How to Prepare Your Budget for the New Year

It's January, which means it's time to prepare your budget for the new year!!

I know what you're thinking... why does she have so many exclamation points? Budgeting is not exciting and falls below sorting hangers on my to do list.

If you will just give budgeting a chance, I promise with a little work it will change your life . Yes, YOUR LIFE.

I tend to be a tad dramatic, but this is not an exaggeration folks.

Budgeting forever changed our finances and I honestly can't imagine what our finances would look like if we didn't budget.

A lot more stress. Frequent money fights. Not near as much saving or investing. Inconsistent and irregular tithing.

If any of these are the norm for you, take heart. I'm here to help!

So, whether you've never set up a budget in your life and want to learn to do so , or if you're a seasoned budgeter, this is a great refresher post for you!

It's important to evaluate your budget for the new year, because it will look different every single year!

Setting up a Budget for the New Year

1) Evaluate Money Goals & Set New Ones

Goals are the driving force behind any kind of monetary success you experience. Without goals, dreams are just ideas.

Take time to set new financial goals, review existing goals, and create and execute a plan of action for the new year!

In order to be successful, your goals need to be:

- Specific - Don't say "I want to increase sales for my business." Rather, be more specific, such as "I want to increase sales $20k over last year." When you are specific, you can create a more detailed plan of action to get yourself from point A to point B.

- Measurable - Break your goal down into steps of action. If your goal is to pay off $12k of debt this year, you need to pay off $1k per month (at least) to achieve your goal. Give yourself daily, weekly, and monthly mini-goals.

- Timeline - Have a deadline for your goals.

- Personal - Your goals must be your own.

- Written - Seeing your goals written down will help you hold yourself accountable.

Your goals should be a line item in your monthly budget. Furthermore, they should be prioritized in your budget after financial obligations, but BEFORE discretionary (flexible, non-essential expenses) spending.

Continuing with previous examples, if your goal is to pay off at least $12k of debt, you should add the $1k per month minimum as line item in your budget. Any and all extra money should be thrown at the debt and allocated to debt in your budget!

If it's not written in the budget, you're not as likely to make it happen. Make it a habit this year to write out your monthly budgets, committing them to memory.

2) Identify New/Changing Expenses for the Year

The first thing you need to do is review your past year and identify what changes to your budget need to be made for the current year.

For instance, we got a notice in the mail just a few days ago that my health insurance premiums will be increasing by $20/month. I know that I will need to adjust the budget for this increase.

We are also having another baby this year, so I know that I need to increase my baby budget category, and we have been padding our savings account to prepare for anything unexpected.

Ask yourself the following questions:

- What surprises did we have in the prior year? Should I set up a new budget category for these?

- Did we have any large, unexpected expenses last year? If so, do we need to set up a sinking fund for these?

- Do we have any major financial outlays to make in the current year? If so, how much and when?

- Are any of our recurring monthly expenses increasing? Common increases include insurance, cable, internet, etc.

Use these as a starting point for identifying and setting up new sinking funds.

3) Set up Sinking Funds

Sinking funds are a way to save up for large expenses by breaking the large expense up into small, monthly savings.

A sinking fund is more specific than a savings account, because you know exactly how much you'll put in and when you're going to use it.

If you plan on saving for Christmas, a family vacation, and maternity leave all in one year and lump it all in your checking account, chances are eventually the lines will blur.

We want to be intentional about our savings.

Get out your calendar and/or review your bank activity from the prior year.

Identify any large expenses that came up this past year that you will likely have again either in the current year or sometime down the road. Set up a sinking fund for these.

Intentionally track your sinking fund balances from month to month.

I track mine using the template pictured right. You can get it here.

Sinking fund ideas

- Christmas fund. The best way to shop for Christmas gifts is when you already have the money set aside! It makes it a lot more enjoyable!

- Baby/Maternity leave. As we prepare to meet our second child in April, we've been setting aside money every month for hospital charges, baby supplies, and padding our savings.

- Car repairs. Chances are your car will be in the shop at some point. Instead of acting surprised when this happens and having your day ruined because of a $500 bill you didn't plan on, set up a sinking fund!

- Medical. We have spent an outrageous amount of money on medical bills this year. They're a little less painful to pay when you set aside money for them year round!

- Vacation. Every single vacation we take is paid for before we even take off. Don't let our vacation follow you home by putting it on a credit card.

- Gifts. Every month there seems to be a birthday, anniversary, baby, or wedding. You can set up a sinking fund for these!

5) Have Room for Error

A slush or miscellaneous fund is a great defense against unexpected expenses that come up throughout the year.

Just be careful, because having room for leeway in your budget doesn't mean that you budget $500 a month for screw ups.

If you're consistently screwing up the budget by $500 then you need to change your spending habits.

Rather, a miscellaneous fund is for honest mistakes and expenses that you simply forget or didn't plan.

I use the miscellaneous budget category for things like extra baby supplies, the baby shower or wedding I forgot about, and for buying different things in bulk.

Instead of beating yourself up, you use the miscellaneous fund, get back on your feat, and keep budgeting!

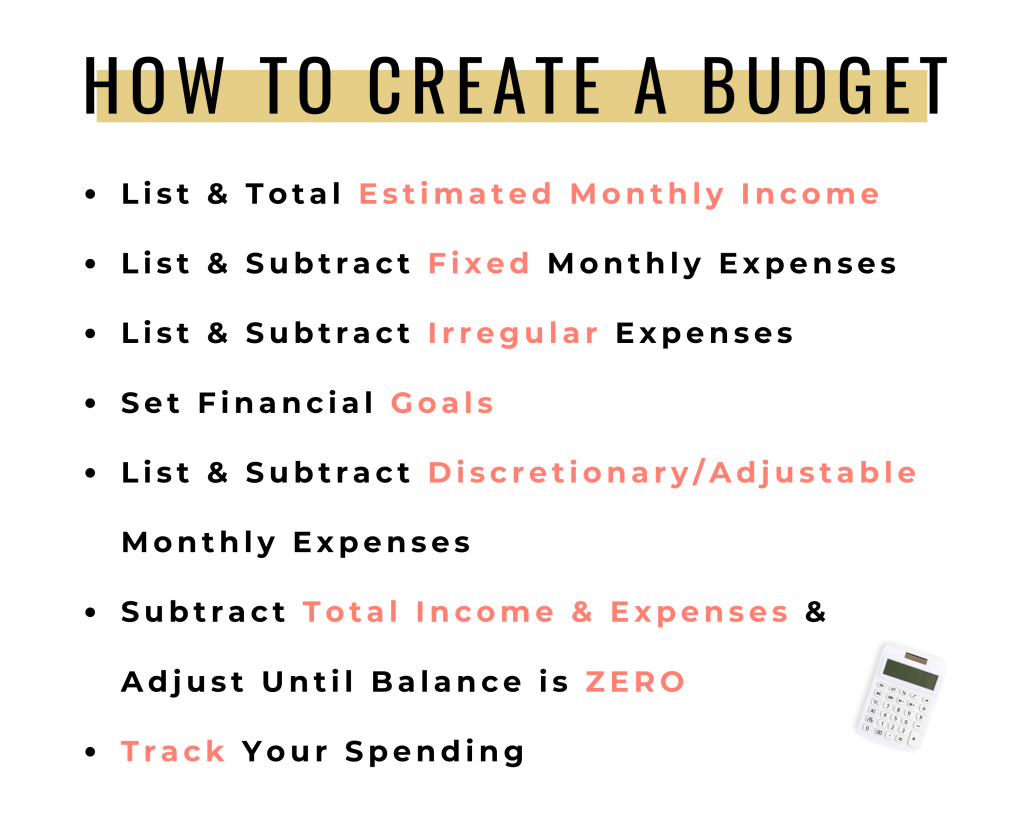

6) Make a New Zero-Based Budget

The final step is to set up your zero based budget.

Having a zero-based budget simply means that every single dollar coming in every month has a function.

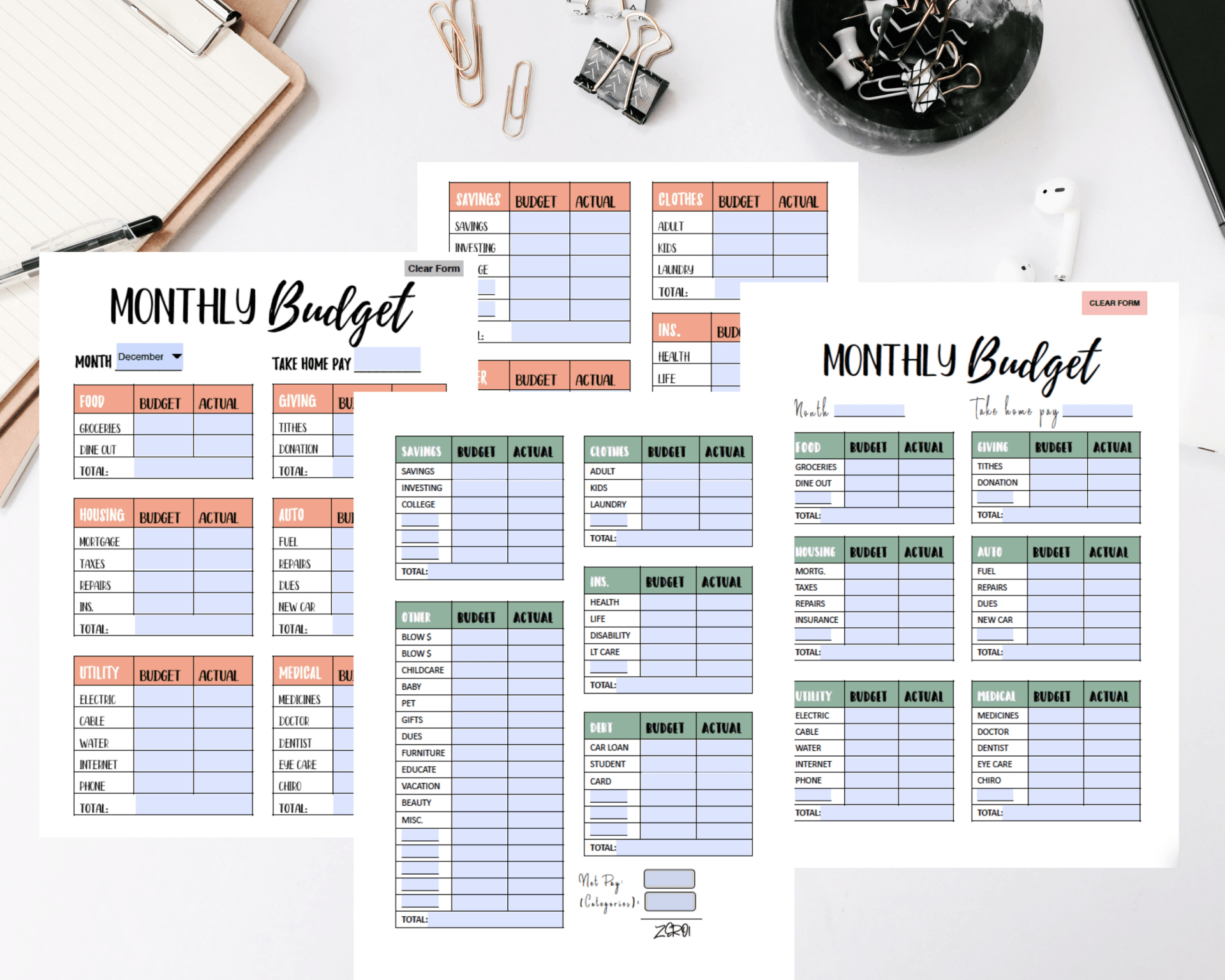

For detailed budgeting forms, including the exact ones we use, check out these templates:

We follow Dave Ramsey's guidelines for what we should be spending on each budget category.

Depending on your needs these might vary a bit, but if you are out of these ranges you could be living above your means.

If you are paying off debt , instead of saving/investing, all extra money would go towards your debt snowball .

Other helpful posts for getting out of debt/ debt payoff hacks:

Monthly Budget Templates

Excel Budget Templates

This easy-to-use excel budget template gives you the tools you need to track your spending and plan your income.

The formulas in this spreadsheet will automatically highlight categories where you are saving up (green) or overspending (red), all you need to do is decide how much of your income you can dedicate to each category (feel free to edit them to your liking!)

Includes a tab for all 12 months and can be used year after year. Simply copy and paste tabs to use indefinitely!

Download as many times as you'd like, in case you lose or switch computers/files.

This excel paycheck budget allows you to take your broad monthly budget and break it down into pay periods. If you're like me, and you like to break everything down into simple steps, this is perfect for you.

You can still print this budget out if you prefer to have a hard copy! It is set up to fit perfectly on traditional letter paper. No adjustments necessary!

By breaking down your monthly budget every pay period, you are staying proactive in the budgeting process.

This way, you are more likely to stick to your budget!

PDF Monthly Budget Templates

If you're not super excel savvy (no shame), and prefer a written or printed budget, I have templates for those too!

Personally, I like to have a written (typed) copy of our monthly budget printed out, and then as we receive our pay throughout the month, I allocate the budget to the paychecks using my excel template!

Additionally, if your budget is written and in plain sight, you're more prone to stick to it!

Pictured left are two of my many pdf budget templates. These templates are fillable, so you can type directly into them!

Note: The blue cells are only to show that these are fillable, they will not print blue :)

Set up your budget for the new year with confidence!

Happy New Year, Cheers!

Share this post!