How to Develop Money Habits so You Reach Your Financial Goals in 2020

If you want to reach your financial goals this year, you might need to start thinking about your goals differently.

This is a good time of the year to talk about habits because this is when everyone and their mother creates New Years Resolutions.

In and of themselves, New Years Resolutions aren’t inherently bad. In fact, I appreciate the sentiment and I’m glad that people want to change!

However, the issue lies in the fact that 92% of New Years Resolutions don’t last and will be gone before Valentine’s Day.

Soon enough you find yourself scouring the house to remember where you hid the candy. Or in the Target checkout line you swore you weren’t going to be in unless the apocalypse happened.

ACHIEVING FINANCIAL GOALS

In his book Atomic Habits, James Clear says that winners and losers generally have the same goals. Successful people and unsuccessful people generally have the same goals.

When it comes to finances, I don’t know anyone saying I want to double the debt I’m in, fight with my spouse about my spending habits, and save nothing for retirement.

If those are your goals, you probably need to see a psychiatrist.

We all have similar goals, yet we end up with vastly different results.

There are some people who will always be broke. Always.

They won’t stop getting into credit card debt. They’ll always feel like there’s more bills left than money at the end of every month. And, they’ll continually blame it on their lack of income.

The truth is, for these people, more money wouldn’t help. They’d just have more payments.

For others, broke will just be a place they are passing through and they will eventually become wealthy.

What’s the difference between these two people?

While both have goals, they have extremely different systems.

1. Start with WHO Goals

When you know who you are, you know what to do. When you’re trying to quit drinking, you say to others who offer you drink after drink “that’s not who I am anymore.” Your identity has changed.

A healthy identity creates positive habits and positive habits reinforce a healthy identity.

Who do you want to become? Do you want to become someone who spends carefully? Who is able to give abundantly? Do you want to be someone who achieves financial freedom? Or maybe you want to be someone who spends carefully instead of shops impulsively?

Identity shapes habits. Next, start with changing small habits.

2. Focus on SMALL Habits

No single action changes your identity. However, multiple, small actions over time will change how you see yourself and will eventually change your identity.

Sean Covey said, “Habits will make or break us. We become what we repeatedly do.”

If we will change what we do and our habits, the outcomes will fix themselves.

This isn't to say that you shouldn't set big goals. You absolutely should! It's how you go about achieving those goals that often gets done the wrong way.

Let's say your goal is to pay off $40k of debt in 3 years. Instead of not buying yourself ANYTHING or going out to eat AT ALL, reduce those areas to a realistic goal.

Success (and money saving) is done little by developing small disciplines that reap a big harvest over time.

3. The Overnight Success Myth

It’s the things that no one sees that bring the results that everyone wants.

Many people have said to me, “of course you could pay off so much debt in 12 months, you had two incomes and no kids.”

However, there was a lot that other people didn't see.

My husband was still in school when we married so we were living off one income during our debt payoff period, we drastically changed our spending habits, it took MONTHS to get our budget right, I picked up extra hours at work to earn extra money.

Lots of people want to be debt free, but they get frustrated because they think getting there will be easy or they get frustrated because of lack of early results.

4. Key Financial Habits You Must Master

When it comes to your finances, what habits can you put in place to ensure that you meet your financial goals?

Developing the following fool proof habits will help you hit your financial goals this year:

- Get on a budget.

- Cut spending so you can pay off debt.

- Automate your investing.

- Set up sinking funds for big purchases so you don’t go into debt.

- Talk with your spouse about money.

These are all s mall disciplines that lead to major results. Just don't quit. Don't get discouraged. One step at a time.

BUDGETING

If you’re frustrated because there’s never any money left at the end of the month, create a budget and stick to it.

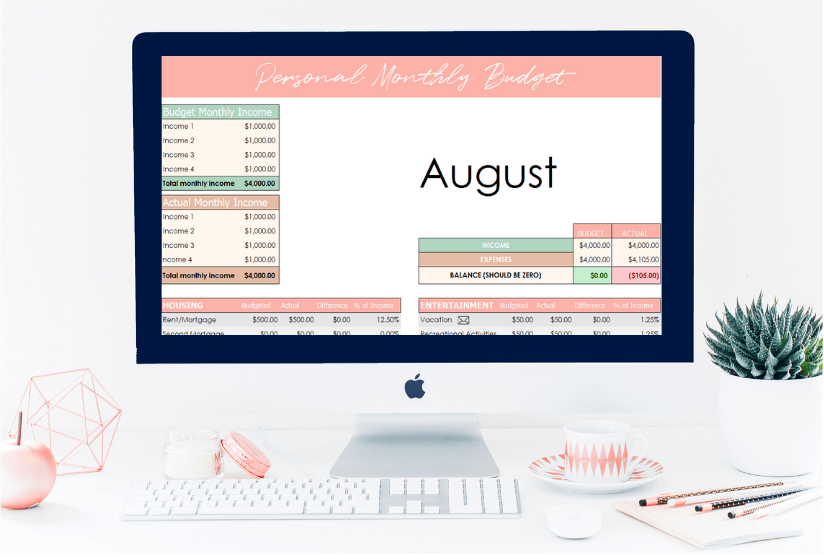

Every single month I create a written budget and an excel budget that are identical.

A budget is one of your most powerful tools to achieve your financial goals.

To learn how to set up a budget that works, take my five day Budget Bootcamp email course.

Or, get started budgeting right away by snagging my free budget template by subscribing to email list!

GET OUT OF DEBT FOR GOOD

Maybe debt payments weigh you down and create lots of financial stress.

Commit to getting out of debt as soon as possible by reducing your expenses.

It's hard to save any money at all if you're a slave to monthly payments.

Don't believe the lie our culture tells you, that debt is normal. Debt will kill your dreams and crush your financial goals.

INVEST FOR YOUR FUTURE

If you are worried about retirement and haven’t saved much, make a plan and automate your investing. Make it an auto-withdraw from your bank account every month.

No one is responsible for making sure you have enough saved for retirement besides you.

Make it a priority.

SET UP SINKING FUNDS

Do you ever feel caught off guard by expenses that sneak up on you out of no where? Maybe you're nodding your head saying yes, every single month.

Sinking funds are a specific and measurable way to set aside cash savings for a period of time.

They allow you you to save money over time for expenses that are not monthly, recurring expenses.

GET ON THE SAME PAGE WITH YOUR SPOUSE

Being on the same page with your spouse regarding money is invaluable.

You will be a lot more likely to hit financial goals that you set and work towards together.

When you have different financial goals or only one spouse is determined to better the financial situation, you are moving apart.

Related:

5. Be Patient with Results

When we don’t see results fast enough, we wrongly conclude that small, good decisions don’t matter that much. Or, we can also wrongly conclude that small, bad decisions don’t really matter that much.

Maybe you decided last year that you were going to get out of debt for good. You stopped going out for dinner 2x a week, started meal planning, and cut out your weekly shopping trip.

At the end of the month, you had an extra $300 to put towards your debt.

Then, instead of owing $28,600 on your student loan, you now owed ONLY $28,300.

You got discouraged. Soon, you were back to your old habits.

Remember, our life is the sum total of ALL the decisions that we make. They all matter.

You rarely wreck your finances all at once.

You cut the corner here, buy a few things without telling your spouse there, and go to the mall just one more time with your friend even though you know you need to start saving more.

While you may not see crazy results right away, but by adding small disciplines to your life, you WILL reap a harvest.

These decisions will get you out of debt. Investing for your future. Changing your family tree. Leaving a legacy for your children.

" Let us not become weary in doing good, for at the proper time we will reap a harvest if we do not give up."

Gal 6:9

Share this post!