7 Surprising Money Habits I Wish I Knew Earlier

Most people don't come out of high school (or college) knowing what money habits are going to set them up to win with money.

In fact, our education system has FAILED young people when it comes to teaching them about finances.

The truth is the norm in many (or most) households is to run the budget like Congress.

Which means there is no budget. You spend what you have in cash, and then you spend some more. No one's really keeping track and everyone has their head in the sand.

Here's what I wish I knew, and what you should know, about money in order to win financially!

First, get my free finance planner

to help you crush your finance goals :)

10 MONEY HABITS I WISH I LEARNED EARLIER

1. The Power of Compound Interest

Unfortunately, they let you graduate high school without knowing what compound interest is.

Compound interest is simply earning interest on interest.

Let's take a look at an example:

You have $1,000 that you deposit into an investment account. You earn 10% interest on your investment in year 1. At the end of year 1, you would have $1,100. In year 2, you earn 10% interest once again. However, in year 2, instead of earning $100 of interest, you will earn $110 of interest.

Year 1 Balance: $1,000 + $100 interest ($1,000 x 10%) = $1,100

Year 2 Balance: $1,100 + $110 interest ($1,100 x 10%) = $1,210

In year 2, you earned $110 instead of $100 (like year 1) because you earned 10% interest not only on your initial deposit, but on the interest earned in year 1.

Thus, you earned interest on interest. Hopefully you can see from this example that investing while you're young is key.

The earlier you start, the longer you will earn compound interest, and the more it will snowball.

Remember, every little bit counts.

2. If You Don't Have a Plan You Won't Win With Money

Living on a zero based budget means you have a plan for every dollar that you take in during the month BEFORE the month begins.

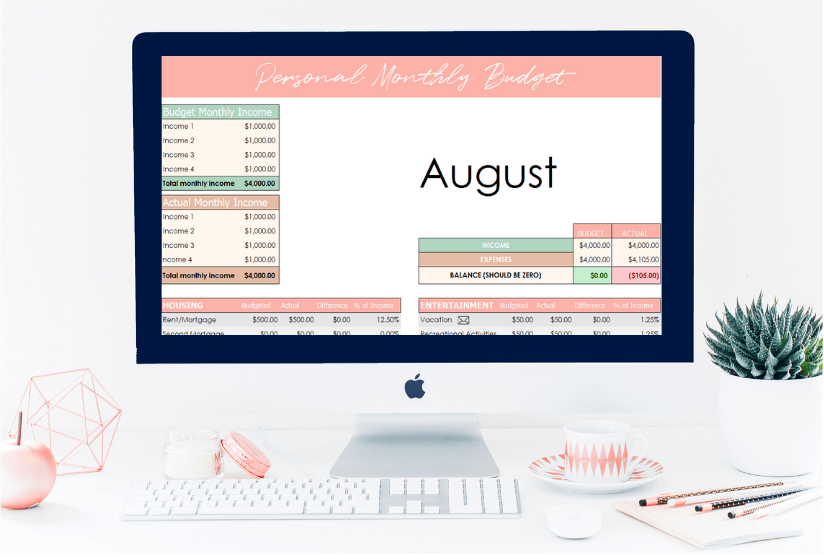

I do this every single month on paper and on my excel budget template (pictured above).

If you've never made a budget before and you don't know where to start, here's a 7 step tutorial.

A big misconception about budgeting is that it's only for people who are math geeks or good with numbers.

Nothing could be further from the truth! Budgeting is not as scary as you think, in fact, it's pretty simple if you're willing to sit down and try.

The idea of budgeting is very basic!

You simply take your monthly take-home pay (or an average if you have irregular income), and you plan out how every single dollar that comes in will be spent.

You won't get it perfect the first month. Or even the second.

However, trust me, if you stick with it, it will become second nature.

Especially if you are a beginner budgeter, it is of utmost importance that your budget is written .

If it's not written, it won't get done.

Your mind is not a good place to store your budget. I can hardly remember what I ate for dinner let alone the monthly budget.

Snag my set of editable PDF budget templates and get started today!

3. Debt is Acid that Eats Wealth

You've likely been taught that debt is a tool and if used carefully, it can benefit you financially.

I want you to chew that up and SPIT. IT. OUT.

Debt is acid that eats wealth.

When you get into debt, you are agreeing to become a slave to a monthly payment. The lender is your master and you do as they say.

The truth is that debt creates enough risk to offset any advantage you could possibly think of.

In my opinion, the biggest risk surrounding debt is that it makes it SO easy to live beyond your means.

If you want something you really can't afford, debt allows you to get it, and get it quickly. '

We have the American Dream backwards. It's not to have whatever you want whenever you want, but rather to live a debt free life free of financial burden.

Pay off debt rapidly & other debt content:

4. Your Spouse Will Probably Have Opposite Money Behaviors than You

Most of the time (not ALL the time), a couple exhibits opposite money behaviors.

There is typically a saver and a spender, and they attract.

Repeat after me, it is okay that my spouse interacts with money differently than I do.

I know, that's hard for me to admit too ;)

The key is learning how to work together as a team so that you can win with money.

HOW TO WORK AS A TEAM WITH YOUR SPOUSE

- Talk about money. Believe it or not, many couples avoid the money conversation altogether. Often this is because talking about it creates stress and/or starts a fight. Don't avoid talking about it.

- Discuss any conflicting views. Who is the spender and who is the saver? Do you view/think about money differently?

- Be transparent about your downfalls . Be honest about where you struggle. Often, savers struggle with being controlling (definitely me) , and spenders struggle with sticking to a budget and impulsive purchases.

- Set financial goals together. If you have the same vision for your finances, it will make it easier to work together and encourage each other.

- Never keep money secrets. This is self-explanatory. Marriage is not for secrets.

- Create a written, agreed upon budget that is the LAW. I don't care if it takes three hours. Sit down together and create an AGREED UPON budget. This means you both have a say and you both will likely have to compromise.

THE RELUCTANT SPOUSE

Many people find themselves frustrated with a spouse who seems uninterested in talking about money and taking control of their finances.

If this is you, please know, it takes time.

The goal is not to control your spouse and force them to change so you can have your way.

Rather, your spouse likely wants the same things you do (financial peace), they just don't like the way you're approaching the situation, especially if you're attacking them.

5. Many People Are Going Broke Trying to Look Rich

Have you ever looked at another persons lifestyle and thought, "well if they can afford that we sure should be able to!"

There's two things wrong with this assessment.

One, you have no idea if they can actually afford it. They could be up to their eyeballs in debt. Two, that attitude is both prideful and toxic.

Statistics show over and over that the Joneses are broke.

In fact, the average American has about $38,000 in personal debt, excluding home mortgages.

The next time you see your neighbor driving their fancy new vehicle, just think about the monthly payment and stay in your lane!

6. No One is Responsible For Your Finances Besides YOU

It's not anyone else's job to save you from the financial choices you have made.

If you have debt, can't save money, etc, the best thing you can do is own up to the choices you've made and then decide to change.

Has anyone ever felt personally victimized by our education system? I know I did before we decided to pay off my student loan debt in 12 months.

Then I realized that it was my choice to go to an expensive four year college, I signed the dotted line every year, and it was no one else's fault but my own.

Own up to your financial mistakes and learn from them!

7. You MUST Live on (A lot) Less Than You Make

While this sounds like a simple concept, many people who THINK they are living on less than they make are actually spending more than they take in.

To achieve the same lifestyle you have now at retirement, it is recommended that you invest at least 15% of your gross income for retirement after paying off all your debt.

The problem is only 16% of working Americans are saving over 15% of their income for retirement.

The average person reading this is saving under 10% of their take home pay (not even their gross pay).

We don't have an income problem, we have a spending and debt epidemic.

People simply don't know how to live on less than they make.

HOW TO LIVE ON LESS THAN YOU MAKE

1. Create a household budget.

2. If you have no room to save or invest every month, cut costs. You have to reduce your spending. It might be painful for a while, but it's possible. Take responsibility.

3. STOP USING DEBT. If you're in debt, it's high time to get out as fast as you can. Use the debt snowball to pay off all your debt.

There you have it, what I wish I knew about money wayyyy earlier.

I am still relatively young, so I'm glad that I took initiative and decided to invest in learning more about money.

My hope is that you'll do the same and I can help you along the way!

Share this post!