What to Do With Your Stimulus Check Based on Your Financial Situation

When the government announced they would be sending out stimulus checks, did anyone else see Oprah in their mind saying "you get a check, they get a check, everyone gets a check!" ??

Or was that just me?! ;) Despite how you feel about this stimulus check situation, the reality is if you meet the requirements you're going to get it.

The requirements are as follows.

To qualify for the FULL amount of aid, your adjusted gross income (income before taxes) has to be under-

- $75,000 for individual

- $112,500 for head of household

- $150,000 for married filing jointly

The money received would be reduced by $5 for every $100 your income is over these limits. That being said, if you make over $99,000 as an individual or $198,000 as a married couple, you would be phased out completely from receiving any relief.

If you are within those limits and you have not yet received a stimulus check, you can find out the status of your check by clicking here.

So, you got a check dropped into your bank account, now what to do with it?!

THE IMPORTANCE OF AN EMERGENCY FUND

A fully funded emergency fund means that you have 3-6 months of household expenses saved in cash.

These funds are specifically set aside and not to be touched unless there is an emergency.

Right now, if you do not have an emergency fund, this needs to be your first priority! Don't wait for the government to bail you out.

Although what's happening economically is not your fault, financially responsible people have money set aside for a crisis.

If you do not, hopefully this is a wake up call!

WHEN DO YOU USE YOUR EMERGENCY FUND?

An emergency would be something like a loss of job, major unexpected household repair, or any other expense unpredictable and unlikely in nature. A new couch is NOT an emergency.

Many household and auto repair expenses aren’t emergencies either, and this is where you need to use discernment. While you don’t know exactly WHEN your car or home will need a repair, you know that at although these expenses are unpredictable in nature, they are probable.

Use sinking funds to plan for expenses that are unpredictable/irregular in nature, but probable (car repairs, home repairs, etc).

[et_bloom_inline optin_id="optin_1"]

ANALYZING WHAT TO DO WITH YOUR STIMULUS CHECK

YOU HAVE A STABLE INCOME

It's important to separate facts and your fears. When we are afraid, we tend to make irrational decisions out of fear.

Don't let fear control you or your money. Instead, make calculated decisions based on the facts of your situation.

If you (and your spouse) have a stable income and a fully funded emergency fund, put your stimulus check towards one of your goals.

GOAL CONSIDERATION

Here are some things I would do if I was in this situation:

- Pay off debt. The number one goal aside from having a fully funded emergency fund is to knock off debt as soon as possible. I'd highly recommend this being a top priority if you are working your debt snowball.

- Add to a sinking fund. Saving for something big like a vehicle replacement or down payment on a home? Use your check to get you closer to your goal!

- Invest. If you are very confident about where you are financially, consider using your stimulus check to beef up your 401k (it could probably use any help it can get right about now). If you're out of debt, you should be contributing at least 15% of your gross income to a retirement account.

- Put it towards your mortgage. Once you are debt free, the next goal is to invest at least 15% of your gross income, and then pay off your home. Consider paying extra on your mortgage right now!

- Give! Use this money to bless someone else you know who really needs it. Maybe the single mom down the street who just lost her job, maybe an older person you know whose sick, or maybe your local church is struggling. Pray about it and ask God for discernment.

If I was in this category and still had student loan payments, I would put the stimulus check towards my student loan debt. Think about it this way, in three months you're going to have to resume payments anyway, why prolong the payoff date?

The goal of the debt snowball (find out more about this method here) is to pay off debt aggressively, and only pause if there is a financial crisis in your home.

There might be a financial crisis in our world right now, but that doesn't mean YOUR household is in a financial crisis!

If you've done the things you need to do to prepare for turbulent times (have an emergency fund and live within your means), you don't need to operate out of fear.

STUDENT LOAN DEFERRAL?

I'd highly recommend having paying off debt as your top priority if you have a stable income and fully funded emergency fund.

Although student loan deferral does not accrue penalties and interest, this does not mean the loan is forgiven. Rather, those payments are still due, it's just extending the period of time you have to pay it (without penalty).

Currently, you can defer your payments through September 2020. However, if you want to pursue this option, you need to contact your student loan provider. They will not automatically defer your payments, you have to call and request deferral.

YOUR INCOME IS UNCERTAIN AND/OR YOU'VE BEEN LAID OFF.

If your income is uncertain or you've been laid off, use this money for what it was meant for- to pay for basic necessities or increase your emergency fund.

If I was in this situation, here is what I would use a stimulus check for (in this order)-

- Take care of the "4 Walls" (Dave Ramsey). The four walls include food, transportation, utilities, and shelter. If you have lost your job or have uncertain income (and won't be able to cover the four walls) keep this money in your savings and earmark it for these four necessities.

- Pay bills you otherwise won't be able to. Use the stimulus check to cover expenses before dipping into your savings. That's ultimately what it is for.

- Add it to your emergency fund. Without any savings, it's hard to feel confident in a financial crisis. If you don't have any to speak of, then this should be your FIRST priority. However, if you do have an emergency fund but it would give you peace to beef it up a little, then do so!

OTHER CONSIDERATIONS WITH UNCERTAIN INCOME.

- Pause your debt snowball. Do pause your debt snowball if you have uncertain income and/or job status.

- Find a part time job if possible. If you can, now would be a great time to find a job (if unemployed) or a side hustle if you're uncertain about your income situation.

- DO NOT go into debt. Whatever you do, don't be tempted to load up your credit card or take on more debt. If your income is uncertain, you need to make sure that your necessities are taken care of and your emergency fund is fully funded.

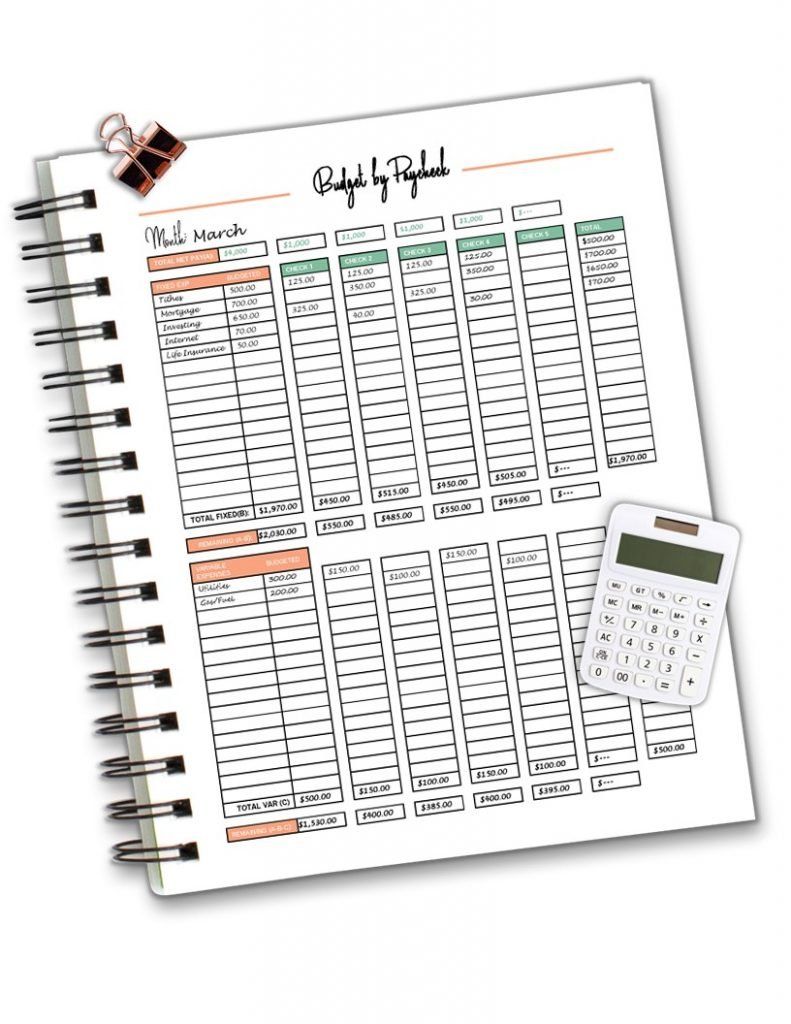

- Be sure you have a household budget. Without a budget, your money controls you. There is no plan, and it does what it wants to. I teach the concept of budgeting from a priority perspective. We want our finances to align with our priorities. Right now your priorities might be covering your bills for the month. Or, maybe it's to build up your emergency fund. A budget will help you maximize those goals and reach them as quickly as possible!

The key to managing your finances well is a budget. I know it sounds simple, but it works!

I can't tell you how much peace living on a budget brings me. Why?

Because I know we're living on less than we make. Our financial goals of saving, investing, and paying off our home early are being met. We don't need a stimulus check to make ends meet.

I don't have to guess about these things- I know they are happening because we are actively telling our money where to go.

Get my monthly budget template for free and step by step help for setting up your budget, modifying it every month, and sticking to it!

OTHER FINANCIAL DECISIONS

In addition to what to do with your stimulus check, many other financial questions arise when we have a global money crisis.

SHOULD I KEEP PAYING OFF DEBT?

If your income is stable and you have a fully funded emergency fund, don't be afraid to continue to pay down debt.

On the other hand, if you don't have 3-6 months of expenses saved up and/or your income is uncertain or lost, I would pause the debt snowball for the time being.

Once this passes, and it will, continue with your debt snowball.

More on paying off debt:

WHAT ABOUT INVESTING?

If you have a stable income and fully funded emergency fund, keep investing 15% (or more) of your gross income.

Many fearful investors pull their money out of the stock market when things start to look bad. As a result, they miss out on the gains of the stock market when it rebounds. Then, they try to dump their money back in, but they have to buy the same investments at a much higher price!

Don't be fear mongered into making irrational decisions.

Take the money from under your mattress and go march it back to the bank ;)

DOES MY BUDGET NEED A CHECK IN?

Now is the perfect time to do a budget check-in . What I mean by this, is it's important to set aside time to evaluate your budget every so often. This ensures that your budget is still reflecting your priorities and you're continually making modifications to it as life changes.

Right now, many of you might be in a time where life is changing and there are a lot of unknowns related to your income, or you just are feeling a bit uneasy and you want to make sure you have all your bases covered.

Either way, here are a few questions to ask yourself when evaluating your budget.

- Do we have enough savings? Like mentioned earlier, you should have 3-6 months of household expenses saved in an emergency fund that you keep in a separate bank account from your primary checking account. If you do not have this, cut all costs to the minimum and quickly save up.

- What discretionary expenses can we decrease to increase other areas (savings, necessities, etc)? Discretionary spending includes expenses such as fun money, dining out, gifts, etc.

- What other ways can we cut costs? If you evaluate your budget and realize you are spending a little on the high side in some areas, brainstorm ways to cut costs. Start with groceries!

- Are we leaving ourselves enough breathing room every month? What does your saving and investing look like? If it's minimal, you probably need to adjust the budget.

Make your budget reflect your priorities.

If you don't have a budget, I have many templates to help you get started:

A budget lets you control your money instead of it controlling you!

WHERE DO I START IF MY FINANCES ARE A MESS?

Hey, I'm not going to shame you. What worked for you before might not be working for you right now, and you need a plan and some hope!

If your finances are a mess and your head is spinning with where to begin, stop, take a breather, and walk through these steps.

--> Start with what you have today . How much money do you have in your account and what bills are due before you either get paid or have income coming in again?

--> Make a plan for every single dollar in your account today. Where is each dollar going to go? Focus on the four walls (food, transportation, shelter, and utilities). Next, focus on any other bills that aren't necessities. Can you pay them all? If not, don't. Make sure your family is fed and the lights don't get shut off.

--> Create a Budget. What does it take you to live every month? Look at your bank statements for the first four months of the year. Find out what your true expenses are. No more guessing. Ignorance is not bliss!

--> Evaluate Whether You Need More Income. Obviously if you are facing job loss, the number one priority is to find work ASAP. If you have not lost your job but you are spending more than you make and/or in debt, consider getting a second job. This can be temporary until you get your finances under control. Consider finding a job at a grocery store or delivery job (Postmates and Instacart) .

--> Read my post How to Stop Living Paycheck to Paycheck and Get One Month Ahead on Your Bills! This is an excellent resource for budgeting when you are living paycheck to paycheck!

Focus on one paycheck at a time, and build from there. Make sure every time income comes in, it get's allocated based on your budget. Here's a template to help you do that.

Remember, now is a great time to make sure your home is in financial order!

Don't wait for the storms to come, beat them to the punch.

You can do it!

Share this post!