Save Money Now: 11 Practical Tips to Immediately Save Money

With inflation being at a 40-year high, nearly everyone is looking for practical ways to save money right now. Here's how to save money immediately.

How to Cut Spending & Save Money Now

Combat food price inflation with careful meal planning.

Combat food price inflation with careful meal planning.

You’ve probably noticed that your grocery bill isn’t getting any lower. High inflation is affecting everyone’s grocery bill, you’re not alone!

We can’t control inflation, so let’s focus on controlling what we can control.

One way that you can lower your grocery budget is by carefully creating a meal plan weekly, bi-weekly, or monthly. But, before you create your meal plan, let me give you a few tips!

Meal plan backwards.

Most people meal plan wrong. They browse the store ads, write down a few things that are on sale, look for recipes that look appetizing, then go shopping. While this will help your grocery budget some, there is a better way to save money on groceries.

The key to saving money on groceries is to aim for a zero-waste kitchen.

No throwing out uneaten leftovers. Or letting food expire.

Here’s my simple process for creating a meal plan with the aim of zero-waste:

- Take inventory of what you already have on hand. Make special note of what food will go bad/expire soon and should be used soon, and foods that you have an excess supply of.

- Search for recipes that require noted ingredients.

Create your meal plan around the foods you have an excess quantity of and foods that will need to be used soon.

- I use $5 meal plan to help me QUICKLY create a meal plan. I have 3 kids that are 3 and under, so I don’t have hours to spend meal planning. $5 meal plan sends me a meal plan to my email inbox every Friday morning with recipes and instructions, as well as a shopping list organized by store section and ingredient.

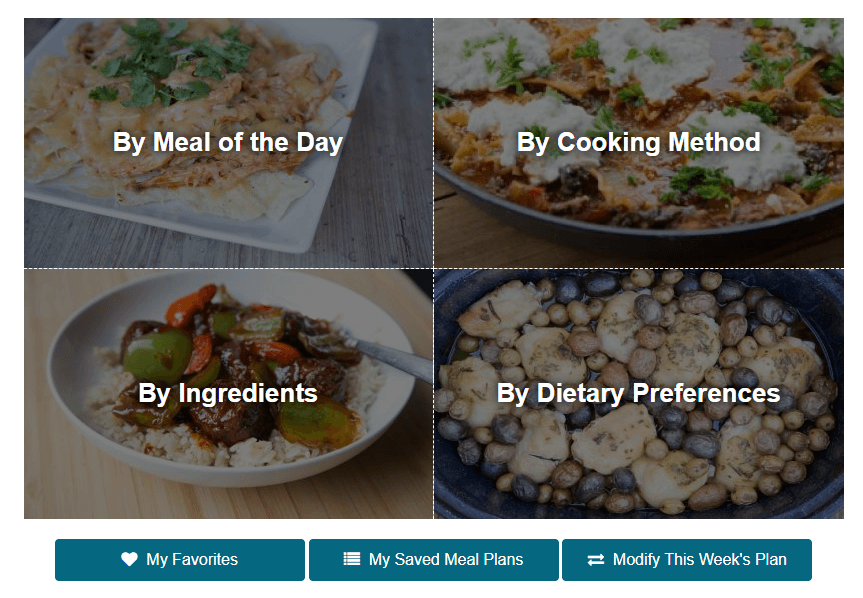

- Often, I use the “build your own meal plan” feature on $5 meal plan, using the filter feature to search recipes by ingredient. My absolute favorite part of $5 meal plan is that I can search their recipe bank by meal of the day, ingredient, dietary need, or cooking method! I then drag and drop (moms everywhere say AMEN) the meals I want, and VIOLA, it creates a pdf printout for me of the meal plan I just created. I’m talking 5 minutes or less moms. It’s magic.

- Quickly browse weekly ads for sales, add sale items to your grocery list. For sale items that don’t expire quickly, I always add them to my grocery list whether they are needed or not. I buy one for now, and one for later. We always have a stockpile of food on hand.

- Go grocery shopping and make it your only trip . Once I go grocery shopping, I try really hard to make that my only trip. If we run out of something like milk, or if I forget a key ingredient than I’ll make another trip. However, if I can switch meals or make it work without the ingredient I forgot, I do that.

- Use cash or online grocery pickup. Most stores offer online grocery pickup, which is super convenient for moms like me with little kids! Additionally, a benefit is that you can see your total as you go, and avoid impulse buying while in the store.

⭐️ Read: $5 Meal Plan Service Review

Buy generic.

Often (not always!), generic food and household supplies are made in the same factory as name-brand food and supplies.

Now, don’t hear me wrong. There are foods that are worth buying name-brand. My husband is a ketchup snob. Therefore, we only buy Heinz ketchup. We have decided it is worth the extra .50 cents for the increased flavor. In fact, there are a lot of foods that we buy name-brand because we believe the flavor to be superior quality, or we’d rather support a small business and pay more.

However, for household supplies (think plastic bags, laundry detergent, aluminum foil, dish soap, cleaning supplies, medications, etc.) we *almost* always buy generic brands.

You decide for your family what products are worth paying more for, but to save money quickly, focus on buying generic as much as possible.

Have your calendar handy.

When you're meal planning, have a calendar handy so you know what days require what kind of meals. For example, if you have a jam-packed day with back to back events and appointments, you'll need a meal planned that requires little prep.

Double a few meals + freeze one for later.

Pick a few meals to double, and freeze one for later. Casseroles are easy to double and freeze. This way, when something unexpected comes up, or you have a busy night, you can just grab a meal from the freezer instead of going through the drive-thru!

Choose a day to meal prep.

If possible, find a day to meal prep breakfasts, lunches and/or dinner. I like to prep breakfast and lunch meals one day per week so that the other 6 days I can quickly grab something.

Use cash back apps like RebatesMe

to earn cash back on online purchases.

Use cash back apps like RebatesMe

to earn cash back on online purchases.

Using a cash back app when online shopping is a great way to earn money without doing anything. If you aren’t currently using a cash-back app, this is a way you can instantly save money.

RebatesMe is one of the top CashBack websites where you can earn money for every online purchase you make. Offering over 4,000 online retailers to earn money while you shop, eat, & travel, RebatesMe provides you with deals, discounts, and cashback services for your everyday needs!

RebatesMe is currently offering a $30 cashback bonus just for signing up – it’s free & easy!

You can even earn DOUBLE cash back at select stores – these change every day so be sure to check here first before making a purchase!

The Offer

Currently, you can earn a $30 bonus when you sign up for a new RebatesMe account. You will be able to cash it out once you’ve accumulated a minimum of $10 in cashback through online purchases.

- Sign up for RebatesMe

- Earn $10 in cashback within the first 365 days to earn your sign-up bonus

Cashing out

Your cashback is able to be cashed out via PayPal, debit/credit card, check, or a gift card.

Browser Extension

The RebatesMe Browser extension is a great add-on as it will give you a pop-up reminder when you are online shopping, showing you any available coupons and the current cash back rate at that particular store. You can even download the app for easy access if you prefer to shop on mobile.

Make a detailed list of all subscriptions & choose a few to cancel.

Make a detailed list of all subscriptions & choose a few to cancel.

Many times, monthly subscriptions are an incredibly useful tool that allow for a discount on a certain product in addition to the benefit of not having to constantly re-order.

I love the subscriptions we use ( Black Rifle Coffee Co., PinkStork, QuickBooks online, etc). But, if you really want to save money, it might be helpful to cut a few out that you don’t use that often.

Make a list of all the subscriptions you currently have and pick one to cut. This will help you quickly save money!

Unsubscribe from emails that encourage impulse spending.

Unsubscribe from emails that encourage impulse spending.

I know that you know what I’m talking about. The emails from your favorite brands and shops that you just can’t help but click when they land in your inbox.

If you struggle with impulse spending, either because you use shopping as a coping mechanism or just because you’re bored, unsubscribing from a few emails won’t hurt!

Think before you buy.

Think before you buy.

If you struggle with impulse spending, commit to at least sleeping on your purchases. Often times when you force yourself to think about a purchase for a while, you discover that you really don't need it after all!

Complete a no spend challenge.

Complete a no spend challenge.

A key secret to changing your money behaviors and disciplining yourself to save more money is to change your habits . Completing a challenge will change your habits.

A no-spend challenge (also called a spending freeze) is completed by challenging yourself to not spend any money for a set amount of time, such as a weekend, week, 2-weeks, or even a month.

Typical rules for a no-spend challenge are as follows:

- Rule 1: Money can be spent on necessities (food, utilities, shelter, and transportation).

- Rule 2: Money cannot be spent on discretionary expenses. Examples include recreation, entertainment, dining out, clothing, gifts, personal items, etc. Anything that is not a necessity.

- Rule 3: Get creative . Do everything you can to avoid spending money on a non-necessity!

The obvious benefit of completing a no-spend challenge is saving money. However, an additional benefit is the spending habits you create.

Taking a break from spending money will allow you to evaluate exactly where your money is going.

Complete a money saving challenge.

Complete a money saving challenge.

Another way to save money quickly is to complete a money-saving challenge.

Use less water.

Use less water.

- Wash clothes on cold . A whopping 90% of the energy used by your washer goes to heating water.

- Use a short washing cycle. If the “quick clean” setting on your washer is just as good as the other settings, use that setting regularly. Many times, a heavy or normal wash cycle is unnecessary.

- Only run the washer if it’s full. The only loads of laundry that I do that are not full are delicate clothes.

- Take quicker showers. This can be a hard one to do, especially if, like me, long, hot showers are one of your favorite ways to relax!

Use less electricity.

Use less electricity.

- Turn off lights. When you leave a room, turn off the lights. Or, if you’re in a room but have natural light, leave the lights off if possible.

- Use a programmable thermostat. This will help with keeping your home at the temperature you prefer at certain times of the day. For example, while everyone is at work (if applicable), you can keep the house cooler. Programming your thermostat ensures that you don’t forget to turn the temp down while everyone is running out the door in the morning!

- Replace air filters. Not only will you have cleaner air, but your system will be running at maximum efficiency!

Refinance your mortgage.

Refinance your mortgage.

In general, you should consider refinancing your mortgage if you have:

- An adjustable-rate mortgage (ARM).

- High interest rate. If the refinance will save you 1-2%, it is definitely worth looking into refinancing.

- 30-year loan instead of 15-year. Converting to a 15-year fixed rate mortgage from a 30-year mortgage term will save you a large chunk of change.

A key consideration regarding refinancing is when you will break even on your interest savings from a lower rate after considering closing costs. In addition, you should also consider how long you plan on staying in the home.

For example, if you lower your interest rate by 1% by refinancing, on a $200,000 loan that would save you $2,000 per year in interest. If your closing costs are $3,000, it would take you 1.5 years to break even.

If you don’t plan on staying in the home for another 1.5 years, then it’s not worth it. However, if you plan on staying in the home for say, at least 5 years, it’s probably worth it considering you’d save $7,000 (4.5 years x $2,000 per year savings).

Get on a detailed household budget.

Get on a detailed household budget.

If you don't know where your money is going, it's hard to find any to save. The save money, you need a plan for where your money should go. Every single dollar should be planned on paper before the month begins. When you have a plan, you have a roadmap to success!

A budget is not meant to be restricting, daunting, confusing, or stressful. Rather, a budget is meant to give you permission to spend without stressing!

If you've never budgeted before, start here , and be sure to download my free monthly budget template.

Share this post!