Melanie

De Jong

Melanie

De Jong

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

The Truth About Debt That No One Will Tell You

I have to make a disclaimer before I begin this post. What I’m going to say is probably going to be quite offensive to many of you and completely against everything our culture teaches. I'm going to tell you the TRUTH about debt that NO ONE ELSE will tell you.

Here it goes...

Debt is a broke person habit that will cripple your ability to become financially free.

Our culture and other people will try to come up with all sorts of reasons why debt isn’t stupid, why it’s actually smart, why you’ll die if you don’t have a good credit score, why you DESERVE to ride around in that brand-new car, etc, etc.

In reality, the truth is...

Debt is dumb. It is not a service or reward.

No, you shouldn’t bow down to your FICO score.

You honestly don’t deserve ANYTHING that you can’t pay cash for.

Do you want to stop feeling like your broke?

Stop making broke people decisions.

What's one broke decision you can decide not to make? Going into debt.

THE TRUTH ABOUT DEBT

1. Debt is a Product

Debt is a product, and one of the most consumed products in history.

It is so heavily marketed that we literally think we cannot survive without it. We NEED it to be happy. EVERYONE has it. Our lives will be better IF ONLY we could have x,y,z; so we finance it.

Those in the debt industry have made their package so appealing that most people honestly believe they can’t get through life without it.

Joe and I started our marriage $30k in the hole because of my student loan debt ($25k of principal & $5k of interest). We paid it all off in 16 months ($20k was paid off in 12 months) and have vowed to never see debt as a tool again.

We don’t have any credit cards. Our vehicles are paid for. When it comes time for a different vehicle, we will pay cash.

Debt is not a tool. It is a product.

Related: Why We Don't Have Any Credit Cards

2. Debt is a Way for People to LIE

What is really REALLY comes down to is that debt is way for people to create the perception of a certain lifestyle that they actually can’t afford.

Guys. Don’t live a lie.

Don’t spend the rest of your life making monthly payments to convince other people you live a life that you can’t actually afford. Not only are you lying to other people, you are lying to yourself .

Jokes on you sister. You are fooling yourself.

Debt is a morality issue.

What's the moral of the story? When you acquire things using debt, you are showing where your priorities lay. Using debt shows that you are willing to acquire things that you really can't afford in order to portray a picture of yourself that isn't accurate.

It is a LIE. Don't convince yourself otherwise.

3. People Who Use Debt Choose Regret Over Discipline

Discipline is choosing between what you want NOW, and what you want MOST.

Take a minute to think about it. What do you want most? A legacy to leave for your children? A paid off house? Freedom from living paycheck to paycheck?

What have you chosen thus far in life?

Many people (namely Millennials) have chosen what they want NOW.

They may have $50k of student loan debt, a car loan and a maxed-out credit card, but you can bet they’re driving better than mom and dad, living in a nicer house than mom and dad, and taking more vacations than mom and dad.

The only difference? It took mom and dad 30 years to get there and they paid cash.

Let me help you out here. The average car payment in America is now over $500. If you took $500 per month and invested in a ROTH IRA from age 30 to 70 you would have over $5 million dollars.

What do you care about MOST?

4. Debt is a Broke Person Habit

Make different decisions than broke people if you don’t want to be broke.

If you want an extraordinary marriage, don’t take advice from people who don’t prioritize their marriage. If you want to know how to keep your mouth shut, don’t take advice from me.

Want to know how to become financially stable and leave a legacy? Don’t take advice from broke people.

The absolute last thing you need to do as a working individual is give your money to someone else in the form of monthly payments and then scratch your head and wonder why you feel like you have no money.

If you can’t write a check and pay for that new car, you can’t afford it.

Just remember, financially stable people ask “How much?” Broke people ask “How much down and how much per month?”

5. The Bible Warns Against the Danger of Debt

Contrary to popular belief, the Bible is not silent on the subject of debt.

The Bible speaks to the dangers of debt.

Proverbs 22:7 says " The rich rules over the poor, And the borrower is slave to the lender."

If you don't want to take it from me, take it from the Good Book. The weight of debt is REAL. It divides family, ends marriages, and creates slaves who have to punch the clock even harder just to make ends meet. It's a vicious cycle.

Further, Proverbs 21:5 reads, "The plans of the diligent lead surely to advantage, But everyone who is hasty comes surely to poverty."

Building wealth takes TIME. Be diligent. Don't be hasty and get into debt- it will lead to poverty.

HOW DO YOU GET OUT OF DEBT?

1. You have to Decide RIGHT NOW to Take Control of Your Finances

Yes, you. Don’t read this post and then say “I’m going to wait until Monday to do something because it’ll be a new week.

If you can’t find a “why” that is worth it right now, you won’t find a “why” that is worth it on Monday.

The people who actually make it financially decided and started right away. They didn’t wait for Monday.

How many more Mondays are you going to wait for in your life? How many more Mondays are going to come and go without change?

Insanity is doing the same thing over and over again. If you want to get to a better place financially, make a change and then start… TODAY.

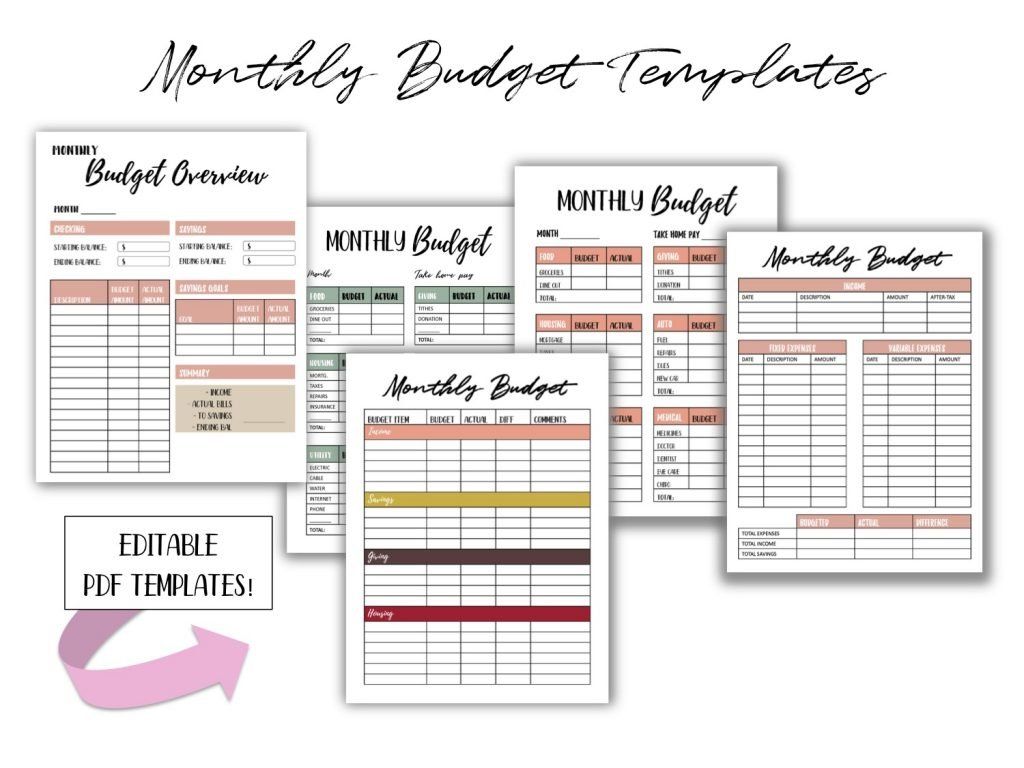

Start by creating a monthly budget if you haven't already! Click here to read my post how to create a budget in 7 steps.

For a free monthly budget template sent directly to your inbox, enter your email below!

If you're looking for something a little more detailed, click here or the image below to check out my ultimate budget bundle!

In addition to the budget templates, the budget bundle comes with 40+ pages of personal financial resources, including net wortheew tracking statement, financial goal planning worksheets, meal planning sheet, and monthly expense and bill tracking sheets!

2. Stop Victimizing Yourself

You are NOT a victim of your circumstances.

Some of the top reasons I hear for people trying to justify going into debt includes…

“My car broke down, so I need to get a new, reliable, safe car.”

“We put our vacation on our credit card, but we needed a vacation. Plus, we haven’t gone on one in years.”

Tell me all the excuses, justification, and reasons why you deserve things. What’s the truth? You are buying stuff with money you don’t have to impress people you don’t even like.

Don’t blame your financial situation on other people. Don’t play that game.

I’ve made stupid financial decisions before. You know whose fault that was? MELANIE’S FAULT. STUPID MELANIE. Then SMART Melanie took over and realized that what our culture teaches about money is absolute BULL$*#%!

Stop feeling sorry for yourself.

3. Get INTENSE

I see way too many people going through life without any passion.

You weren’t made to just survive, you were made to thrive. I 100% believe that. Those who have made the choice to live life with passion are those who live a fulfilling life.

Do you want to break the bondage of debt and create a legacy for your family?

GET INTENSE, MAD & MOTIVATED.

Don’t go through life thinking about what could have been.

IF ONLY you had stuck with your debt free plan, IF ONLY you had paid off your car, IF ONLY you had saved and invested when you were young.

When you are getting out of debt, you are going to have to make major sacrifices. That being said, you're going to have to learn how to motivate yourself.

4. Re-Define Affordability

Broke people think of affordability in the terms of monthly payments.

When a broke person says they can afford something, what they actually mean is they can afford the monthly payment.

When a rich person says they can afford something, they mean they can pay cash for it in full RIGHT NOW.

5. Be Patient

Oh, it’s taking too long to get out of debt? It takes too long to save and pay cash for a car, ring, etc?

Nobody who has a legacy worth leaving builds it overnight.

Yes, it will take hard work, perseverance, grit, and sacrifice. I PROMISE you it will take those things.

That’s why the reward is so great, because the people who are willing to take the necessary steps is such a small crowd.

Have patience. You can wander into debt, but you can’t wander out.

LIKE THIS POST? PIN ME :)

FOLLOW

ON IG