11 Ways to Quickly Save Money for Christmas

With the holiday season quickly approaching, I want to share how to budget for Christmas, so you avoid financial stress and have peace of mind, no matter how much or how little money you have for Christmas shopping.

Between the rising cost of food making Christmas dinner cost a small fortune, travel expenses, and the pressure to buy extravagant gifts because of what we see on social media, the Christmas season can be a huge financial stressor for many families.

In fact, in 2019, U.S. households spent an average of $1,496 on Christmas shopping.

Even more, over one-fifth of Americans went into debt for Christmas shopping. Of those that went into debt, 30% were relying on their tax return to pay it off.

Yikes! Nothing like counting your eggs before they hatch.

Allowing your Christmas spending to follow you into the New Year via credit card debt will create financial stress; not a great way to kick off the New Year!

The good news is with a solid financial plan for the holiday season – no matter how much money you make -- you can rest assured you’re not spending beyond your means.

SAVE MONEY FOR CHRISTMAS

While some of these ideas may seem extreme, keep in mind they are designed to help you save money fast.

1) Budget for every single person.

Set a realistic budget for every family member or person on your list. Make your gift list and check it twice! Then, stick to your list and your total Christmas budget (the hard part). Don't feel bad about declining to be part of a gift exchange if it's not in the budget this year.

I budget $75 per kid for Christmas, and that includes gifts and stocking stuffers. Our total budget for Christmas presents has to match what we've saved that year. In other words, we save for Christmas year-round, and whatever I have saved when I start shopping is what our total Christmas budget is- no exceptions.

For reference, in the United States, parents spend an average of $276 per child on Christmas gifts.

We have a large family and little kids, so we don’t spend near that per child. Once we have older kids we may spend more, but even then, I don’t think we will hit anywhere near the $276 range.

2) Track your spending.

As you begin your Christmas shopping, be sure to track your spending as you go. I know, elementary stuff, right? The problem is this is often the hardest part, actually logging what you’ve spent. To make it easy, I’ve created a free google sheets Christmas budget tracker!

Download my free Christmas budget printable to help you keep track!

⭐️ Other holiday savings tips:

List of Services

3) Take inventory of subscriptions.

Cut out any unnecessary subscriptions. These days everything has an option for a subscription. Before you know it, you’re having stuff delivered right to your door every other day! While very convenient, chances are not all the subscriptions you have are necessary. See if you can cut—even temporarily—a few subscriptions to save the money instead.

4) Use cash back apps.

Using cash back apps is a way to save money with just a click of a button. I know this sounds sketch and like a scam, but it is truly a very simple, fast, and easy way to save money. You know how when you go through the coffee stand and forget to have them punch your card for a free one? That’s how I feel when I shop online and don’t use a cash back app. You literally just earn money just for the purchases you make.

My favorite cash back apps are Rakuten and Rebates Me. They both offer cash back at thousands of popular stores! Additionally, they consistently offer double or triple cash back at certain stores.

Stores include Target, Sam’s Club, Macy’s, American Eagle, Verizon, etc. Look yourself!

You can easily install Rakuten on your web browser within minutes. This way, Rakuten will show you a notification when you visit a site that they offer cash back for.

Rakuten and Rebates Me even search the web for coupons available to the site you are on and automatically applies them to your order at checkout.

If you do a lot of online shopping, this is an effortless way to save!

5) Stop eating out until Christmas.

Are you a restaurant or fast-food junkie? One of the biggest ways we saved money when we were paying off debt was cutting out dining out.

Let me tell you, it adds up FAST.

What I thought we were spending eating out and what we were actually spending were vastly different.

Commit to eating dinner at home and bringing lunch to work to save up cash.

You can also read 8 expenses you need to cut from your budget!

Tips to avoid the drive-thru / dining out

To avoid eating out altogether, you have to be very intentional about setting yourself up for success. Here are a few tips.

- Meal plan every single week (or two weeks, month, etc.). It is no secret that those who have a plan are more likely to succeed. Personally, I use $5 meal plan to plan my meals for me every single month. It costs $5 per month and saves me hours every week! Every meal is designed to cost under $2 per person!

- Reduce waste by using what you have on hand. Those with creative gifting will love this! I hate it! I take inventory of ingredients I have then search the recipe bank on $5 meal plan using the sort by ingredient filter. This is a life saver! You could also search google. If you are creative, whip something up out of your imagination!

- Make freezer meals for busy nights. For nights that there is no way you can get a meal in, keep a freezer meal stash handy. The creator of $5 meal plan also offers MyFreezEasy, a meal planning service designed to help you make 10 freezer meals in 1 hour. An app is included as well as video tutorials. I usually take 2-3 meals from my meal plan for the week, double the recipe, and freeze.

Once we started doing the three things mentioned above, we saved hundreds of dollars on groceries!

Other money saving grocery hacks:

6) Find something small to cut out temporarily.

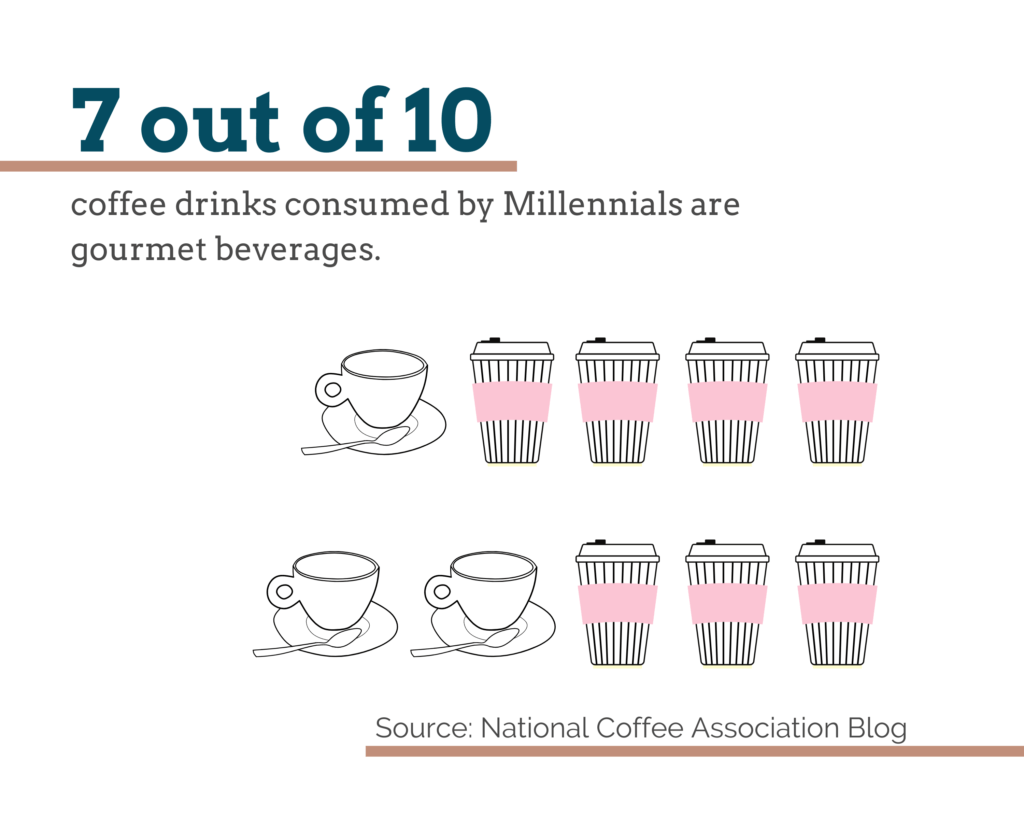

I know many people are sick of hearing “cut out latte’s and you’ll save money!” Although many people roll their eyes at this suggestion, it adds up! For certain generations, they consume more gourmet coffee beverages on average than plain coffee:

If you get a coffee 3x per week, that adds up to $15. If you save $15 per week for 6 weeks, that equates to $90.

See how simple that was?

Remember, cutting out treats isn't forever, it's just to help stock up cash.

Depending on your budget, that can go a long way for Christmas shopping!

Other ideas include nail salon visits, subscriptions for “extras” (non-necessities), gas station purchases, etc.

7) Save for Christmas year-round in a high-yield savings account.

So, what is the best way to save money for Christmas? I highly recommend saving for Christmas year-round! You can do this by setting up a Christmas sinking fund in your budget.

This way, when December rolls around you aren’t scrambling to get cash together for various Christmas expenses. It’s a great feeling to have the cash ready to go when it’s time to buy Christmas gifts!

You can even keep your Christmas savings in a high-yield savings account and earn interest on the money you’re setting aside. We use CIT bank for our savings account and love the higher-than-average interest we earn.

While this is the best way, life happens! Sometimes you roll with it and stack up as much cash as possible a few months before.

8) Shop with cash.

To avoid making impulse purchases, use cash for your in-store transactions. This will help you hold yourself accountable for your spending.

While credit cards are convenient, and even boast many benefits, studies show that we tend to overspend when using a credit card vs cash or a debit card. The reason is simple—we don’t “feel” it as much because we aren’t required to pay for it right away.

While credit card rewards are a huge pull fo rmany people, the psychological impact of using a card typically outweighs those benefits; you spend more with a card.

For us personally, we shop with cash or debit cards. I don’t even want the temptation or option to have credit card bills following me into the new year.

9) Shop Black Friday or Cyber Monday.

I do the bulk of my Christmas shopping on these holidays. It’s inevitable that you’ll have to utilize online shopping; so if you’re going to do it, shop on one of these spending holidays for steep discounts! I'm not a last minute shopper, I like to have all my ducks in a row well before Christmas. This doesn't always happen, but I try my best to make it happen.

10) Complete a savings challenge.

A savings challenge is a great way to build momentum, save money fast, and stay motivated! There’s something about doing a “challenge” that psychologically changes how determined and motivated we are to reach a specific goal.

Even more, having a large goal broken down into smaller, bite-size steps makes it more likely we will reach that goal.

For savings challenge ideas, read this blog post that details how to complete a no spend challenge, $10k savings challenge, bi-weekly savings challenge, weekly savings challenge, etc.

MAKE MONEY FOR CHRISTMAS

Instead of focusing on cutting costs to save, try and make some extra money for Christmas! Especially if you already have a tight budget, some of the above tips might not be possible. Here are some creative ways to make money for Christmas!

1) Sell stuff.

If you have stuff that you’re willing to part with, declutter and sell. Many times, you can list your stuff on various social media sites. Price it cheap and get it out the door. The goal isn’t to make a huge profit on your stuff, the goal is to get cash into your hands. Plus, you'll feel better too having less stuff to look after. We've found that having lots of stuff creates a chaotic home environment!

2) Deliver on the side.

You can make good money delivering pizzas! My friend recently delivered pizzas for 3 hours and made $60 plus a free meal. That’s $20/hour! If you have 3 hours to spare on a weeknight or weekend, it is an effortless way to make some good cash!

3) Clean houses.

Nowadays, so many people work outside the home and are just busier in general than ever before. As a result, they are looking to create more time by outsourcing some basic tasks.

Cleaning is one of those tasks and is prime real estate for an easy side hustle!

This is a very practical way to make money. Place an ad in the paper, make a post on social media, and ask friends to spread the word.

4) Offer teaching or coaching.

Do you have any special skills? Actually, it does not have to even be a special skill. There are many people who lack common skills (myself included) that are looking for someone to teach them!

Everyone has something to offer. Are you a great gardener? Do you decorate well? Have you figured out some cleaning hacks to save time for busy moms?

While these might seem like “basic skills” to some people, I was looking for more guidance and expertise.

I have taken paid online courses for baby sleep training, money management, and scheduling your day with little kids.

How to do it:

Offer in person training or coaching or create an online course.

There are benefits and drawbacks to each. Let us briefly look:

Online Course

Benefits

- Automated income stream

- Less time (create course once and you’re done)

- Flexibility to work from wherever

- Work at your own pace

Drawbacks

- No personal relationship with customers

- Must have high quality recording equipment

- Have some technical knowledge required

- More cash to start up front (equipment & course hosting fee)

Coaching / in-person

Benefits

- Develop personal relationship with clients

- Can charge more per hour for one-on-one coaching

- Cheaper to start

Drawbacks

- Time restraint

- Not as flexible

- No automated income stream

WHY TEACHABLE?

If you go the online course route, I recommend using Teachable. They help you EVERY step of the way. Additionally, they have an amazing resource library full of step by step videos. Teachable also has regular webinars with successful Teachable course creators sharing their secrets to success!

You can start building a course for free, and only start paying for the platform when you put up your course for sale!

5) Babysit or pet sit while people are out of town.

The sitter market is hot. I will tell you what. I remember getting paid $3-$5 per hour to watch multiple kids. Not the case anymore. Our sitter cost more than our dinner a lot of the time!

While we love having grandparents babysit, they need a night off sometimes too 😉

I am always looking for trustworthy, responsible sitters for my kids whether young adult, middle-aged adult or older.

Obviously, the holidays involve traveling for most people. If you are going to be staying home, consider offering pet sit while owners are out of town.

Additionally, many parents have work parties and other holiday parties that require them to find a sitter.

Give up an afternoon, weekend, or entire day to make some quick cash!

6) Start an Etsy shop.

Much to my surprise, one of my most successful streams of income is from Etsy.

You are probably thinking, yeah but you spend hours on end working on it every week I bet.

Nope. Right now , I am spending less than 10 hours per week working on every aspect of my business- the blog, Etsy shop, and online courses.

I do 3 simple things to be successful on Etsy:

- Follow their recommendations

- Research what people are searching for

- Create printables based on my research

Like an online course, Etsy is a great passive income stream. This is perfect for busy moms who do not have a lot of time on their hands.

In fact, I only work on my online business when my kids are napping or in bed. That’s it.

I became a stay-at-home mom to be with my kids more, not start a full-time job and park them in front of the TV.

If you can't do either

On one hand, maybe it’s not in the cards for you to save more money this year because you have cut all the costs you can. On the other hand, maybe you’re not in a position where you can extra time to make more money.

Or maybe you’re like me and you think holiday spending is obnoxious, and your frugal heart just can’t bear it.

Whatever the case, here are some things you can do to make the holidays more enjoyable and less focused on money.

1) Focus on time with your family.

Try to focus on the quality of time with friends and family rather than the quantity of gifts you give or receive.

Although this sounds cliché, memories last a lifetime. Some of my favorite childhood memories are of our big, hectic family gatherings with screaming kids and wrapping paper strewn everywhere.

I do not remember any of the gifts I got growing up. Not one.

I must jog my memory to remember what my husband got me last year.

However, I can tell you exactly what my favorite parts of the day were- playing games with family and enjoying a nice dinner together.

Focus on the memories, not the gifts!

2) Frugal gifting ideas.

No matter what your financial situation is, you can do something special for everyone on your list. Consider handmade gifts and shopping at thrift stores. Remember, Christmas shouldn't be a competition of who gives the most expensive gifts.

A great idea for kids that you can do on any budget is to follow the 3-gift rule.

With this rule, each kid receives 3 gifts:

- A want

- A need

- Something to read

This is a great way to keep the gifts down and remind your kids that gifts aren't the most important part!

3) Find free activities to do.

There is an abundance of free activities for families during the holidays! These are some of our favorite things to do:

- Drive around looking at Christmas lights

- Watch old movies

- Attend church/community events

- Make eggnog, cookies, sangria, and all the goods for your family & others

You don’t have to look far to have free family fun. Search your local newspaper, community Facebook page, etc. for updates on events!

4) Stay off your phone.

While this is easier said than done, put your phone away for the day. Instead of trying to recreate the perfect photo op, just focus on being present.

Many times, our kids, spouses, and family compete with our phone for attention... and lose.

In addition to taking away from our families, our phones also feed our envy.

If this is a tough year financially, scrolling through social media will not help you feel better.

There is nothing worse than feeling guilt for what you cannot afford and opening social media to see all the 10-year-old's that got iPhones for Christmas.

Do yourself a favor and stay off your phone!

BUDGETING FOR CHRISTMAS

With some careful planning, you can create a holiday budget that aligns with and allows you to still reach your financial goals.

This is my step-by-step process for budgeting for Christmas.

- Start with listing every single person you plan to buy a gift for this year.

- Then, list how much you would like to spend on each person.

- Total it up. This is your total budget.

- Evaluate the Christmas budget total. Is this feasible?

- Consider what you will be saving by cutting expenses and/or making more money.

- Add to your monthly budget. If you have never made one before, here's how to do it. You can snag a monthly budget template from my Etsy Shop:

- Stick to the plan & keep track of your spending!

A plan is great, but you must execute the plan. While it’s tempting to overspend, remember, paying cash for Christmas and exercising self-control will put you in a much better place financially.

You will be so happy you started the New Year off with no financial strings attached!

These are just a few of the best ways to save and/or make money or Christmas.

🎄 READ:

Share this post!