9 Simple Ways to Save for Stress Free Vacations Every Year

These are the sure-fire, stress-free ways to save for vacation.

Proven and tested by the De Jong family. Five stars.

First and foremost, I want you to remember that everyones vacation budget is different. A vacation to Mexico might be what you can afford or a staycation might be what you can afford this year.

Don't focus so much on where you're going, focus on the memories made.

Some of my favorite memories growing up were super cheap vacations my family took. We hiked, camped, and backpacked often.

My parents never took us to Hawaii (nor have they ever been), yet I have memories with them that will last a lifetime!

Act your wage. Do what you can afford.

*Steps off soap box*

Okay, back to the regular programming. Budgeting for vacation.

9 WAYS TO SAVE FOR VACATION (MY STEP BY STEP PROCESS)

This is the OFFICIAL Melanie vacation budget prep process.

I can't offer any travel credentials, because this is coming from a girl whose no world-renowned traveler.

However, I do know a thing or two about budgeting, saving money, being frugal, and staying out of debt!

These steps can be applied to any trip you are planning! :)

This is my simple process for setting a vacation budget, saving for vacation, and spending on vacation.

Step 1: Estimate Your Costs

The first step is to estimate how much your trip is going to cost you. Go high to be on the safe side.

Add up EVERYTHING you can possibly think you'll be spending money on, including:

- Flight

- Gas

- Car Rental

- Lodging

- Activities

- Restaurants/Food

- Parking

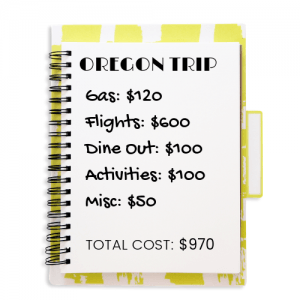

I've done this for our next trip to Oregon to visit my family at their new abode.

I estimated that our upcoming trip would cost about $970.

Obviously, our lodging is free since we are staying with my family, which is a huge cost savings!

My parents will be picking us up from the airport and being our chaperone while we're there, so we won't have any car rental fees.

To keep my numbers easy, I estimated about $1,000 total after writing out this list.

Plus, I would always recommend shooting high and adding a little cushion to your budget, you never know what you'll forget to budget for!

Step 2: Make a Savings Plan

Next, make a plan detailing how you are going to pay for this trip.

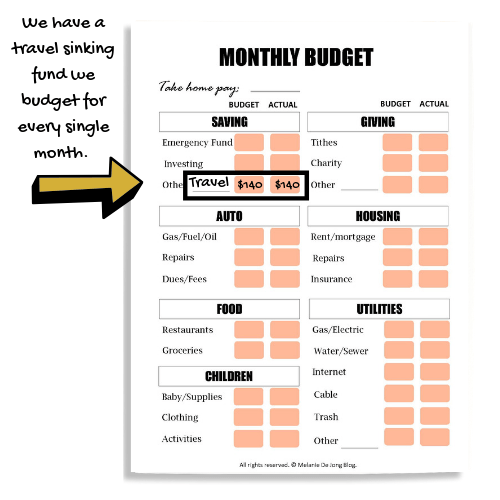

Since we have a travel sinking fund , we budget a set amount every month for travel even if we aren't planning any trips yet.

That being said, most of the time when we formally decide on a vacation we already have a good head start on our saving since we budget for it every month no matter what.

When we decided on our Oregon trip, our travel sinking fund had about $800 in it.

However, we were planning a weekend getaway that would cost $500, so I had a $300 head start on my saving for the trip!

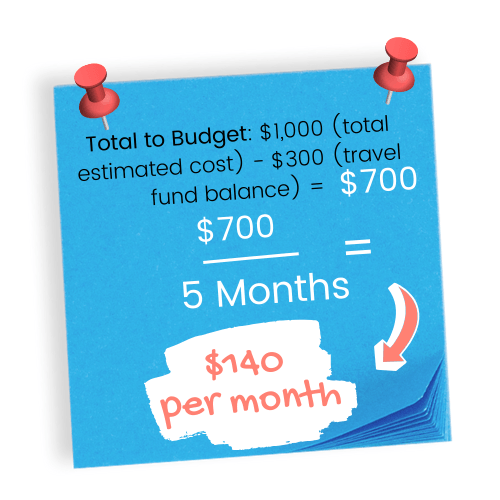

Here's how I calculated what we needed to set aside (minimum) per month for our vacation:

We started saving for our trip the beginning of March.

I took the total cost of our trip of $1,000 less our starting travel fund balance of $300 to get $700 that needed to be saved by August.

This gave us five months to save $700, which meant we 'd have to set aside $140 per month to meet our goal!

Step 3: Put it in the Budget

Everyone who is debt free should have a travel sinking fund in their monthly budget.

This way, if your family decides in September they want to do a Christmas vacation in December, you already have a head start on your saving!

Once I know how much I need to be setting aside every month to meet our vacation goal, I immediately add it to the budget.

Here's a how it would look on my free monthly budget template!

To get this exact monthly budget template, subscribe below and it will be instantly delivered to your inbox! :)

If you don't live on a monthly budget, this is an essential step to saving money for vacation.

It's really hard to find money to save if you don't know where your money is going in the first place.

Like I said earlier, we set aside money every single month for travel (in a sinking fund), whether we have a trip planned or not.

Budgeting Tools:

Step 4: Decide Dates

Now it's time to decide when you're going to be taking this trip.

If you're dates are flexible, you can save a lot of money.

Our dates were semi-flexible for our upcoming Oregon trip, we knew we were going to go sometime during the first two weeks of August.

In the past, our dates have been more flexible and we've made our decision based on flight prices.

I use flight tracking apps/services to make sure I get the lowest possible ticket price.

Here are some of the tracking services I use:

The best part is that if you use Ebates you can get cashback on all your flight purchases through most of the sites listed above!

When I visited Expedia, this popped up in the right corner of my browser:

All I would need to do is click the activate button to get 8% cash back on my flight purchase since I have the Ebates browser button installed!

We use Ebates to get the rewards without having the credit card!

Step 5: Search for Deals

After deciding dates, it's my favorite step- deal hunting! This is where champions are made. This separates the boys from the men.

That might be a bit dramatic , but I like to keep things exciting.

In the case of our Oregon trip, I didn't have to search for deals on lodging, and it's a small enough town that they don't have any Groupon specials.

Here are a few ways I search for deals on lodging, activities, and dining out!

- Activities

- Check Sam's club for great deals on activities everywhere. You can even filter by state to see what's available in your area! Here are just some of the travel/entertainment deals Sams's Club offers:

- theme and water parks

- music festivals (includes Watershed, Country Thunder, etc.)

- Disney

- zoos and aquariums

- concerts

- movies

- Dine out - I use Groupon and filter my search specific to the area we will be for deals on dining out. Often I'll find a deal to pay $35 or $40 for a $50 meal voucher.

- Lodging- Search Sam's Club first (they offer discounts on TONS of hotels), then try Expedia or Booking.com to get the best possible price for lodging!

Deal hunting is my favorite part of planning our trip. I love seeing how cheap I can do things and how I can get the most value for the lowest possible price.

You don't need to feel bad about being thrifty/frugal.

The way I see it is you work hard for your money, and there's nothing wrong with wanting to get the most for it!

Step 6: Financial Prep for Trip

As your trip approaches, it's time to start revisiting your financial plan and evaluation your game plan for the actual trip.

For our Oregon trip, I knew when I started planning that there was a possibility we'd be going to a concert before the Oregon trip, which would take a good chunk out of our travel fund.

So when I was calculating how much I needed to save, I calculated as if we were going to the concert for sure (which we did end up going).

As your trip get's closer, be sure to see how you're doing on your savings goals.

If you weren't able to save as much as you thought, you might have to cut out a few things from your trip.

Step 7: Bring Cash

Decide how much cash you are going to bring on the trip, and be sure to get your envelopes filled before you take off!

If you don't use cash envelopes, seriously consider it. Using cash envelopes has completely changed our spending behaviors!

You can click here to check out the beautiful floral watercolor cash envelopes pictured above :)

Our income is the highest it's ever been, and we use cash envelopes just like we did when we were broke newlyweds paying off a mound of debt.

I always like to have our spending money and dining out money in cash, because those are the areas we tend to overspend the most.

If you'd like to give cash envelopes a test run, I have a free printable template available if you subscribe below to my email list!

Remember, personal finance is all about behavior.

If you have overspending tendencies, cash envelopes will help you tremendously.

It's hard to stop spending when there is no one telling you to stop !

Don't take it from me, take it from the experts. It's been proven study after study that there is a different chemical reaction in your brain when you use cash instead of credit!

Step 8: Track Your Spending

Fight the temptation to forget all about your budget while on vacation. You'll have a greater piece of mind if you commit to tracking your spending while on your trip.

I find five spare minutes every day of vacation to update our spending and see how we're doing.

The problem with using credit cards while on vacation is that the money isn't coming out of your account that instant you swipe your card. So it doesn't hurt.

When we are on trips, I use the EveryDollar app to track our budget!

I log into our bank account and then put the trip expenses in our app to see how much we have left in our vacation budget.

Try and do this at least every other day of your trip!

Step 9: Review How it Went

On the plane ride/car drive home, evaluate your spending for the trip. How much did it cost you? Were you over or under your budget?

Our first few trips we took after we started budgeting we were way over!

Although I had budgeted for the trip which was a good step in the right direction, I failed to track our spending as we went.

I thought in my head I had a good idea of where we were at, but I always forget things! I'd forget about the $30 we spent on parking. Or the $10 of snacks we bought at the gas station.

Little expenses add up, and before you know it you spent $100 on gas station food and parking!

Don't be discouraged if you're over on your first few trips!

Learn from it. Reflect on what went well, and what you need to do next time to ensure you stick to your budget!

Share this post!