Why You're Frustrated About Your Money & How to Fix It

Money problems and frustration with your money is something that many people battle their entire life. Here's why.

It's payday. You check your bank account, woohhoo!

You calculate what you'll have left to work with after the bills you need to pay before your next check are paid. Hmm, not bad. You can finally get your mom a NICE birthday gift, sign up your daughter for dance lessons, and have a date night!

You think to yourself FINALLY we will get on track with money! Then...

You get a notice your annual community pool membership fee is due next week. Your calendar tells you it's your turn to make breakfast for your sons baseball team, a hefty addition to your grocery spending. An unexpected visit to urgent care after your daughter fell off the trampoline.

Next thing you know, you're limping a long until your next payday and you're FRUSTRATED because all the things you wanted to do with your money once again aren't done.

Opportunities might arise, but you can't take them because your money is held hostage until the next direct deposit.

What it all boils down to is that you are frustrated because you're money is not doing what you want it to.

While you might be frustrated that unexpected expenses arise out of nowhere, the root of your frustration is that you wanted to use that money for something else that is a bigger priority to you.

This is why it's important to have a plan and a plan that is based on your priorities.

HOW TO EFFECTIVELY DEAL WITH MONEY PROBLEMS

1. CREATE A PLAN

In order to tell your money what you want it to do, you have to create a plan that you can stick to every month. The best plan you can have for your money is a monthly budget. Here's a detailed instructional post on how to create one.

Additionally, you can snag my free monthly budget template to get started drafting your budget.

My budgeting worksheets & tools:

WHY THE BUDGET WORKS

Even if you're not a budget person, stick with me here.

What separates ok plans from excellent plans is the ability of the plan to work in both the good times and the bad times.

A budget is an excellent plan because it works in the good times and the bad times.

Most people think of a budget as a restraining, complicated, time-consuming task that they don't need because (for the time being) they are doing fine financially without one.

Then the crisis hits. A job layoff, unexpected medical bills, your transmission in your car goes out, you have big goals that seem unreachable. The stress mounts.

Once the fog clears and you're left with the mess, you realize that you need a plan! You realize there is a problem. This is good! You are coming to terms with the fact that money is indeed finite and it needs to be managed if you want it to reflect your priorities.

Your monthly budget is the foundation of your financial plan. Once you create a budget, it will feel like you got a raise! It's like breathing in cool, fresh, mountain air.

2. DEALING WITH THE UNEXPECTED EXPENSES

Another common reason money problems seem to arise out of nowhere is because of unexpected expenses that catch us off guard. These expenses leave us stressed and defeated!

The best way to deal with unexpected expenses is to build an emergency fund and set up sinking funds.

EMERGENCY FUND

Simply put, an emergency fund is a fancy term for a savings account that holds 3-6 months of your household expenses. This is your protection against the curveballs life throws at you.

When you don't have an emergency fund, you are living at the mercy of life's unexpected events, which I promise will come!

Here are some instances where using your emergency fund might be necessary:

- Job loss (cover your lost income until you find a new job)

- Unexpected medical event (meeting your deductible)

- Unusually large vehicle or home related expenses

- l eaky roof

- New AC unit

A brand new TV is NOT an emergency ;) It's important that you make sure your emergency fund is only used for true emergencies, and immediately replenished after use.

SINKING FUNDS

Sinking funds are a simple tool you can use to save money for larger expenses over time. It sounds so easy, right? It is! The hardest part of funding your sinking funds is being disciplined to not use the money for anything else. Because of this, I recommend setting up a separate bank account for your sinking funds!

If you want to go on vacation, purchase some new furniture, or buy a new vehicle, the logical thing to do would be to save up the money for it over time!

However, that's not what the majority of Americans do. Rather, they decide one day they need something, and whether they have the cash for it right now or not, they buy it!

This is why Americans have more credit card debt (and debt in general) than ever before.

I'd like to introduce an alternative method to debt, sinking funds!

it will require patience, but it's worth it to not feel the weight of debt and monthly payments every month. No one likes the feeling of having a looming large credit card balance hanging over their head.

SETTING UP YOUR SINKING FUNDS

Setting up your sinking funds will take a little time, especially if you're not sure where things are at in your finances. In other words, if you don't know what you're spending every month, it's going to take some leg work.

Here's how to set up your sinking funds:

- Review 3-6 months of bank statements.

- Identify seasonal/irregular and unexpected expenses. What expenses caught you off guard in the past months? Are there any expenses that you repeatedly forget about?

- Make a list of all expenses you can think of that fall into those categories .

- Decide how much you would like to contribute to each sinking fund per month .

- Add to your monthly budget . For a detailed tutorial on how to do this, read this blog post.

- Track your sinking fund balances. You MUST keep track of your sinking fund balances, especially if you don't have them in separate bank account. Otherwise, it's easy for your sinking fund money to be spent on other things!

- When an expense arises, decipher between using emergency fund or sinking fund.

Don't forget to track your sinking funds every single month! If you don't, you can easily lose track or use the money for something else.

We are leaving for vacation next week, and it feels so good to know that we have the money set aside in a sinking fund, and our vacation spending isn't going to follow us home! No buyers remorse or guilt when we get home!

By purposefully planning your expenses, and I mean ALL your expenses (monthly, quarterly, annually) you negate the feelings of frustration of not being prepared for certain expenses.

3. KNOWING YOUR PRIORITIES

LETTING YOUR PRIORITIES LEAD

This is where budgeting gets fun!

You get to create a unique and specific plan that will allow you to live a life based on your priorities.

I'm not saying you won't have frustrating months where you have to use your emergency funds more times than you'd like, but when your spending consistently reflects your values and priorities you experience true freedom.

So how do you create a budget that reflects your priorities?

First, define your priorities. What are you money goals? Some of ours include:

✅Be generous.

✅ Invest

for our future.

✅ Leave a legacy

for our children.

✅ Have me stay home

with our children.

✅ No consumer debt.

✅ Pay off our home

early.

✅ Visit my family

in Oregon at least once a year.

Once we defined our priorities, we made sure that after our financial obligations (fixed expenses we HAVE to pay) were budgeted, we added these goals into our monthly budget.

Essentially, even though these items are not fixed financial obligations, we treat them like they are.

PRIORITIES CAN CHANGE

Realize that your priorities will change over time, and that's okay! In fact, that's good!

For example, when we found out we were pregnant with our first child, we had to shift our priorities. Instead of throwing all extra money at our retirement and home, we started aggressively saving for maternity leave and medical costs.

➡️ Read: How to Budget for a Baby

Because our priorities changed, our budget changed. We added a sinking fund for the costs mentioned above, and we also started a sinking fund for baby supplies.

It's okay for your priorities to change, and when you have a plan to ensure your finances are reflecting your priorities, you'll have financial peace!

GENERAL GUIDELINES

So you've set your priorities, made sure your obligations are accounted for, but now you're wondering- how do you know if you're overspending?

First of all, if after you account for your financial obligations, goals, and sinking funds you have a negative balance, you have to find a way to cut spending and live on less than you make.

However, even if you come out positive, that doesn't necessarily mean you aren't overspending!

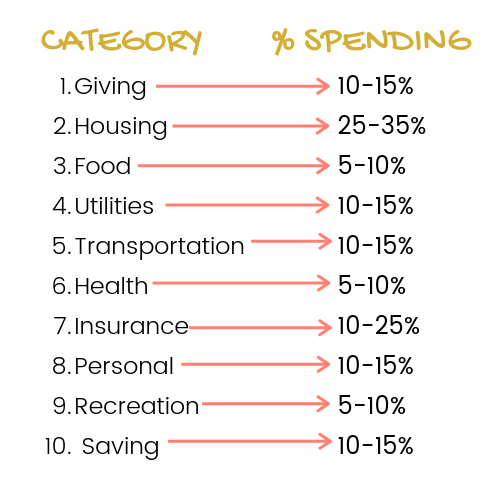

These are some general budget guidelines based on the Dave Ramsey budget system:

If you're outside these ranges a little it's not a big deal, because everyone's situation is different. However, if you are way off from these guidelines, that could be a sign of overspending.

4. DEALING WITH YOUR SPENDING

If you are overspending, the only way you will know is by tracking your expenses. I recommend using an app or an editable pdf expense log and bill tracking sheet!

What items can you trim down? Or, do you simply need to make more money?

What frustrates a lot of people is that often the only solution offered to money problems it to cut out your daily latte.

Trust me, while it adds up over time, I understand that for many people that isn't going to cut it because they have an income problem!

In that case, I obviously highly recommend starting a blog (it is super nice side money)!! Otherwise, look for a part-time job, sell on Etsy ( I make a good chunk of money on Etsy), or consider finding a virtual assistant job.

You can always find a way to make more money:

Share this post!