What Does Financial Freedom Look Like & How to Get There

Have you ever had to make a decision, but only one choice (the worst choice) was a realistic option due to some limitation? It feels like you're being trapped, because you have no options. There are other options, but you can't choose them.

This can look like an unexpected medical bill for $500 showing up in the mail causing an uneasy feeling in your stomach knowing you can barely make it to payday as is. You know it has to go on the credit card, and you also know you won't be able to pay the credit card any time soon.

But what if in those situations you didn't have to think twice about it? What if you have the money set aside and a looming crisis turns into an inconvenience?

Financial Freedom

Financial freedom is having options because of the way you've prepared through saving, paying off debt, budgeting, and investing.

How to Get Financial Freedom

Get Out of Debt

Building wealth proves to be difficult when your income is tied up in monthly payments. A $500 car payment here, a $200 student loan payment there. Not only do you have monthly payments on assets that are going down in value, you are paying interest on them. What if you invested the money instead? If you invest $700 every month for 40 years, averaging a 10% rate of return, you'll have over $4 million at retirement. Have you every stopped to think about it that way? Or have monthly payments become a way of life and you feel trapped in the cycle?

If you haven't added up the total balance of all your consumer debt, it's time to do so. You CAN get out of debt. It's harder to get out of debt than it is to get into it, but doing hard things always results in payoff.

Watch my Pin below for an illustration of how to get out of debt using Dave Ramsey's debt snowball method. We paid off over $20k of student loan debt in 12 months while living on one income using this method.

The debt snowball method uses the momentum theorem as it's basis. While it doesn't seem to make sense mathematically to pay off your debt from smallest to largest (because you are not considering in interest rates), it works psychologically! Getting a small win will help you believe that you can do this, and keep you focused and motivated on your journey to becoming debt free.

Invest 15% for Retirement

Investing is foundational to building wealth and becoming financially free. Those who are financially literate understand the opportunity cost of putting off saving for retirement. If you're young, time is on your side. If you're not, you'll just have to work a little harder to make up for lost time! Investing success is based on the principle of compound interest. Simply put, compound interest is interest earned on interest. Over time, this leads to exponential growth.

Investing tips:

- Take inventory, calculate what you have now and what you need to retire.

- Start investing at minimum 15% of your gross income (not counting any employer match).

- Always invest in your 401(k) plan at least up to the ER match.

- Don't invest in anything you don't understand.

- Hire a professional.

Build a Strong Emergency Fund

We fear what we don't know, especially when it comes to our finances. If you don't have the cash to take care of an unexpected major expense, you'll live in constant fear of it occurring. Not to mention the stress that comes with knowing you're one unexpected expense away from going further into debt!

Rainy-day funds are essential because it's not a matter of if you'll have an unexpected financial emergency, but when. A fully funded emergency fund turns an unexpected major expense into an inconvenience rather than a crisis.

Keep your emergency fund in a separate bank account, and use it only for emergencies. A new couch or TV is not an emergency!

Live on a Monthly Budget

Without a monthly budget, your finances will be haphazard and it will be hard to make progress towards your goals. Even if you have a large income, steering the ship in no real direction will eventually lead to crisis. The problem with no plan is that it only works when things are going really good. The second you experience any financial struggle, it will be difficult to climb out. A good plan works in the good times and the bad times!

To create a monthly budget follow these simple steps:

- Write down your expected monthly income for the month you're budgeting for. This includes hourly pay, salary, commission, gifts, etc. If you have irregular/unpredictable income, use your lowest estimate.

- List your fixed monthly expenses. These are expenses that don't change month to month and are absolutely due (rent/mortgage, utilities, etc).

- Write down non-monthly (seasonal/irregular) expenses and convert to monthly amounts. Budgeting for non-monthly expenses allows you to save up for them over time instead of trying to cash flow them in a single month.

- Set financial goals and put them in the budget. This includes saving and investing goals. They should be a line item in your monthly budget!

- Write down and budget for discretionary expenses. These are expenses you have every month, but are not necessities.

- Subtract expenses from income. The goal is to budget every single dollar down to zero. Adjust/tweak your budget until you get there!

- Track your spending! It might be helpful to us an app to help with this! Decide how often you'll track your expenses. I recommend at least weekly!

A monthly budget is your roadmap to financial success. Budgeting gives every dollar of your income a purpose, on paper, before the month begins. You're taking control of your personal finances, instead of letting your finances control you!

Live Below Your Means

The gap between your income and expenses every month is your breathing room. If there is no gap, you'll likely feel stressed and overwhelmed all the time because you're one paycheck or major expense away from a financial crisis. Assess where you're currently at financially - take inventory. Doing a monthly budget is most of the leg work to figure out where you are, but it's not the entire picture. What's your total household debt in relation to your income? Is there a single expense that's suffocating your budget? Figure out how you can effectively increase the gap between your income and expenses.

Avoid Being House Poor

If your mortgage payment is more than 25% of your net take-home pay, you might be house poor. Given the recent major surge in interest rates and housing prices, Americans are now spending on average 31% of their income on housing. That doesn't leave room for much else, especially after the rising food prices! The average grocery bill for a family of 4 is now $887 per month! To make up the difference, you have two options - cut costs or increase income.

Pay Cash for Large Purchases

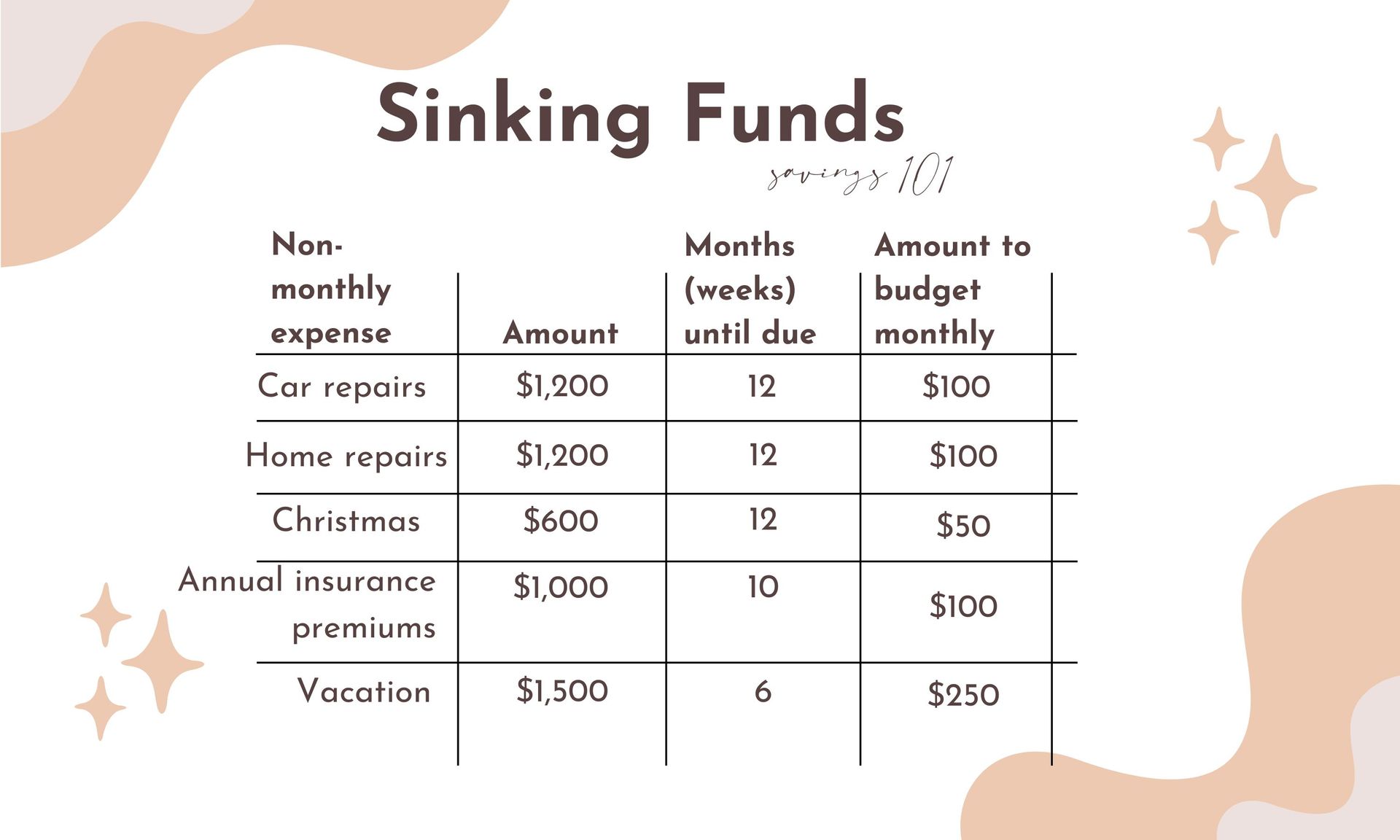

Instead of going into debt for large expenses, save up for them on a monthly basis using sinking funds. A sinking fund is not that different from a savings account, the main difference being sinking funds are very specific. When you establish a sinking fund, you are creating a budget category whose balance will be carried over from month to month.

There are countless expenses you can save up for, but some sinking funds category ideas to get you started include:

- Car repairs

- Home repairs

- Gifts (weddings, anniversaries, birthdays ,etc)

- Furniture & appliances

- Vacation

- Insurance dues

- Maternity leave

Those are just a few- you can tailor this list to your needs.

To set up your sinking funds, you will take total cost / amount of months left until expense needs to be funded. Click here for an in-depth tutorial on setting up your sinking funds in your monthly budget.

Delay Gratification

Creating habits that are conducive to wealth building and becoming financially free require delaying gratification. When you live on a budget, you can only spend what's in the budget. Once you decide to get out of debt and never go in again, you will be limited. You don't have the option of putting something on the credit card and worrying about it later. However, you will reap what you sow in due time. Don't make rash short-term decisions with long-term consequences. Carefully consider the cost of every choice you make today.

Share this post!