How To Attack Debt With Intensity

If you want marriage advice, chances are you aren't going to ask someone who has been married 10 times

what the key to a lasting marriage is. If you want to be financially successful, chances are you aren't going to ask broke

people how to do so.

To have success in any area of your life, you have to mimmick what other people who are wildly successful

in that area do.

Why is this important? Because debt is a broke person habit. It is not a wealthy person habit.

Wealth and debt cannot co-exist.

I'm not against having nice things, I want you have to nice things but only as a reward AFTER you have paid off all your debt (besides the house), you are investing at least 15% of your income, and you have a well-funded emergency fund.

But, first things first.

How do you attack your debt so that you can achieve financial freedom?

HOW TO ATTACK DEBT WITH INTENSITY

Change Your Mentality About Debt

One of the biggest financial myths is that debt is a tool to be used at your disposal. The truth is debt is something that broke people use to buy things that they can't afford to impress people they really don't like.

To be quite frank, if you're willing to go into debt to buy a new car, new furniture, to take a fancy vacation, you care more about those things and your own pleasure than you do about your financial security.

You would rather be stuck with monthly payments than use that money to invest for retirement.

How do you know if you can afford something?

IF YOU HAVE THE CASH TO PAY FOR IT. If you can't pay for it RIGHT NOW , you CAN NOT afford it.

Debt is quite literally the enemy of your income. Once you realize this, you will be motivated to do everything you can to get out of debt as fast as possible. You must make it a priority, because I promise you it will not be easy. I've heard it said before and I know it to be true from my own experience-

"You can wander into debt, but you can't wander out."

Related Content:

Make a List of ALL Your Debt

This is where you give yourself a strong slap in the face.

Some of you have had debt around so long it's like a pet.

When you actually write out all your debt (this includes credit card debt, student loan debt, house debt, car debt, WHATEVER kind of debt you have), and total it all up, I can almost guarantee it will be more than your "mental estimate."

The sad part is, that's not even the total. You'll end up paying a lot more depending on your interest rate. So make a list (include the interest numbers if you have the actual. If you don't, use an estimate), and write them down from smallest to largest.

You should pay off your debts from smallest to largest, so that you gain momentum.

Make A Plan/Set Goals

The next step is to calculate how long it will take you to pay off all your debt if you only make the minimum payments.

After you do so, adjust your budget (for more on budgeting, click here ) and see how much extra you can pay on your debt per month and set a goal for when you want to have certain debts paid off and be debt free.

In any given month, if you have more money leftover than anticipated or you make more than anticipated, throw that towards your debt.

You must have a plan in place for how you are going to pay off your debt early, and you must stick to that plan .

Use a Debt Snowball

The best way to pay off debt as quickly as possible is to use Dave Ramsey's debt snowball method!

Even though we only had one form of debt (student loans), we still used this method because I had multiple student loans through the federal government.

We used the debt snowball tracking templates pictured right to keep us on track and stay motivated! It's important that you have a visual reminder of your progress.

Without a visual reminder, we often give up because it seems like an impossible goal to reach.

Here's how the debt snowball method works!

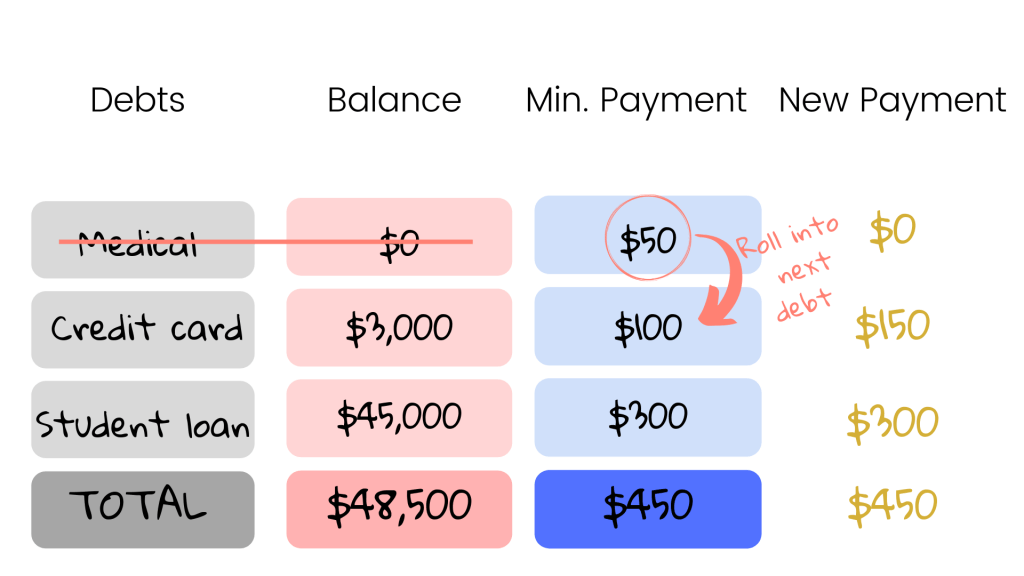

◾️ You start by calculating the amount of extra money that you can squeeze out of your budget.

Whatever that amount is, you put it towards the debt with the smallest balance.

◾️ All the other debts you have (besides the smallest) make minimum payments on.

◾️ Once the smallest debt is paid off, you take whatever you were paying on that debt and apply it towards the next smallest debt, plus the minimum payment.

You continue this until all your debt is paid off, and your snowball builds larger and larger as you go.

Here's an example:

Once the smallest debt (the medical debt) is paid off, the minimum payment plus whatever additional money you can throw at the debt is rolled into the next largest debt's payment.

The process would continue as your snowball builds!

Cut Out Everything But The Necessities

Over the past year, we cut out everything but the necessities and lived off one income so that we could use the other to pay off our debt fast.

We cut out eating out at least once a week, we reduced our grocery budget , and we cut out some personal spending items like my daily lattes.

It is still important to have a little money set aside for personal spending! This keeps you from impulse buying and binge spending because you have a weak moment.

Joe and I do $60/week each right now, but when we were paying off debt that was quite a bit less. So make sure you have some, but make it reasonable. Keep your goal in mind.

You can't effectively cut costs without knowing how much you're spending in the first place.

The best way to cut spending is to budget! Once you start budgeting, it will suddenly feel like you have more money!

Related Content:

Figure Out Ways to Earn More

Your income is your biggest tool at your disposal when paying off debt. If you can find a way to increase it and use the extra income towards the principal of your debt, it will greatly decrease your debt payoff time.

When you get intense about paying off debt, you will find extra ways to generate income.

Here are a few ideas to help you out!

- Clean out your home and sell stuff

- Work extra hours

- Start a money-making blog (here's a tutorial)

- Use cash back sites like Rakuten to earn money on purchases

Use every tool that you have! We used our birthday and Christmas gifts and put it towards our debt payments.

I can't stress enough that every little bit helps.

Hang Out With People Who Encourage You

It is hard enough to stay focused and disciplined with our finances without anyone encouraging us to do otherwise. So if you add the pressure from those who are pursuing a different financial path than you are, it becomes really hard.

I would never tell you to stop hanging out with someone because of money.

I would however tell you that it might be a good idea to sit down with your friends and explain why you need to scale back a bit on the spending, and ask them to support you while you work your way out of debt.

Most of your friends will understand!

Keep Your Eye on The Prize

Make sure you stay motivated!

If you have a lot of debt to payoff, you can become discouraged in the process if it's taking longer than what you'd like.

It's important to reward yourself for your wins!

Once you payoff a loan/debt, treat yourself to a coffee or something else that you like that you cut out while paying off debt.

One way that I made sure that I stayed motivated was I printed out all my "loan paid in full" notices for my student loans, and kept them where I could see them often.

You have to remind yourself why you started and why you're sacrificing.

Share this post!