What You Need to Know About Retirement Planning

Planning for retirement can seem daunting, but retirement planning is extremely important if you want to retire with dignity.

Many people, especially those in my generation, the millennial generation, are trading retirement savings to live comfortably now.

If you can learn to delay your gratification, and sacrifice now, the reward will far surpass living comfortably now.

Don't look around at everyone else who is paying big money for experiences like travel and get caught up in living for now!

Here are the basics of retirement planning that you need to understand in order to retire with dignity!

START EARLY

Time is money.

If your game plan for retirement is to hope your social security fairy magically saves you from the perils of financial ruin, your chances look pretty slim.

The good news is, if you are in your 20’s , you have time on your side.

I want to keep the concepts in this post basic, because who has the time or capacity to try and know all the ins and outs of retirement planning.

In all honesty, it really does not have to be that complicated, and principle #1 (time) is pretty simple.

The earlier you start investing, the higher the return on your investment, because the longer your money has to grow.

HOW MUCH SHOULD YOU INVEST?

We follow Dave Ramsey’s baby steps, and he advises to invest at least 15% of your gross income (pre-tax income).

A common misunderstanding regarding this principle is that if you and your spouse both have 401k plans at your work, and you both elect to contribute 4% of your income to that plan, then you are investing 8% of your income already.

Spoiler alert…you are actually only investing 4% of your TOTAL income, NOT 8%. This is an easy mistake to make if you don’t think it through.

Additionally, if you have a retirement plan at work that offers an employer match, the employer match portion does NOT count towards the 15% Dave Ramsey recommends.

Stick with 15% of your gross income as a baseline number to invest!

Related content:

UNDERSTANDING YOUR OPTIONS

WHAT IS A 401(K)?

A 401k is a retirement plan available through your employer. The first step to investing is to contribute to your 401k up to your employer match because this is FREE money.

What makes these plans appealing is that most employers will offer some sort of matching contribution to what you put into this account.

For example, if a company offers a 401 (k) with an employer match of 4%, that means that any amount you contribute up to 4% your employer will match dollar for dollar and contribute to your account.

The downside of 401k plans is that it typically has few investment options and high fees.

Because of this, I would recommend only investing up to the employer match, and doing the rest of your investing outside of your 401k.

ROTH VS. TRADITIONAL IRA

The main difference between the Roth and Traditional IRA is how they are taxed.

ROTH IRA

Tax advantage: Withdrawals in retirement are not taxed (as long as you are 59 ½ and have had the account more than five years), and no mandatory withdrawals required.

If you are eligible, you should open a Roth IRA and invest above and beyond your 401k, to get to at least 15% of your gross income.

If your work offers a Roth 401k, you can certainly invest the whole 15% there, as long as they have good options.

The main benefits of the Roth IRA include-

- Withdrawals in retirement are tax-free

- Earnings on contributions grow tax-free

- No required minimum distributions at a certain age, unlike the traditional IRA.

- You can contribute to your Roth IRA past normal retirement age (subject to income limitations).

- If applicable, beneficiaries that inherit your account will also receive money tax-free

For the majority of people, a Roth IRA is preferred over a traditional IRA.

However, you need to make a decision for yourself based on your personal facts, so let’s learn about the Traditional IRA!

TRADITIONAL IRA

Tax advantage: Contributions are tax-deductible in year made; contingent upon your eligibility and adjusted gross income.

The benefit of the Traditional IRA is that you can potentially get a tax deduction in the year you make the contribution (dependent on certain rules that I’m not going to get into on this post).

Additionally, there are not any special eligibility rules regarding who can contribute.

Anyone with earned income can contribute to a traditional IRA, BUT just remember the tax deduction for your contributions can be limited based on income limits and whether you participate in an employer sponsored plan.

The downfall is that you are taxed at ordinary income rates when you take a withdrawal.

ROTH 401K VS. ROTH IRA

If your employer offers a Roth 401k, it is important to note that this is not the exact same thing as a Roth IRA, but it is close.

It does work the same way. Your Roth contributions are after-tax, and therefore since you already paid taxes on the contributions, distributions in retirement are tax-free.

Additionally, just like a Roth IRA, there are no required minimum distributions from a Roth 401k.

The key difference between the Roth IRA and Roth 401k is that you will be taxed on the matching contributions from your employer when you withdraw them in retirement.

This means the earnings growth on your employers contributions will be taxed in retirement.

WHAT IT COMES DOWN TO

When deciding which retirement plan option is the best for you, there is a key question you need to answer- do you expect your income to increase or decrease in the coming years?

If you expect that your income will continue to rise (as it does for most people), then the Roth IRA is a great option, because even though you are putting money in after-tax, you will take it out tax-free (when you’ll be in a higher tax bracket).

A Roth IRA will allow you to take advantage of the time value of money and tax-free growth, specifically if you are in the lowest tax bracket you’ll ever be in today.

In other words, the Roth is generally the better option for those who expect to make more money as time passes, and thus be pushed into a higher tax bracket.

INVEST AT THE RIGHT TIME

The right time to start investing is after you have paid off all your debt (excluding your mortgage).

For those of you who read my blog faithfully, you know that I personally believe that you should stop all investing until you are out of debt.

It is important to focus on one thing at a time, and when you are paying off debt, you need all mental focus and energy to propel you through that time!

When we were paying off my student loan debt, we halted all investing.

Remember, you can’t do everything at once, and you are more likely to stick with and follow through with something if you focus on one thing at a time.

If you're in the debt payoff phase, get aggressive using the debt snowball.

The editable PDF debt snowball templates pictured above are a great way to visually track your progress and stay motivated during your debt payoff journey!

I kept our templates taped to our fridge when we were paying off our debt.

Get out of debt help/tips:

DON’T INVEST IN ANYTHING YOU DON’T UNDERSTAND

Do not put your money into something that you don’t understand, and don’t assume because everyone else does it they understand it.

You work hard for your money, and the last thing you want to do is blindly follow someone else’s advice without knowing what they’re talking about.

Any investment professional worth hiring will make sure that you know and understand where your money is going!

AUTOMATE YOUR INVESTING

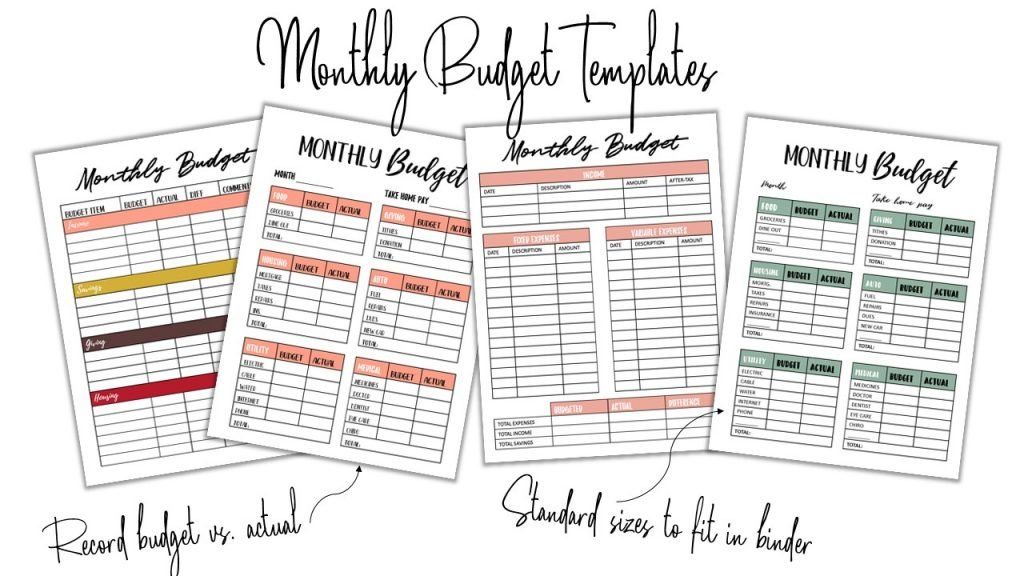

The best way to make sure that you are saving for retirement is to automate your saving and investing. Use a budget to ensure you put away money every single month.

Don’t fall into the trap of telling yourself that you’ll invest whatever is left over at the end of the month.

If you do it that way, you will never have enough money left over and you’ll find other ways to use it.

Instead, create a budget, and be sure that saving and investing is a part of your budget.

The best thing you can do is set up automatic direct transfers from your bank account to your IRA every month.

Make it a hassle for yourself to not invest every month.

Budgeting tips/hacks:

RETIREMENT IS NOT SHORT-TERM INVESTING

If you want to successfully save for retirement, you have to be willing to ride out the market highs and lows.

Don’t let temporary downturns scare you into losing potential profits.

When you are investing for retirement, you should be in it for the long-term.

DIVERSIFY YOUR PORTFOLIO TO MITIGATE RISK

Instead of investing in individual stocks, be sure that you have a well-rounded portfolio in order to mitigate risk. Mutual funds are a great investing option.

Millennials specifically tend to buy and sell stocks based on what is trendy, but that can get you in big trouble.

Instead, investing in mutual funds allows you to spread your investment among many different companies, mitigating the risk that comes with investing in single stocks.

The best part about mutual funds is that they are easy to invest in with a Roth IRA or Roth 401k!

The four different types of mutual funds that Dave Ramsey recommends include:

- Growth

- Growth & Income

- Aggressive Growth

- International

Don’t worry, if you feel like this is a lot of information to take in, an investment professional will be able to help you!

My husband and I had a lot of questions as we started the process and our financial advisor was happy to take the time to make sure we understood in great detail exactly where our money was going.

KEY TAKEAWAY

The most important thing that you can do if you are not already saving for retirement is to START NOW!

Retirement is not some far off distant dream that can be planned for in 10 years.

In case you haven't noticed, the government is not known for it's ability to handle money, you can't count on social security to fund your retirement!

No one is responsible for your retirement besides YOU.

Take ownership, take responsibility, and take action!

Related content:

Share this post!