Why Lifestyle Creep is Your Biggest Hidden Money Problem

You can give me every excuse in the book, but the honest truth is more than likely your biggest money problem is your lifestyle creep.

You get a big bonus or raise and it's time to upgrade the cell phone, get a new car, plan the exotic vacation you've been waiting for, and remodel your home!

Without realizing it, you've effectively spent MORE than your raise, putting you in a worse financial situation than before, even though it appears to be better.

When people talk about their financial struggles, they usually point back to their wage as the issue.

This is a clever tactic because it diverts the attention and symptom of the problem from themselves and their own actions.

Lifestyle creep is the reason many people with modest incomes are actually wealthier and better off than those considered top income earners.

Anyone can fall into the trap of lifestyle creep. If you aren't careful with your money and don't practice self-discipline you'll likely be next!

WHAT IS LIFESTYLE CREEP?

Lifestyle creep is when you live on more than you make, making it hard to save, invest, and results in living paycheck to paycheck despite having a higher income.

Many times lifestyle creep is brought on by an increase in wage and/or bonus that results in your standard of living increasing by more than the increased income.

All of us can fall prey to this trap when our income rises.

Your paycheck is larger, and you're ready to give yourself a big pat on the back for a job well done!

Suddenly the mall sounds more appealing than the thrift store.

You reward yourself with a nice dinner out, but soon enough dinner out becomes the norm.

The problem with lifestyle creep is that it's impossible to get ahead financially if you are spending more than you make, no matter what your income is.

Lifestyle inflation can be avoided by laying some ground rules and practicing some good old fashioned self-discipline.

HOW TO AVOID LIFESTYLE CREEP

AVOID DEBT AT ALL COSTS

I can't say this enough- just because you can afford the monthly payment doesn't mean you can afford an item.

True affordability is defined as being able to pay the full cash price for the item right now.

For example, let's say you get a $5k raise and reward yourself with a new vehicle for $15k that you finance over 5 years at 3%.

Although your monthly payment will hover around $270 and cost you $3,240 a year (less than your $5k raise), you're stuck with that $270 monthly payment for four more years.

Even if you get another $5k raise the next year, chances are your household costs will have risen, and you'll again find a way to reward yourself.

If you're currently in debt, start the debt snowball today and break the chains of monthly payments.

Monthly payments destroy your ability to save, invest, and have financial peace .

REWARD YOURSELF WISELY

It's not a bad thing to reward yourself with a nice dinner for working hard, just make sure it's in the budget!

Instead of buying yourself a nice new car and outspending your raise, treat yourself to a nice dinner and do a budget check in.

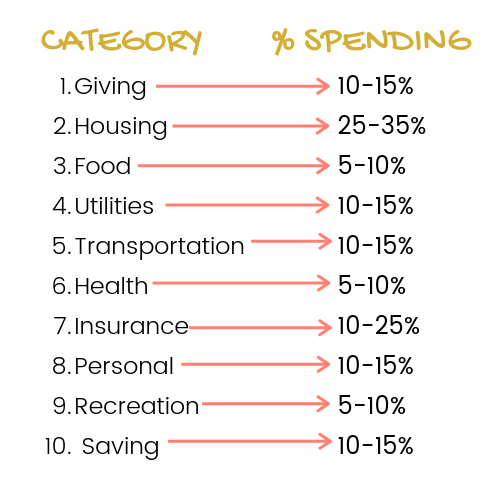

Adjust your budget for your new income, but stick to your budget principles.

Your adjusted budget should still follow the percentages above (the percentages represent % of monthly take home pay).

Makes sure you put some fun money in the budget otherwise if you deprive yourself of guilty pleasure spending completely you'll be more likely to bust the budget.

GET ON A DANG BUDGET

A zero based budget helps you to avoid living beyond your means.

Most people are scared away from a budget because they say they don't have time.

Our monthly budget takes me five minutes to complete at the start of every month and I just created an excel version of my best selling monthly budget template for those in a real time crunch!

If you're new to budgeting or need to brush up your budgeting knowledge, click the image below to sign up for my free budget bootcamp email course!

DON'T MAKE HASTY MONEY DECISIONS

When you get a raise and/or bonus, don't drive straight from work to the car dealership.

As your income rises, make gradual money changes.

If you make hasty money decisions, you're headed straight for financial ruin due to lifestyle creep (the phrase itself sounds icky) !

A few good rules to avoid making hasty money decisions include:

- Sleep on it.

- ALWAYS talk to your spouse first.

- Create a mock budget.

- Research.

Any time our income rises, we don't make ANY sudden changes.

We actually make REALLY REALLY slow changes, and that has saved us from poor decision making!

DO THE MATH

If you are set on purchasing an item, make sure you've done the math to see if you will be spending more than your raise.

This seems like common sense, but so many people say their money problems started when their income rose and their spending rose more.

Most people know how to do the math, but let their impulsiveness get the best of them.

In fact, I'd argue that Americans are the least self-disciplined they've ever been when it comes to money behaviors.

Even if the math doesn't make sense, we just can't say no.

Stick to this rule of thumb- if you're spending more than you make you need to start telling yourself no.

Share this post!