Budgeting: The Simple Tool You Must Have to Control Your Money

Most people are familiar with the term budgeting, but I think that many avoid it because if we're being honest, we are afraid to know exactly where things are.

This is probably the case considering two-thirds of American households do not keep a personal budget.

In fact, only 30% of Americans have a long-term financial plan that includes savings and investment goals.

No wonder Americans consistently rank money as the number one source of stress , no one has a plan for their money!

I get it, it sounds mundane, restricting, and like a waste of time. I used to think the same. Never did I think that using a simple budget would transform our finances and save us hundreds and now thousands of dollars!

To be honest, never did I think we would be able to stick to a budget. IT IS POSSIBLE.

It will take discipline, perseverance, andtime, but keeping a personal budget will help you get out of debt, stay out of debt, and win with money.

Below I have listed how to create a budget (for beginners), and then I'll expand on some budget tips that have made the difference for us in our financial journey.

I'll also lay out what your budget should look like if you are trying to pay off debt, or if you have no debt!

Let's get started!

STEP BY STEP BUDGETING FOR BEGINNERS

My monthly budget template is a great tool for beginners and for those who simply want to learn the ins and outs of budgeting.

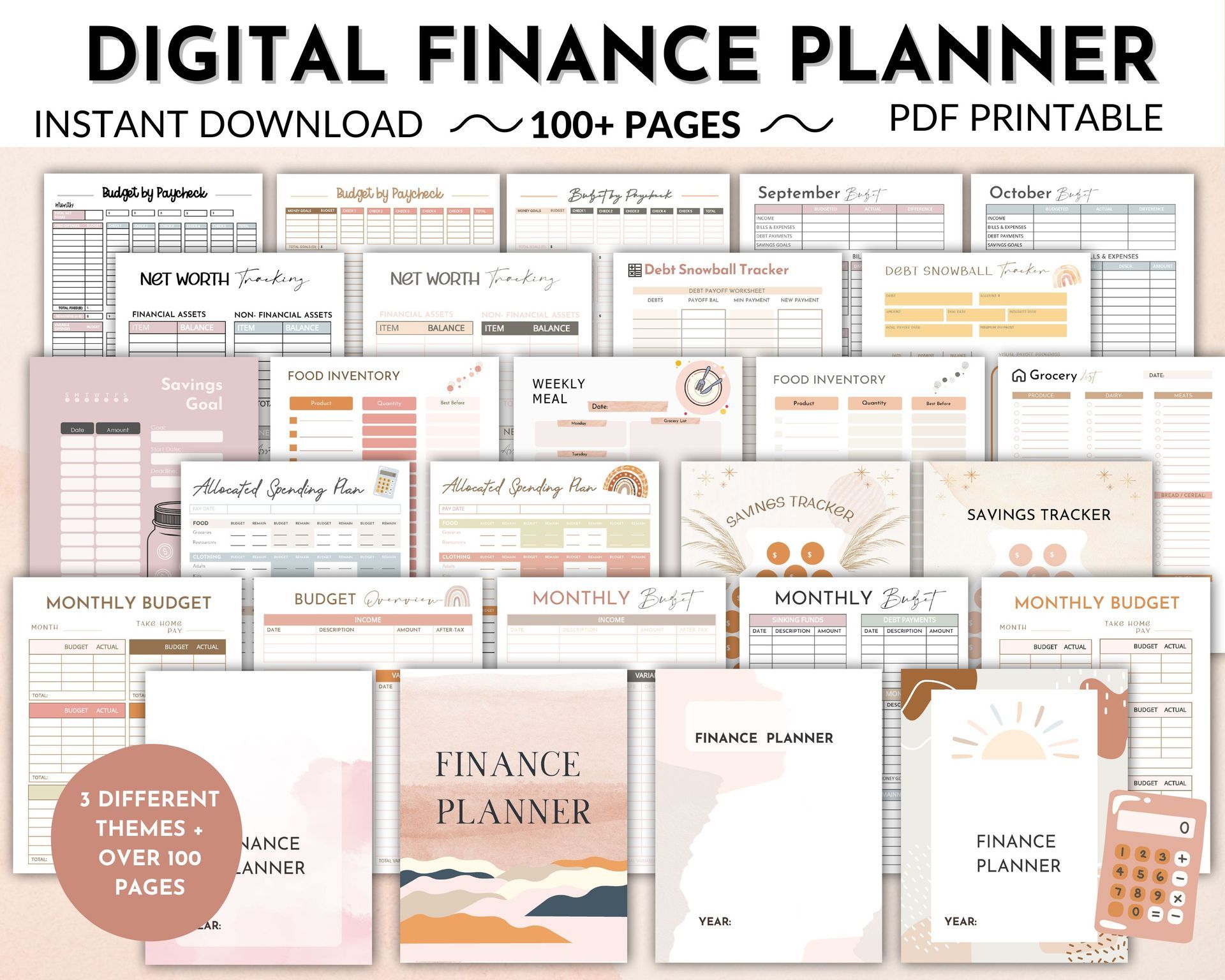

If you want to expand your personal finance tracking and organization, I have budget bundle that I custom made that includes 45+ pages of personal finance tools.

My budget bundle is one of my best selling finance planners.

This takes you a step beyond basic budget tracking, and it makes it easier than ever to know where your money is going every month!

Now, let's get to the good stuff.

(1) Simple Steps to a Personal Monthly Budget

Step 1: Determine your monthly income

This is pretty simple for most people. However, if your income is irregular use an average.

Step 2: List all necessary expenses

Key Word: necessary. This would include things like utilities, rent, gas, groceries, tithes, etc.

Step 3: Add amount you want to save and/or pay down on debt

Add your goal for either your debt payment, what you want to put in savings, or what you would like to invest for the month.

Step 4: List all unnecessary expenses

See the order here- debt payment/savings/investing is budgeted first, then you budget what is LEFT OVER on the unnecessary expenses. I would consider clothing (to a certain extent), vacations, home furnishings/decor, entertainment, etc. unnecessary expenses.

There you have it, budget made!

(2) If You Have Debt, The Budget Should be TIGHT

The truth is you have to make a decision about how you're going to live. If you're in debt, your budget has to be tight so that you can pay it off as quickly as you can and live a debt-free life and give more, save more, and invest more.

When you're working to pay off debt, you have to gain momentum and be PASSIONATE about overcoming debt. That being said, your budget will reflect how passionate and focused you are on becoming debt-free! A disciplined budget is one of the most powerful tools you have at your disposal.

I recommend the following allocations when paying off debt:

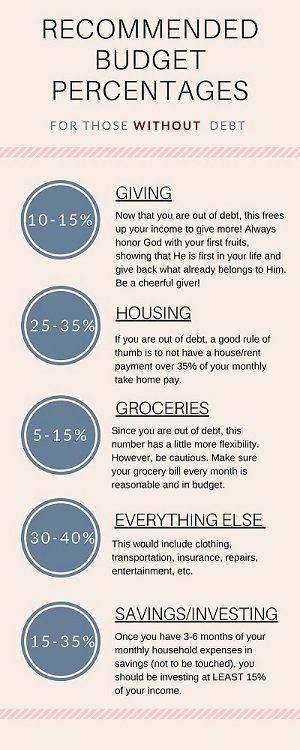

(3) If You Don't Have Debt, the Budget Should be SEMI-TIGHT

This budget looks similar to the one above, but notice some key changes.

- Greater flexibility in housing budget- up to 35% of monthly take home pay.

- Greater flexibility in grocery budget, but if you can TRY TO keep it the same.

- Now you are SAVING (3-6 months worth of household expenses) and INVESTING ( I recommend temporarily halting investing while paying off debt).

(4) Zero Dollar Budget

One tip that I think has contributed to our success budgeting is making sure our budget is a zero dollar budget.

If you list all your necessary expenses and subtract them from your monthly income and add your debt/savings/investing for the month and there is money left over, that leftover money also needs to be budgeted. That money shouldn't be your 'we will see where it goes' fund, because I can tell you this- you won't know where it went, but it won't be there at the end of the month.

Make sure every single dollar is going somewhere on paper before the month begins and the money is actually received.

(5) Make Sure Your Budget is Realistic

⚠️ Fair warning: if it is your first time budgeting, chances are you will fail the first month.

It is a process of TRIAL and ERROR . Make sure you create a budget that is challenging, but also realistic for your family.

Every budget will be different , and that is okay!

If you have kids, your grocery budget will NOT look like mine. If you live close to your job, your budget will NOT look like mine (Joe & I both live at least 30 min away from our job, so we spend quite a bit on transportation).

You get the point- don't dwell on the fact that your budget isn't as tight as mine. If you have more in your family that is expected!

(6) Using Cash

I mentioned before that I use cash envelopes for certain categories in our budget.

I would highly recommend this for those of you who have a hard time being disciplined! You will be shocked how much less you spend when you use cash vs debit/credit card!

For us, I take out $75 in cash every week and that is what I allow us to spend on groceries. I will also take out $60 per week most of the time for my personal spending money.

Find my adorable floral watercolor cash envelopes here! :) They include pre-made categories (like pictured right) and blank ones for you to customize!

BONUS! They come with 4 different designs! All you have to do is print!

They are easy to laminate too, this way you don't have to print them every month when you start your budget over!

I simply use rubbing alcohol to wash off my markings from the prior month before using again.

(7) If You're Married, Make the Budget Together

The number one cause of divorce is money problems. The number one cause of stress for Americans is money problems.

See the trend here?

I am the saver in the relationship and Joe is the spender. In order for our finances to work together, we have to have compromise and we have to make sure we are on the same page. I came to a point in our marriage where I became very frustrated with Joe's spending and what seemed to be his lack of interest in our spending.

What helped us get on the same page was sitting down together and looking at all of our expenditures for one month. I think Joe was surprised when he saw how much we were actually spending. He thought he had an idea, but like me, he was blown away when he actually saw the exact dollar amounts!

It is SO important that you both know what you take in every month, and how much goes out every month. I'm not saying you have to meet every month and plan the budget- but if you do, great!

For us, I make the budget every month and Joe knows what it is and can tweak it if he likes. All I ask of him is that he tells me if he knows of any expenses coming up that we will need to plan for like oil changes, new tires, etc.

Find a system that works for you, but make sure you are both aware and working towards the same financial goals!

When you and your spouse agree on spending, you agree on dreams, goals, and priorities.

(8) Our Personal Budget

Like I said in my previous article (How We Paid Off $20k of Student Loan Debt in 12 Months) , we live on less than 50% of our income.

How do we make that possible?

- We keep track of our spending. I use the EveryDollar app (it's free!) to reconcile our expenses every week so that I know how much we have left in each budget category. It takes approximately 5 seconds to punch in every expense- so don't tell me you don't have time!

- We give more. We tithe based on our gross pay and typically give 10-15% to our local church. When you are a cheerful giver (even while paying off debt), you are at your best financially!

- We live in a not-so-new apartment. We could easily afford an upgrade, but our rent is cheap and we are saving for a house so we make it work! P.S. - don't buy into the "YOU'VE BEEN MARRIED 10 MINUTES AND YOU HAVEN'T BOUGHT A HOUSE?!" If you are in debt, work on paying that off before you even think about buying a house.

- We hang out together more at home. Instead of going out, we stay home and play cards, take walks, play basketball, etc. together. We eat out once every two weeks and go to an occasional movie.

In my personal opinion, budgeting is one of the key tools to financial success.

You can make a lot of money, but if you don't budget and have no control over your finances, you will have nothing to show for it. Challenge yourself to create a budget and stick to it, I think you'll be surprised at how much you can save simply by planning every expense.

A budget will get you on the path to financial freedom!

Remember, its the sum of your large AND small decisions that will change the direction of your life.

Share this post!