Extra Paycheck With Purpose

During an extra paycheck month, it's important to make a plan for your extra money so that you are spending based on your priorities. This doesn't mean you don't get to enjoy it at all! Rather, you want to make sure you have covered all your bases before enjoying the excess!

What I mean by a month with an extra check refers to the fact that some months have four weeks and some months have five weeks. If you are paid weekly or bi-weekly, this means you will have months where you have an additional paycheck.

If you've ever felt like there was a month where you had a little extra money leftover than normal, you're not going crazy!

Unfortunately, if you are paid once a month you will never know the magical feeling when you're in an additional paycheck month!

The beauty of having an extra paycheck when you're living on a monthly budget is that you can take that extra cash and put it towards something that truly matters to you- whether that be saving for vacation, paying off student loan debt, or beefing up your emergency fund!

Don't worry, there's room for enjoyment too :)

Here are some things to consider when budgeting your additional paycheck!

HOW TO BUDGET YOUR EXTRA PAYCHECK

First things first, it's important to actual budget your extra paycheck. Otherwise if you spend it too quickly, you might find at the end of the month that you come up short on your budget.

When you budget every single dollar that comes in to your bank account, you are creating a plan for that money based on your priorities.

Here are some things to keep in mind and consider during an extra paycheck month!

First, get my free budget by paycheck template by subscribing to my email list!

DON'T FORGET WEEKLY EXPENSES

When you live on a monthly budget, it's easy to forget that certain expenses occur weekly. If you don't consider these weekly expenses, at the end of the month you might be left wondering why your numbers don't add up!

Here are some examples of weekly expenses that can cause a road bump in your budget:

- Daycare

- Groceries

- Date night

- Gas/Fuel

- Bi-weekly mortgage payment

These weekly expenses need to be accounted for in a month where you have an additional paycheck.

Be realistic.

Although groceries, date night, and fuel are variable expenses that can be easily adjusted/manipulated to fit the budget, if you aren't realistic when budgeting you'll be frustrated.

Is it realistic to think that you'll be able to stick to your $500/month grocery budget on a five week month when you're used to only having to stretch the grocery budget four weeks? If you do some extra planning it might be. However, if you don't carefully plan ahead of time it's probably not realistic to think you'll have a week where you don't have to buy any food.

Likewise, it's irrational to assume that you won't drive anywhere for a week. Therefore, you should add a little extra money to your gas/fuel budget as well.

GET A MONTH AHEAD ON YOUR BILLS

How amazing would it feel to always be living on last months income? We always have one months worth of expenses as a buffer in our checking account, and 6-9 months of household expenses in our emergency fund.

When you live on last months income, you break the paycheck to paycheck living cycle and are able to have peace because you have a buffer and a PLAN.

In order to do this, simply calculate what your monthly obligations are (you don't need to include expenses that are NOT obligations like investing). After you've done your calculation, take that portion of your check and put it into your checking account.

This way, you constantly have a one month of expenses buffer in your checking account!

Alternatively, you could keep this designated amount in your savings account if having it in your checking account tempts you to spend it.

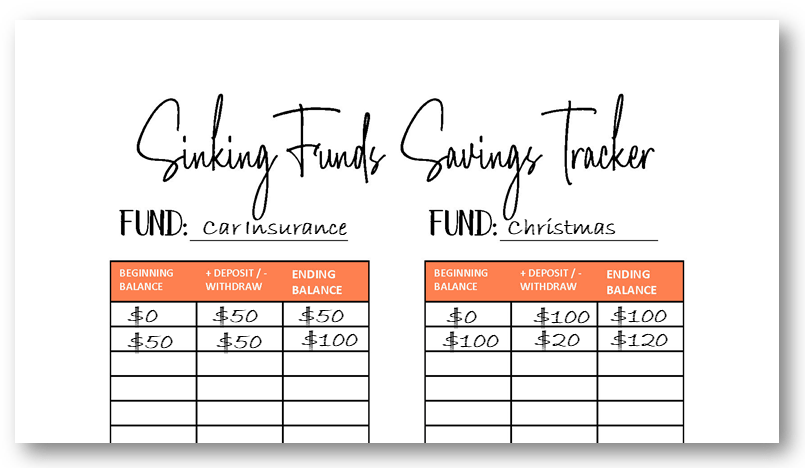

BOOST YOUR SINKING FUNDS

Before spending your extra cash, consider boosting your sinking funds! I know it's tempting to spend it on something you've been wanting for a while, but remember your priorities.

Is it important to you that your family takes a vacation every year and spends quality time together? Put some of your paycheck (after you've thought about your weekly expenses that need to be covered) towards your vacation fund!

The goal of sinking funds is to have the cash to pay for larger, seasonal/irregular expenses instead of finding yourself overwhelmed when they hit because you didn't plan for them.

Some other common sinking funds include:

- School fees/dues

- New car

- Car repairs

- Home repairs

- Furniture

- Private school tuition

- Christmas gifts

- Medical expenses

- Insurance premiums

Allocate a portion of your extra paycheck to your sinking funds so you get closer to reaching your financial goals!

A good way to keep track of your sinking funds is to use a worksheet every month , like the one pictured above! This way, if you keep the money you have earmarked for certain sinking funds in your checking account (or all sinking funds in a savings account), you can easily track the balances and reconcile to your checking or savings.

⭐️Related Content:

BEEF UP YOUR EMERGENCY FUND

I'm a super saver by nature so beefing up our emergency fund is always a really attractive option for any extra cash we get!

If you don't have 3-6 months of household expenses in savings already, you should put your extra check into your savings account.

I can't stress how important it is to have a fully funded emergency fund.

When you have an emergency fund in place, large, unexpected cash outlays become an inconvenience rather than a financial crisis.

PAY OFF DEBT

If you are in debt, I highly recommend using your additional income months to pay down your debt.

We paid off over $20k of student loan debt in 12 months while living on one income, and one way we were able to do this was by putting any extra money we received towards our debt. This included gifts, bonuses, and additional income.

Add your additional check to your debt snowball! If you are not familiar with the debt snowball, this is a method of aggressively paying off debt (no matter what your income)!

In short, using the debt snowball method, you make minimum payments on all your debts besides the smallest one. You throw as much money as possible at the smallest debt until it's paid off. Next, you take the amount you were paying on that debt and add it to the second smallest debt.

You continue this process until all your debt is paid off- hence the term debt snowball!

If you are working on your debt snowball or would like to start, use my editable and printable debt snowball tracking worksheets!

When paying off our debt, we taped these tracing spreadsheets to our fridge to keep us motivated! It really helps to have a visual reminder of your progress, because without a visual reminder it's easy to discouraged!

Seeing your progress every single day will not only motivate you, but make you proud of how far you've come!

INCREASE YOUR INVESTING

A good goal for investing is to be setting aside at least 15% of your gross income for investing every single month.

Whether you're hitting that number or not, you might want to use your extra income to contribute to your investment account (or start one)! Investing is such an important budget line item, because this is quite literally your financial future.

Do I hope you inherit a bunch of money or win the lottery? Absolutely! But I don't want you to bank on that as a retirement plan ;)

Studies have shown that the majority of people have not considered or calculated what they need to be setting aside now in order to retire with the standard of living they'd like in retirement.

Investing resources:

- ⭐️Read:

- What You Need to Know About Retirement Planning

- 7 Things You Should NEVER Do in Times of Financial Hardship

- The Best Investing Tips Millennials Need to Know

- How to Invest When it Feels Like You Have No Money

- The 7 Baby Steps to Stop Living Paycheck to Paycheck

- 10 Habits to Start in Your 20's to Retire a Millionaire

- The 7 Most Important Money Habits You MUST Know

- 7 Things Millionaires Do Differently With Their Money

- 7 Surprising I Wish I Knew Earlier About Money

ENJOY IT

Last but not least, enjoy your extra income!

I'm not against fun and enjoyment, I just want to make sure that you cover all your bases before spending your extra paycheck. This way, you avoid frustration at the end of the month stemming from not properly planning.

Additionally, by planning, you ensure that your priorities are being covered.

When how you want to prioritize your finances doesn't match how your money is actually being spent, you'll be frustrated and feel defeated. I felt this way as a beginner budgeter myself.

This is why I created my own unique financial plan and budgeting system that serves one purpose, to make your money reflect your priorities.

MY UNIQUE PRIORITY BASED BUDGETING RESOURCES :

FOLLOW

ON IG