Melanie

De Jong

Melanie

De Jong

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

Hey There, I’m Melanie! I am a former CPA turned personal finance blogger and mom of three. When you ‘Budget With Mel’, you’ll develop monthly budgets, cost-cutting tactics, and learn new behaviors and beliefs about money. It’s time you took the stress and confusion out of your personal finances.

7 Things You Need to Do to Simplify Your Life and Reach Your Financial Goals!

How do you ensure you reach your financial goals year after year?

Simplify your life.

That's my goal this year.

While that doesn't sound like that big of a goal, it is. I am a very high-energy person, but also a very high-stress person. This is something I don't talk about often, but I have a serious issue with stress and trying to control things that are out of my control.

I worry about the future, I plan, and if things don't go according to my plan, I worry some more, and to top it all off I stress myself out because I remind myself that I worry too much and I'm missing out on life!

Anyone else out there feel me?

In order to reach your goals in the new year, I challenge you to think about them differently.

I challenge you to simplify your life, and in doing so, I think you will find that you can easier reach your goals (whether financial or not).

I've laid out below how to simplify your life in the new year and reach your goals!

⭐️ READ:

7 HACKS TO REACH YOUR FINANCIAL GOALS

(1) Create a Small Habit

According to statistics, only 8 percent of people actually follow through with their new years resolutions.

Why? They aren't consistent.

It's important to create goals and the New Year is a prime time for doing so, but success comes from things you do consistently. You are not going to become a new person overnight.

Start with a small habit that you can implement into your life.

For example, if your goal is to pay off your student loans, start putting an extra $20 per month to your payment, and build from there.

The reason most New Years resolutions don't work is because we tend to start with drastic changes rather than gradual, momentum building changes .

Use this habit tracking worksheet to start tracking TODAY and stay motivated.

(2) Worry About What You Can Control

I fail at this, all the time. I worry way too often about things that are out of my control.

My husband has to constantly remind me that stressing about those things are not going to make us any better off in the long run.

Being afraid of things that can go wrong is not going to make things right, and no amount of anxiety will change the future.

One small habit that I'm going to change to reach my goal of simplifying my life is to memorize scripture.

Having those verses ingrained in my mind is my best defense against worry and anxiety about things I can't control (and even things I can).

In regards to your finances, worry about what you can control.

You can control your budget, your spending habits, whether or not you save for a rainy day, and how well your live below your means.

(3) Don't Sweat the Small Stuff

Confession- this is another big struggle.

I have a tendency to sweat the small stuff. If you go over budget one month, don't worry about it. Look forward.

If you are over budget month after month (follow these steps when you are) , that's a different story and you might need to tweak your budget.

Don't let the small things get to your or ruin your day. Life happens!

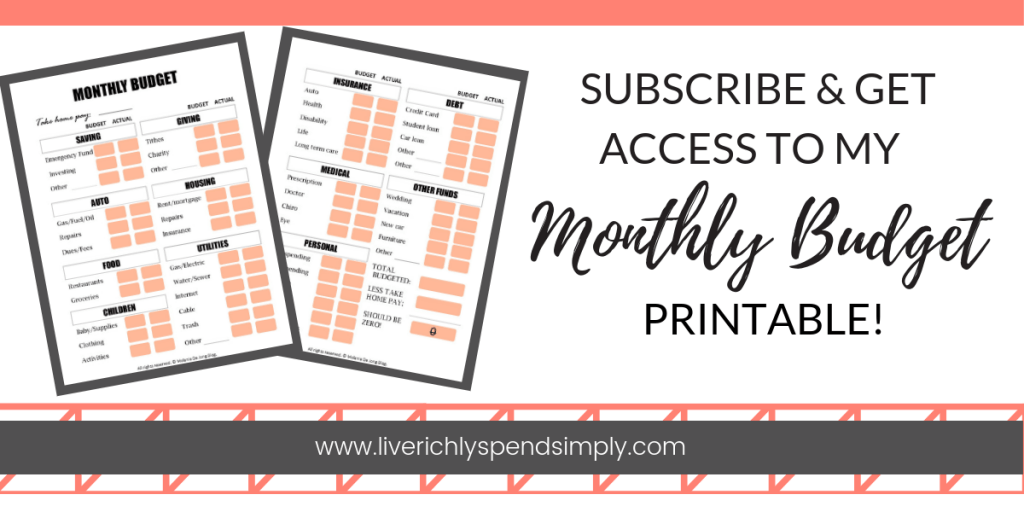

(4) Plan For Changes (As Much as You Can)

If you are going to have changes next year, start planning NOW.

If you're going to need a new car, plan how much you need to save every month in order to pay cash for your car and set up a sinking fund.

Whatever changes are coming your way, make sure you are adding what you need to save to your monthly budget.

One way you can plan for changes is by making sure you are using a monthly budget to stay on track with your finances.

A budget is life-changing.

You can sign up for my free monthly budget form below!

Related:

(5) Live Below Your Means & Don't Apologize For It

In America, the norm is to spend more than you make, and there is a hefty price for doing so. Our addiction to borrowing and inability to see saving as a priority will be the death of us.

You MUST learn to live below your means , and well below if you want to accumulate any kind of wealth.

Those who live below their means are able to sleep soundly while the rest of the world panics during a financial crisis, or a situation like a loss of job or medical emergency.

BUT, since this idea of living below your means is not so popular these days, it is my duty to warn you that you will probably get made fun of.

If getting poked fun at is the price I have to pay for that peace of mind, I'm fine with that. There's a bigger reason why I'm frugal , and that is to ensure we live below our means.

My biggest advice regarding dealing with naysayers- don't apologize and stand your ground.

Related:

(6) Keep Track of Your Financial Goals

Make sure that you have some way to measure your successes and failures throughout the year.

Whether it be a spreadsheet, a visual, loan paid in full notices (that's what I did for my student loans), make sure you are keeping track of how far you are from your goal and how much/long you have left to go.

Often, the hardest part of reaching our goals is staying motivated throughout the entire journey.

There will be ups and downs, but you have to constantly remind yourself how far you have come!

Here are some of the best resources to help you get your finances together this year.

You Need a Budget

You Need a Budget

Reaching my goals is something of value to me, and something I prioritize.

Make your monthly budget a priority.

When you budget you give yourself permission to spend money without guilt, because you've planned every single dollar on paper.

A budget is one of the most powerful tools in your arsenal to get your finances in order.

I know what it feels like to be crushed by the weight of debt, and I want nothing more than for you to break free from those chains. We did and we've never looked back!

Budgeting hacks & tutorials:

(7) Surround Yourself With People Who Encourage You

This is SO important.

I've said this many times before, you become who you hang out with.

That is the cold, hard, truth.

Make sure who you surround yourself with is reflective of who you want to become.

Don't be part of the 92% of people who don't keep their New Years Resolutions!

Make goals and use the tools above to make sure that you reach them. I will keep you updated on our goals (I need to be kept accountable too!), and I will be transparent about the struggles and successes along the way.

CHEERS!

FOLLOW

ON IG